Tension is high on the social and economic fronts. FBI Background checks continue to trend higher, dissatisfaction with the direction of the country is trending high, and the underemployment rate (U6) isn’t real encouraging in this sluggish economy. But it’s a sluggish economy with inflation. You need only look at your checkbook and credit card bills, not the government’s worthless CPI, to find it: Education, Condo’s in Boston/NYC/Miami, food (the type you buy) and taxes to name a few are sky-high. Gold is up 20% YTD. Your dollars are getting smaller by the day. And the pathetic dividend yield of just over 2% on stocks is well below the norm.

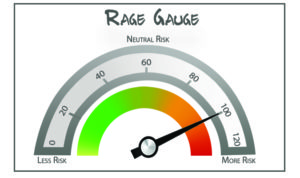

What should you make of this? Well, retirees that are reaching for yield—when they should be protecting what they’ve earned over a lifetime of working and saving—will feel the pain. When? No one knows. I don’t spend much time trying to predict the when. But when it does happen, you should be prepared. This is not a market that favors the needy. And like always, it is the needy investor that tends to get crushed by the market for hurling Hail Mary passes in the fourth quarter. With the RAGE Gauge signaling high risk today, you should avoid adding risk where possible and continue to focus on the long- term.