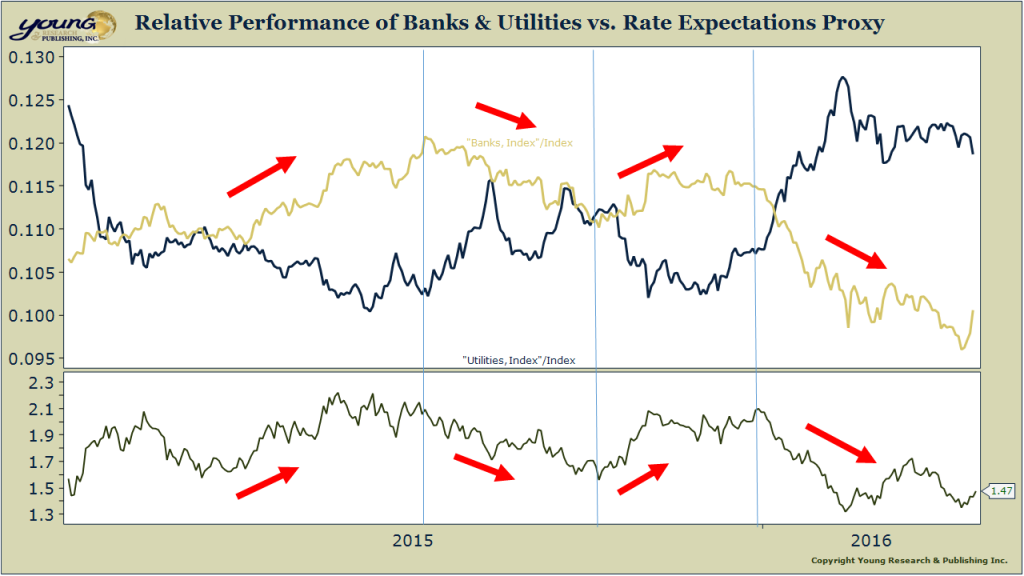

In case you needed more evidence that the Fed is playing an outsize role in equity markets, I present to you the following chart. This shows the relative performance of banks and utilities versus an interest rate expectations proxy (bottom pane). When rate expectations go up, utilities fall, and banks rise. When rate expectations go down, utilities soar, and banks fall.

Jeremy Jones, CFA, CFP® is the Director of Research at Young Research & Publishing Inc., and the Chief Investment Officer at Richard C. Young & Co., Ltd. CNBC has ranked Richard C. Young & Co., Ltd. as one of the Top 100 Financial Advisors in the nation (2019-2022) Disclosure. Jeremy is also a contributing editor of youngresearch.com.

Latest posts by Jeremy Jones, CFA (see all)

- Money Market Assets Hit Record High: $5.4 Trillion - May 26, 2023

- The Mania in AI Stocks Has Arrived - May 25, 2023

- The Wisdom of Sam Zell - May 24, 2023