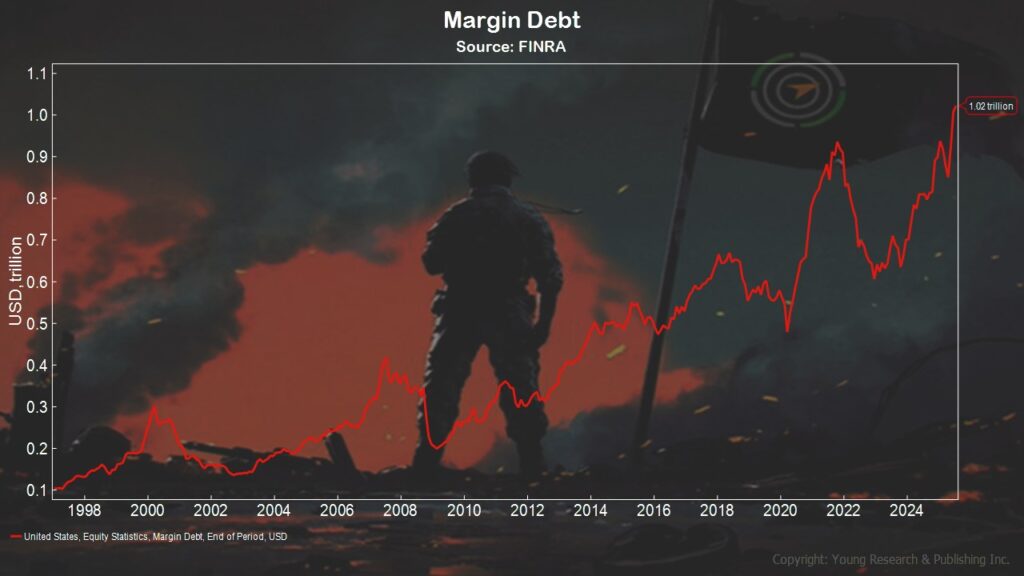

When you look at the level of margin debt, you have to wonder what happens when markets go the other way and the bankers come a-knockin’. Your Survival Guy eschews margin debt and advises the same for you.

Investing is hard enough as it is, to then worry about prices—prices going down to where margin calls are made and positions are automatically sold. It reminds me of stop losses that always sound good on paper, but investors forget you need a buyer at your stop price, and the lines to sell wrap around the corner block. No, thank you.

In The Wall Street Journal, Telis Demos explains the dangers of all that margin debt in a falling market, writing:

Even if it isn’t a “market top” signal, though, margin levels still matter to some stocks. Shares of brokerages and Wall Street trading firms have been essentially supercharged bets on the rising market. Robinhood is up more than 400% over the past year. Interactive Brokers is up over 100%, and Schwab is up around 45%. Morgan Stanley and Goldman Sachs GS -0.42%decrease; red down pointing triangle are up about 40%. The S&P 500 is up 13%.

But this can be a double-edged sword. If prices plunge, so can margin lending. Investors roll back borrowing to slash risk. And as collateral needs shrink, rather than grow, margin debits can become credits, and interest income falls. So, too, can fees that are based on the value of assets or portfolios. This means revenues can drop on the downswing just as they rose on the upswing. And brokers’ shares may fall faster on the downside, too.

Action Line: When you want to talk about margin, or the lack thereof, in your portfolio, email me at ejsmith@yoursurvivalguy.com. And click here to subscribe to my free monthly Survive & Thrive letter.

Originally posted on Your Survival Guy.