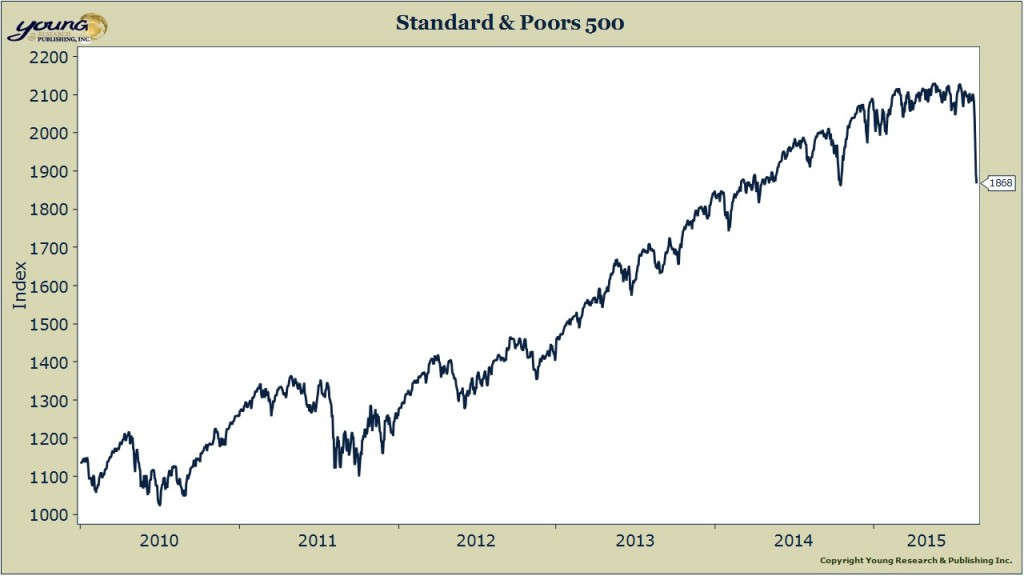

Over the last five trading days the market has cratered by almost 11%. An 11% decline in stocks is not an out of the ordinary correction. Stock market corrections, defined as a decline of 10% or more happen about once every year.

The last 10% correction in the stock market was all the way back in 2011 so we were overdue. The suddenness of this correction and the speed of the uninterrupted decline is what is uncommon and rather disturbing.

Over the last seven decades, there have only been seven other occasions when stocks fell by as much as they did over the last five trading days. We are in rarefied air to be sure.

But could this be the new normal for stock market corrections? The market structure has changed markedly over the last decade. High Frequency traders (HFTs) now account for over half of stock market volume, exchange traded funds (ETFs) play a more prominent role in financial markets, and hedge-funds, many of them leveraged, are also a bigger part of the investment landscape than they were in decades past.

HFTs have the potential to exacerbate market declines because they are now such a large part of the market and they are under no obligation to provide bid and offer quotes in periods of market stress as NYSE specialists once were.

ETFs, while a net benefit to the investor class, don’t offer the same buffer that traditional open-end mutual funds do. When you put in an order to sell your traditional mutual fund in the morning, your portfolio manager has the entire day to come up with a way to meet your redemption. He may have to sell shares to meet redemptions, but he can also dip into cash or borrow temporarily. When you put in an order to sell your ETF in the morning, it is executed immediately and if many investors are putting in similar orders at the same time the aggregate order volume can have an impact on the underlying stocks in the ETF.

Hedge funds tend to be fast money traders and many use leverage, so in times of market stress margin calls mount and trading activity picks up.

If HFTs, ETFs, and hedge funds are contributing to the speed of this stock market correction, we may be looking at a new normal.