As we outlined last week, economic fundamentals are not in-step with market movements. While the prices of stocks have been moving skyward in reaction to worldwide monetary and fiscal stimulus measures, the real economy takes on an ever bleaker look.

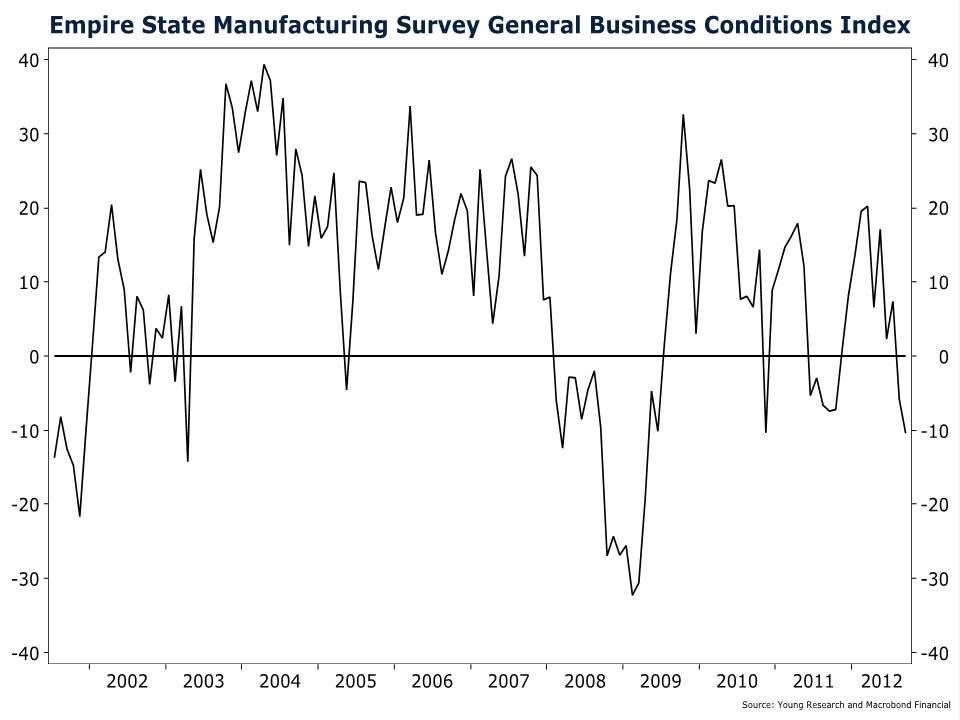

By way of evidence, we point to the Empire State Manufacturing Survey released this morning. For the second consecutive month the index has marched deeper into negative territory. The September survey indicated that the General Business Conditions index fell to -10.4, an indication of a worsening business environment for manufacturers in the region. Of those surveyed, 29% of respondents reported that conditions worsened, compared to only 14% that thought conditions had improved.

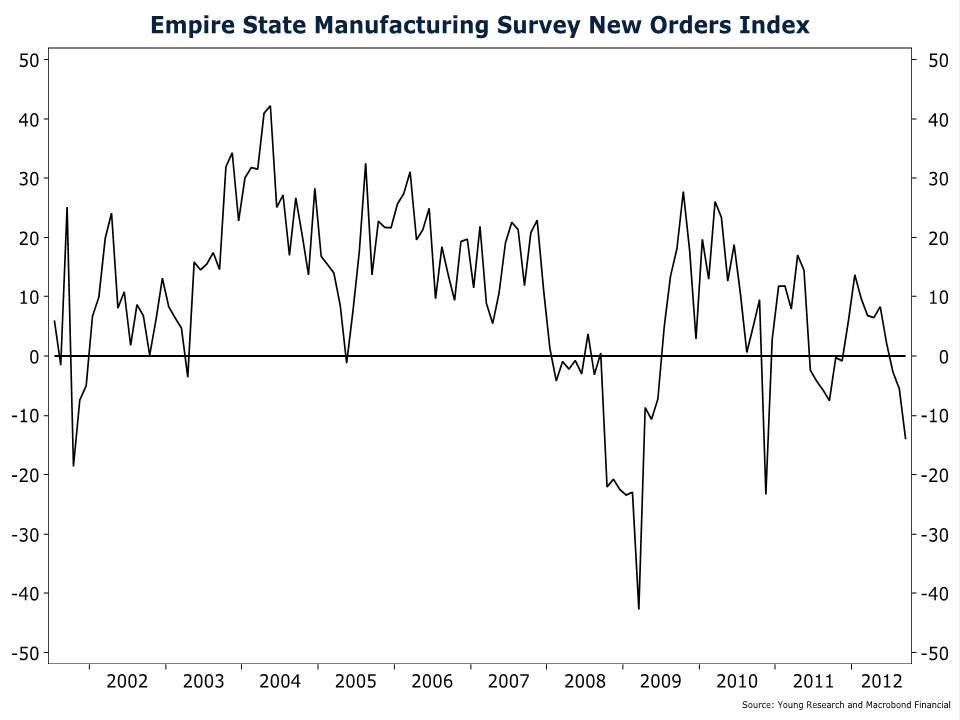

As you can see in the chart below, the New Orders Index also fell. New orders are a popular leading indicator, and a decline in orders is seen as a sign of future weakness in manufacturing. The New Orders Index has produced negative numbers for the last three months.

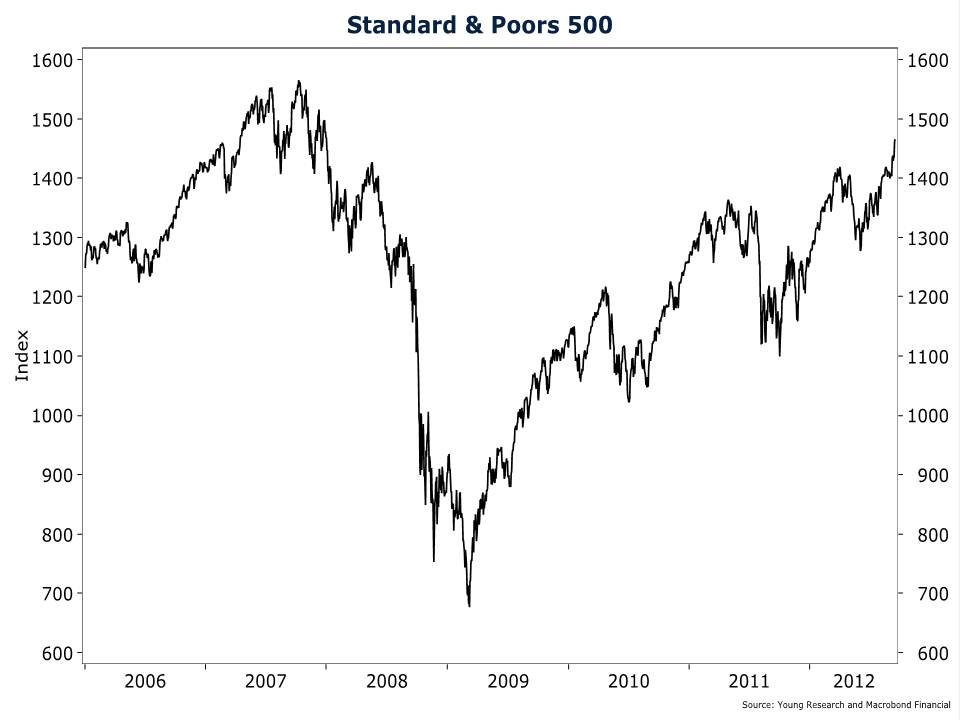

While New York’s manufacturing sector comes under increasing pressure from poor economic fundamentals, just down the road on Wall Street, investors have bid the S&P 500 up to 1,465.77 only 100 points below its all-time high set before the recession in 2007. If recent history is any guide, the divergence between price and fundamentals will be resolved in favor the fundamentals (see tech bubble and real estate bubble).