If you own a waterfront home, or a mountain retreat, or some land with a barn not too from the city, then you know their values are going up. I’m seeing it here in coastal Newport at every turn with license plates from NY, NJ, MA, and CT filling the streets—the secret’s out. But most have been dreaming about the “lifestyle” for years. They just needed a push to get in the game.

“If you’re on some kind of fence, Covid shoves you off of it,” explains Luke Siegel as he and his wife Johanna bought a home on 30 acres with a barn just north of NYC. (You can read about here).

Sitting on the fence or inertia also keeps successful Americans from finding the investment/retirement/financial plan they deserve. Inertia is a beast. I get it.

Everyone wants “Preservation of principle and growth”—the equivalent of a city home and your 30 acres with a barn just 30 minutes away. I’m here to tell you that, yes, you can have your cake and eat it too.

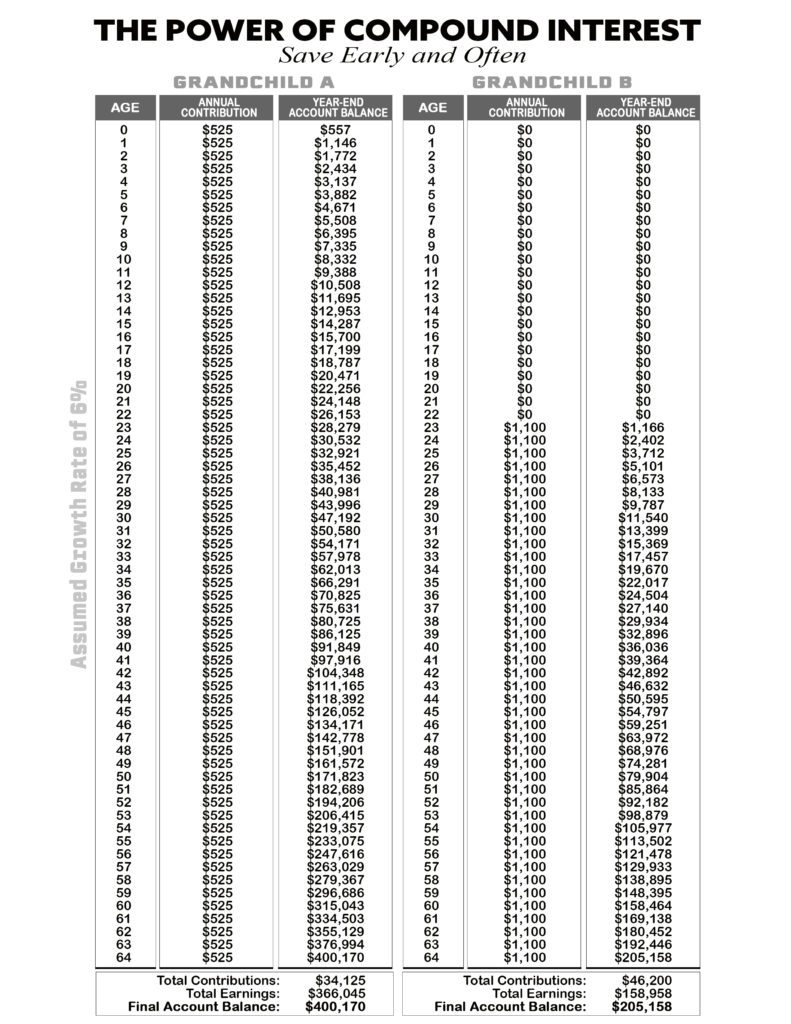

Because once you start compounding, at say six percent, you look back and have a hard time believing how well off you truly are. What’s even better is, you didn’t have to speculate and risk losing 50% (I see it all the time).

There’s virtue in making money slowly—you respect it and do whatever it takes not to lose it. Time becomes your friend. But at some point, the money and the thought of losing it becomes too much, and you end up sitting on the fence, not sure what to do.

I want you to think of your financial plan as having it all—where you have your country home, and the place your kids call home. You do that by taking control of your money—by putting time on your side. If you do, your kids and grandkids will never forget you.

Get a head start on retirement and generational wealth. Send this along to someone you care about whom you know will tend to the family’s wealth with the care it deserves. Let’s stay in touch. You can sign up for my monthly Survive & Thrive newsletter for more, but only if you’re serious.

If you’ve been with me during this crisis, then chances are your investments are in good shape. I can’t guarantee it, but I can guarantee you’re smiling inside when someone asks how your portfolio is doing.

We all know the guy who tells you he sold at the top and waited out the bottom. That guy, however, still has to figure out when to get back in (if he was ever in, to begin with).

As far as I’m concerned, he would have been better off collecting dividends and reinvesting them at lower prices and perhaps picking up some cheap, high-income bonds.

It’s because of times like these that you’re with me. I care about you but have no time for the guy I described above. If a loved one expresses concern about their situation, you want to help. You always want to help someone you care about. Remember, every stock needs to have a reason for being in your portfolio.

I think of you when I look around at this speculative craze. Is it time for us to talk? Only you know if a serious talk will help with your financial planning. I would love to help you. Let’s have that talk. The calm of a storm is fleeting. Don’t miss this boat. If you’re serious, and only if you’re serious, about your financial situation and your family’s financial and personal security you can email me at ejsmith@yoursurvivalguy.com.

Originally posted on Your Survival Guy.