Quick public service announcement. It’s going to be a busy summer in Newport. Your Survival Guy can sense it. Last night, for example, we went down to the Clarke Cooke House on Bannister’s Wharf for some oysters. It felt like the middle of summer, and it’s only mid-February. If you’re planning to visit Newport, make your reservations now.

OK, let’s dig into this. When it comes to investing and personal security, Your Survival Guy looks at risk, first and foremost. As a rule of thumb, I do not base my investment decisions on past performance, and I always look to Dick Young’s North Star for guidance.

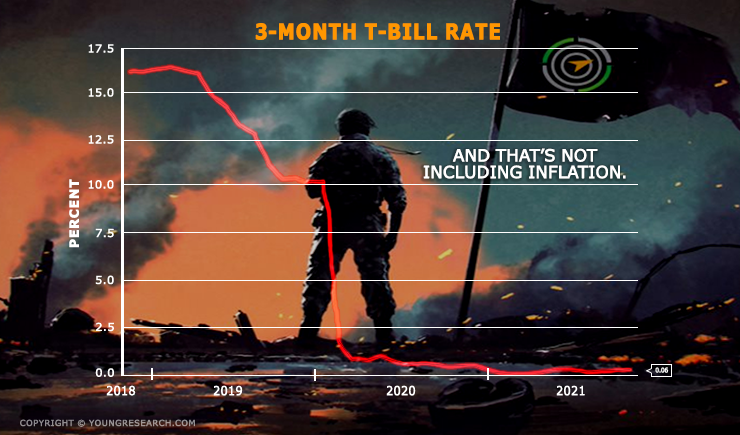

When I see investments yielding many multiples above the risk-free rate of return, I think about risk. Think about real estate, for example. The yield on real estate investment trusts (REITs) is hardly what I’d consider a value, and any private deals offering higher yields scream “no liquidity” to me. The reality, though, is average investors can’t handle one percent on their money. That is until they realize it’s gone and then it’s a “poor me” sob story and the usual blame game.

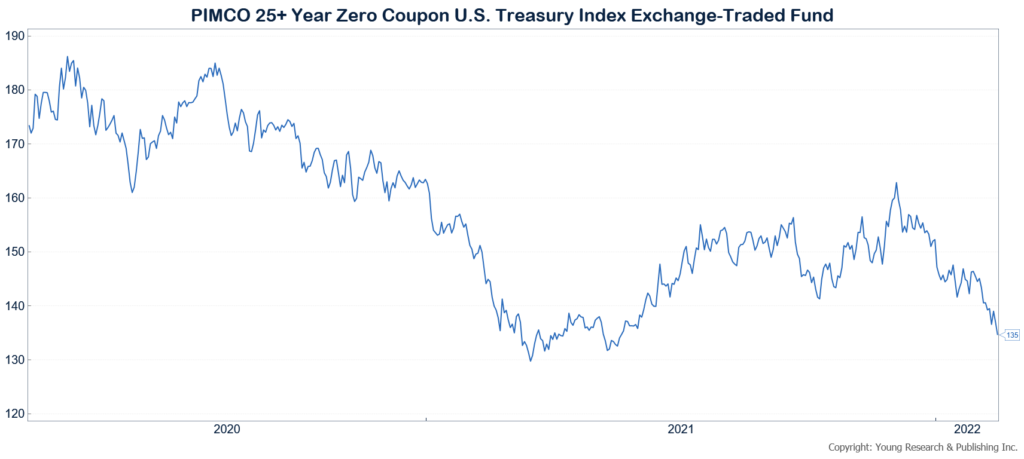

Take a look at the chart below. This is what happens when investors reach for yield. This is an example of the PIMCO 25+ year Zeros ETF. It’s down 27% from its April 2020 high. At current long-term interest rates, it would take about 15 years of compounding to break even. That’s a stock market-like dry spell.

Action Line: If you need help building a portfolio with risk in mind, I would love to talk with you. If you would like to get to know me before we talk on the phone, there’s no better way than signing up for my free monthly Survive & Thrive letter. In the letter each month, I encourage and push you to achieve the personal and financial security goals you’ve set for your family. Click here to subscribe. We’ll get to know each other, and get serious about your future success.

Originally posted on Your Survival Guy.