Despite the positive signal that the Trump rally in the stock market is sending about the state of the U.S. economy, the auto market is adamant that we are in the winter stage of the economic expansion. Pro-growth policies from the incoming administration have the potential to prolong the expansion, but General Motors, Ford, and Chrysler are taking an, “I’ll believe it when I see it” approach to growth. The WSJ reports that the Big Three have scheduled down-time at their factories of as much as three weeks in January to clear inventories resulting from cooling demand and shifting consumer tastes.

Detroit auto makers are pulling back on first-quarter production in response to a cooling in retail demand and a shift in consumer tastes, a speed bump for an industry that has laid the foundation for U.S. economic expansion in recent years.

All three domestic car companies this week said they have scheduled down time at some of their factories for as much as three weeks in January. Auto makers typically idle assembly plants for a week or two around the holidays—but shutting factories for multiple weeks in January is unusual.

The moves are an attempt to help clear inventory of certain models such as sedans and minivans, which have been stacking up on dealer lots at a rapid pace in recent months. Such cars have attracted paltry interest among buyers more interested in sport-utility vehicles.

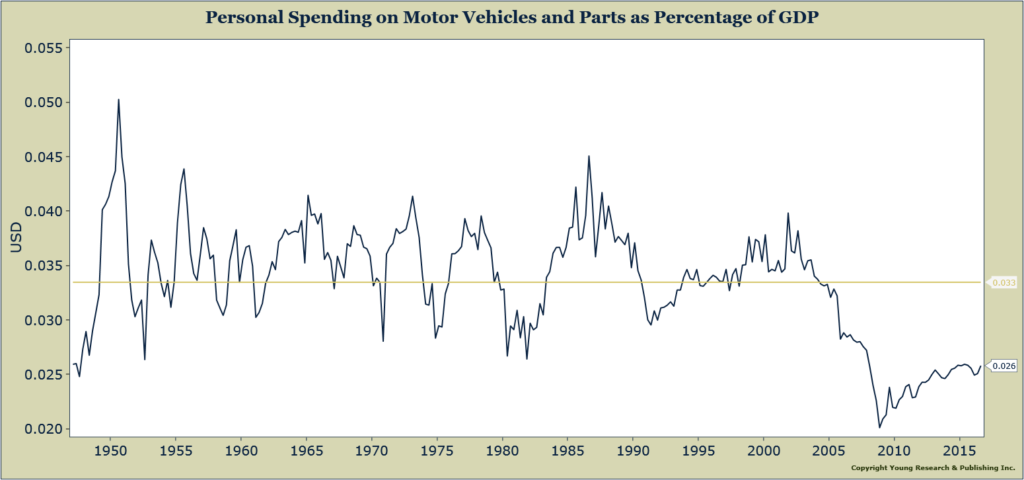

As goes General Motors so goes the nation was once a useful adage. GM isn’t as crucial to the economy as it once was, but the auto industry remains an important player. See chart.