St. Louis Federal Reserve President James Bullard who has made a habit of moving markets by lobbing monetary policy grenades into the markets when they are least expected is coming clean on the Fed’s failed monetary experiment. You may recall that many investors credited Bullard with single handedly putting a floor under a nasty stock market correction last October by suggesting the Fed should halt the taper. Well he is sort of coming clean.

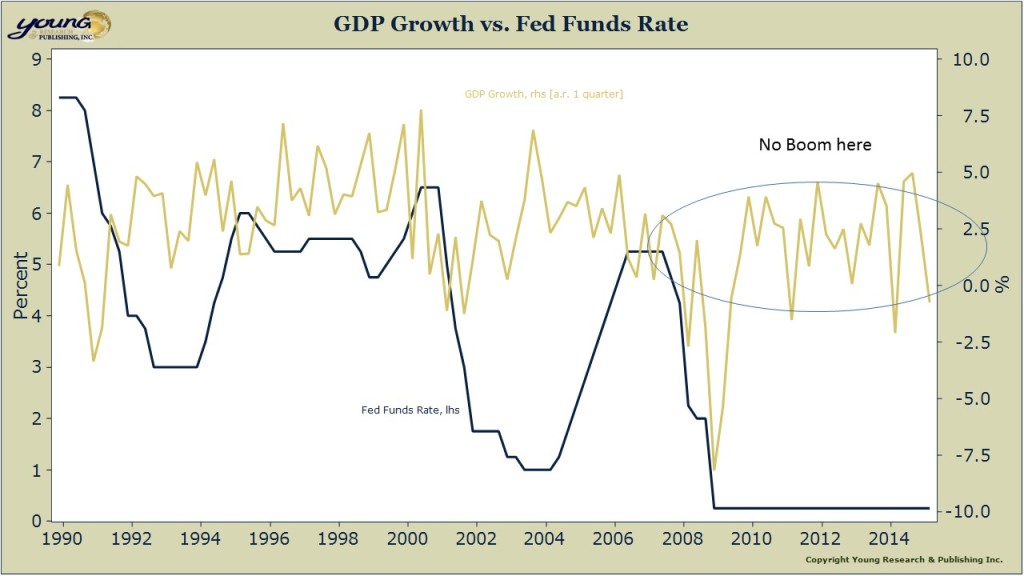

Bullard is out with a new paper that comes to the very obvious conclusion that holding rates at zero since 2008 or promising to hold them there for years has not created the economic boom that the Fed expected. Nor has decades of zero rates created a boom in Japan.

Bullard is suggesting that there is something special about zero percent interest rates that isn’t picked up in the theory. I’m inclined to agree with that premise. I would go as far as saying that years of zero rates may actually hold back growth. See here. Zero rates obviously create a boom in asset prices, but the same is not true for the economy.

Bullard’s solution to the problem would probably create more trouble in the long-run than would just allowing the economy to heal on its own, but at least he is acknowledging the Fed has a problem. That is after all the first step to recovery!