According to the Employee Benefit Research Institute, 22% of people in their 60s have more than 80% of their 401(k)s allocated to equities.

With only a few years left until retirement, an 80% allocation to stocks is asking for trouble. An 80-20 mix of stocks and bonds can experience crushing losses that are difficult to recover from—especially if one is already taking an income stream from the portfolio.

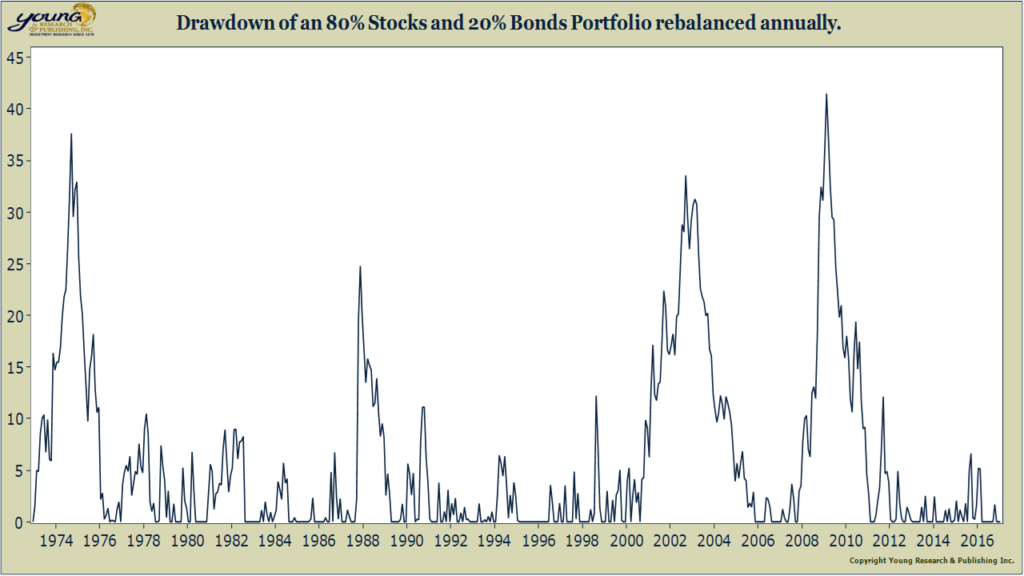

Our chart shows the drawdown of an 80-20 portfolio invested in the S&P 500 and the Merrill Lynch Government and Corporate Bond Index and rebalanced annually. The drawdown is the peak-to-trough decline in a portfolio. The chart uses monthly data.

During the last big bear market an 80-20 portfolio would have suffered a peak to trough decline of over 40%. A 65 year old investor on the verge of retirement would have seen his retirement income future devastated by such a loss.

If you are in or nearing retirement, a good back of the envelope guide to a proper asset allocation is to invest your age in fixed income. You can also try your age minus 10. So if you are 65, you might consider putting 55-65% of your portfolio in fixed. This is of course a general guide and does not take into account your own financial situation or risk tolerance, but it can keep you out of trouble.