Savvy investors are gobbling up these yields. Because you don’t need to compound big numbers to have big success. To double your money, you could do it with T-bills paying more than five percent today, compounding them for 15 years. But the key is, will they stay at five percent?

Think about the Rule of 72. The math. Dividing 72 by a compound interest rate tells you how many years it takes to double your money.

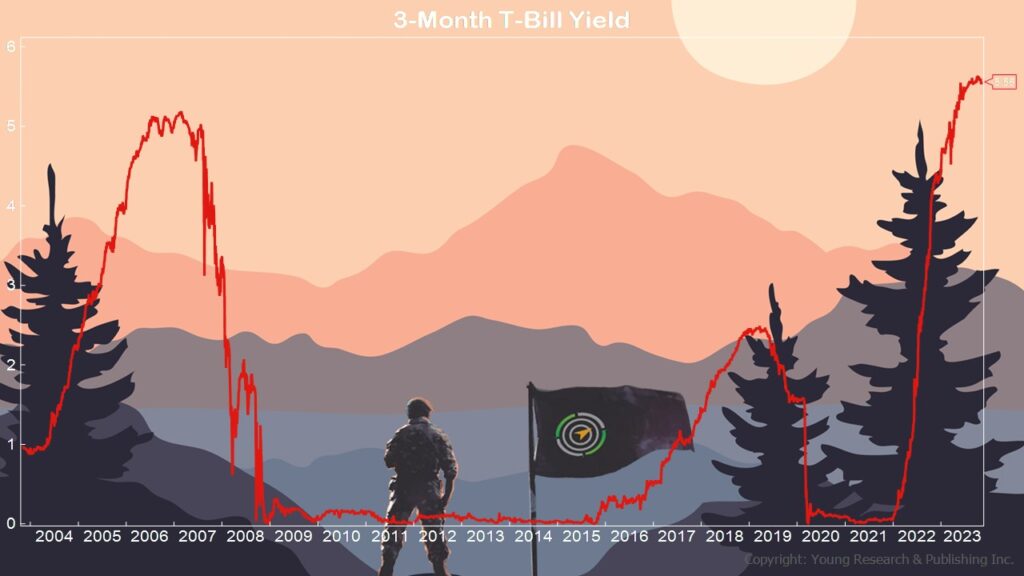

But it’s tricky. Because T-bills have a short lifespan. They provide comfort for three months at a time. It’s why investors are gobbling them up. They’re hard to pass up. But I want you to think about locking in solid yields for longer periods of time.

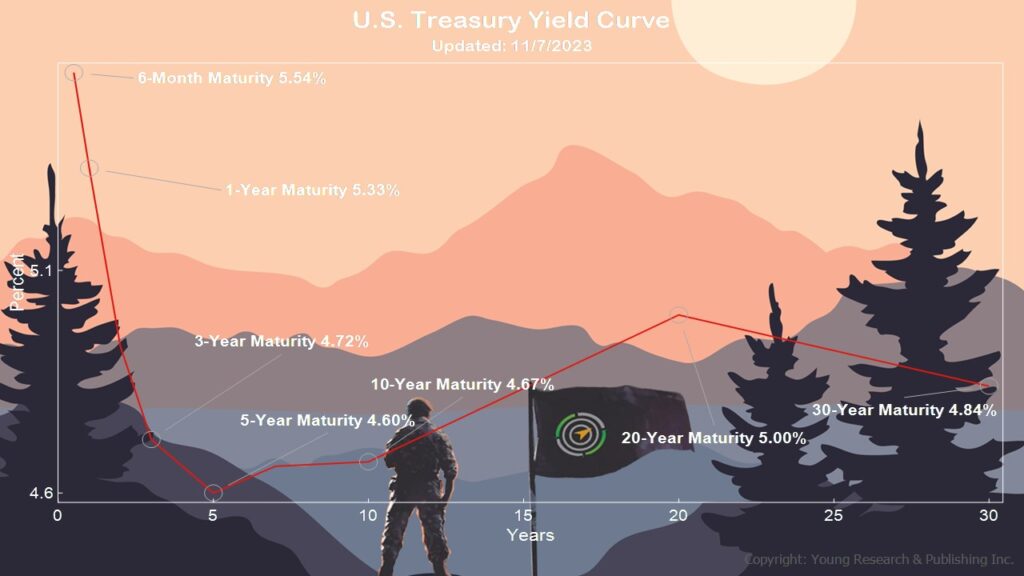

Look at the yield curve.

If the economy gets into trouble, for example, and the Fed cuts rates, you can kiss the T-bill yields goodbye faster than you can say “pass the gravy.” And if history is any lesson, we know how low rates can go, and for how long they can stay there. Talk about a winter’s nap. It wasn’t that long ago we were looking at rates nailed to the floor.

If you have lazy money sitting around, and you can invest for longer than a few months, isn’t it time to look over the horizon and invest accordingly?

Action Line: When you’re ready to talk, I’m here.

Originally posted on Your Survival Guy.