Short-term noise is an investor’s worst enemy. As if it’s not hard enough to set an appropriate course, you have the constant barrage of information that can make you feel uneasy. Times are changing. That’s a fact.

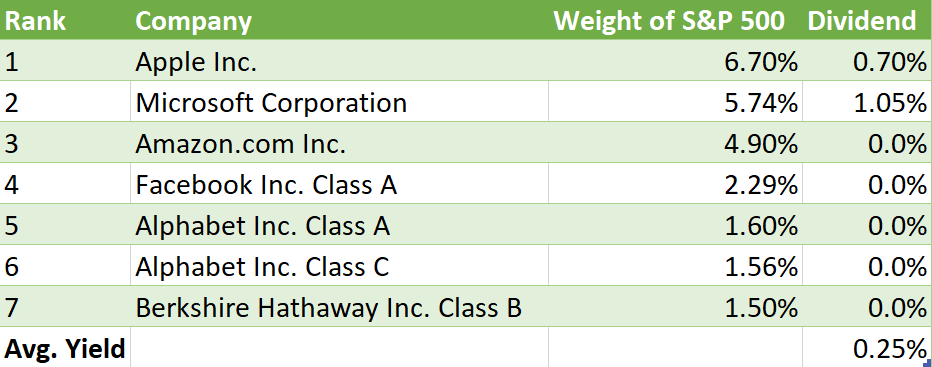

Take a look at the S&P 500 or Vanguard’s Index 500 or some other ETF. Today, seven stocks account for 26% of the index, while not one of them trades at less than 33x earnings.

You have read here that the stock market has dropped by 33% three times already this century. Doesn’t it make sense that the chances of that happening again become more likely when only seven companies rule the roost?

You know I want you to be paid to invest in this market. The way you get paid to invest is through dividends—just like the income from your rental properties. You and I know you don’t worry month to month, quarter to quarter about the price fluctuations of your properties, just as long as you get paid. That’s the mentality I want you to have about stocks.

The measly dividends from the big seven make them look more like the seven dwarfs. Only two of them pay a dividend, and their yields average 0.88% (that’s 0.25% averaged out over all seven). Day traders love the “action” in the market. You know, through your own investing in income properties, for example, that it’s hard, especially the random phone calls when stuff breaks. But you and I know that when you think about how much you’ve made over years of compounding rental income, you never imagined how truly wealthy you are.

Meet the Seven Dividend Dwarfs

Action Line: Don’t be left at the station, get hooked up to the dividend train, and join the compound interest express. There’s never a bad time to be “all aboard!”

Originally posted on Your Survival Guy.