Coronavirus Infects Stock Market: Part XXXV

You feel it in your gut: The cure is worse than the disease. The numbers don’t support a stay-at-home, out-of-work policy for an entire country, never mind most of the world.

Turns out Sweden was right from the beginning as was President Trump, who explained that America is not meant to be closed for business. Business, not the government, is our country’s lifeblood.

Don’t tell that to the blue states though, as they demand bailout checks for pensions—math that even a first-grader knows doesn’t work. Remember the Golden Rule muni bondholders: He who has the gold makes the rules. Don’t think for a second government will pick you over their pensions.

Let’s not forget the ratings agencies either. You know the ones who kept ratings high on some toxic waste bonds made famous in The Big Short. How reliable are they? Be your own ratings agency. Know your portfolio.

Remember, gold can be an expensive asset to own considering it doesn’t pay you interest or dividends. What ammo will the Fed use when there’s a second wave? Has there been a better case for high-quality stocks?

High dividend payers, by nature, pay above average. Don’t be average, never mind below average. Invest for margin of safety.

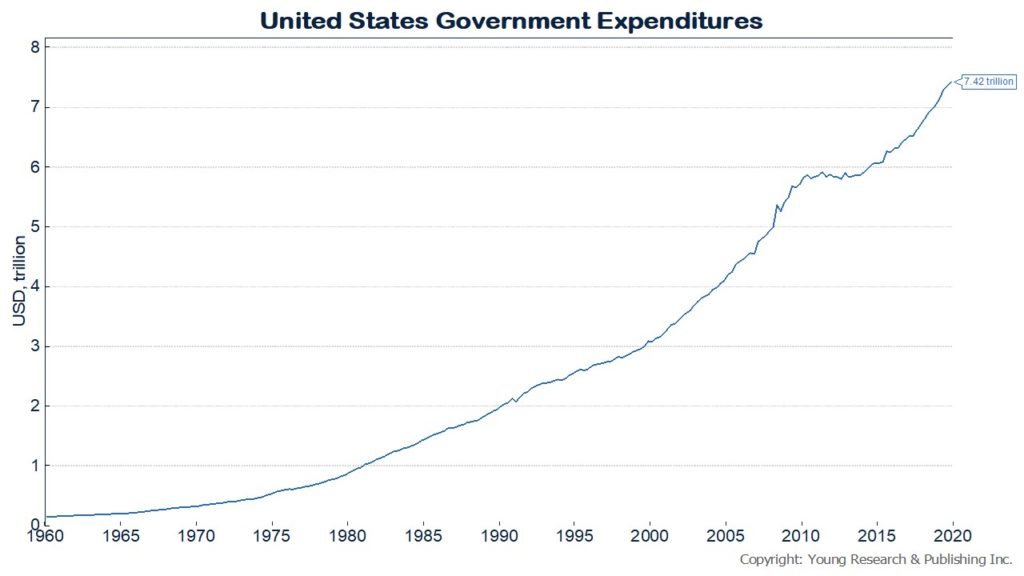

As 26 million jobs are lost the government grows.

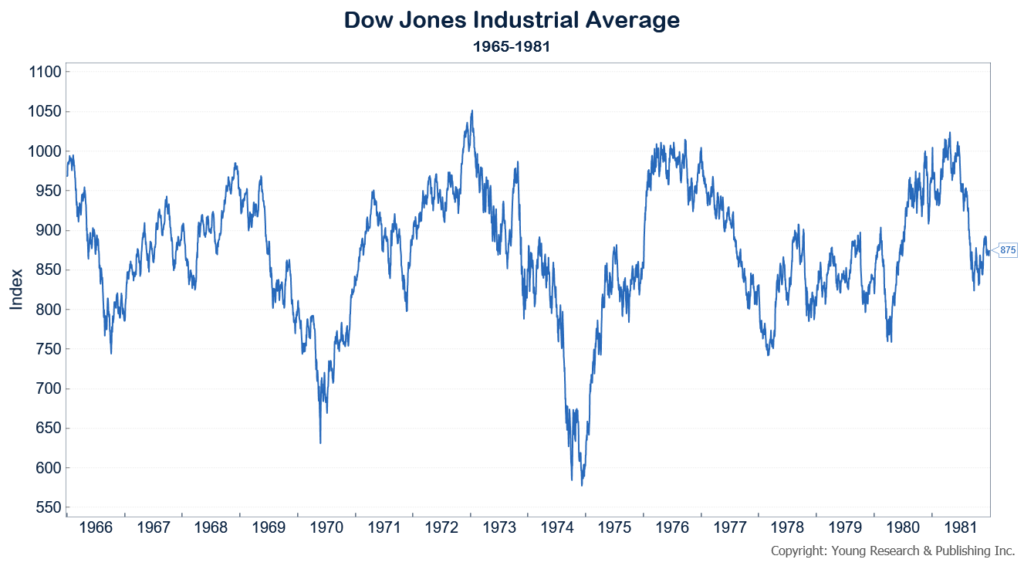

If your financial house isn’t in order, put your finger at around 1974 in the chart below and see how brutal markets can be. Government has gone wild with no end in sight. It’s time to get back to work.

“Way Back Home”

Gadd Gang, September 1988 Live at Bottom Line, NY with Steve Gadd, Eddie Gomez, Cornell Dupree, and friends.

Read my entire series, Coronavirus Infects Stock Market here.

Originally posted on Your Survival Guy.