Retirement income. We all want it. We all need it. How do we get it? Well, dear reader, you’ve come to the right place. Let’s start with bonds. My feeling about them is once you get to age 50 or so, if you don’t already have them, then you need to get some. Your Survival Guy rounded that corner not too long ago, and I have had bonds for years. But I’m probably one of the more conservative investors you’ll come across.

I don’t “play” interest rates. I don’t try to predict where they’ll be. I look at what the markets are paying today, and I decide if I like the value proposition. A big part of my decision-making process is what are the chances for the return of my assets, not the return on them. I work too hard to see my money disappear. Treasurys, backed by the full faith and credit of the U.S. government fit the bill today.

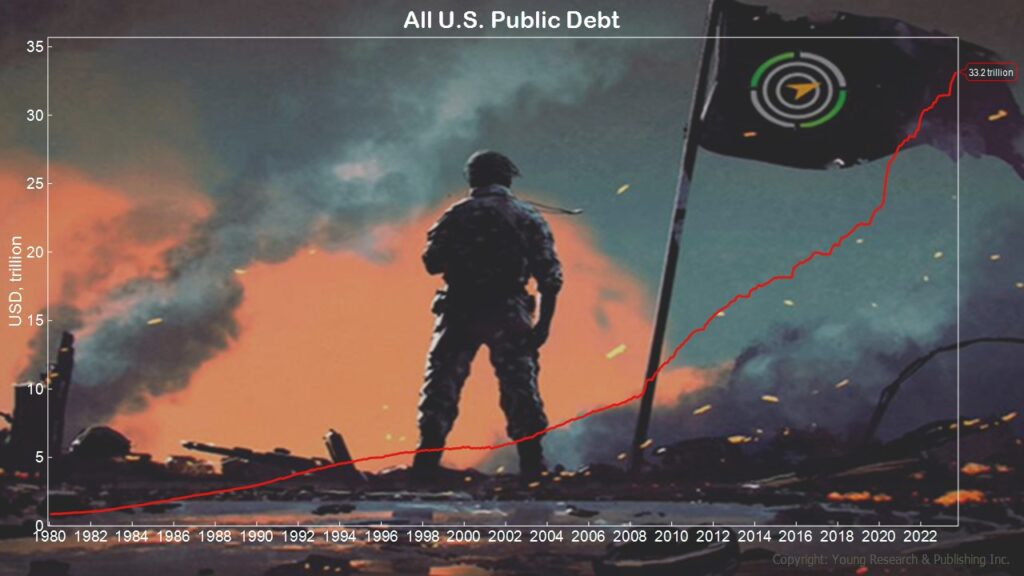

Yes, the U.S. dollar and government are still the nicest house in a bad neighborhood. But that’s no guarantee. It’s not an entitlement. Because that’s a huge IOU for the country, and based on the debt held by the public, the neighborhood’s not getting any safer.

But let’s not forget that you can draw around four percent on Treasurys today without touching principal. I like that math, and it’s why I like locking in these rates for longer periods of time. You can sink your teeth into these yields and keep them for years to come. I like that.

Action Line: When you’re ready to talk, I’m listening.

Originally posted on Your Survival Guy.