“Never pick a stock again,” proclaims the headline of a recent article by Money. The California Public Employees Retirement System is considering making cuts to its allocation of active managers. Meanwhile, robo-advisors are hawking a “new” model of investment management centered around broad based index ETFs (I’ll have more on robo-advisors in a future post).

The financial press and many more in the finance industry are hailing index based ETFs as the savior of the investing masses.

Is this the real deal? Are we finally seeing a secular shift in the money management business or is today’s infatuation with index based ETFs merely a guidepost of the stock market cycle?

A Secular Shift Toward ETFs

There is undoubtedly a secular component at play here. At Young Research, we started writing about the profound effect that exchange traded funds were likely to have on the mutual fund industry as early as 2006. We expected the ETF industry to, over time, hollow out the mutual fund industry. Exchange traded funds offered too many advantages over the fee-laden, front-end load, closet index funds that were being pushed on the public.

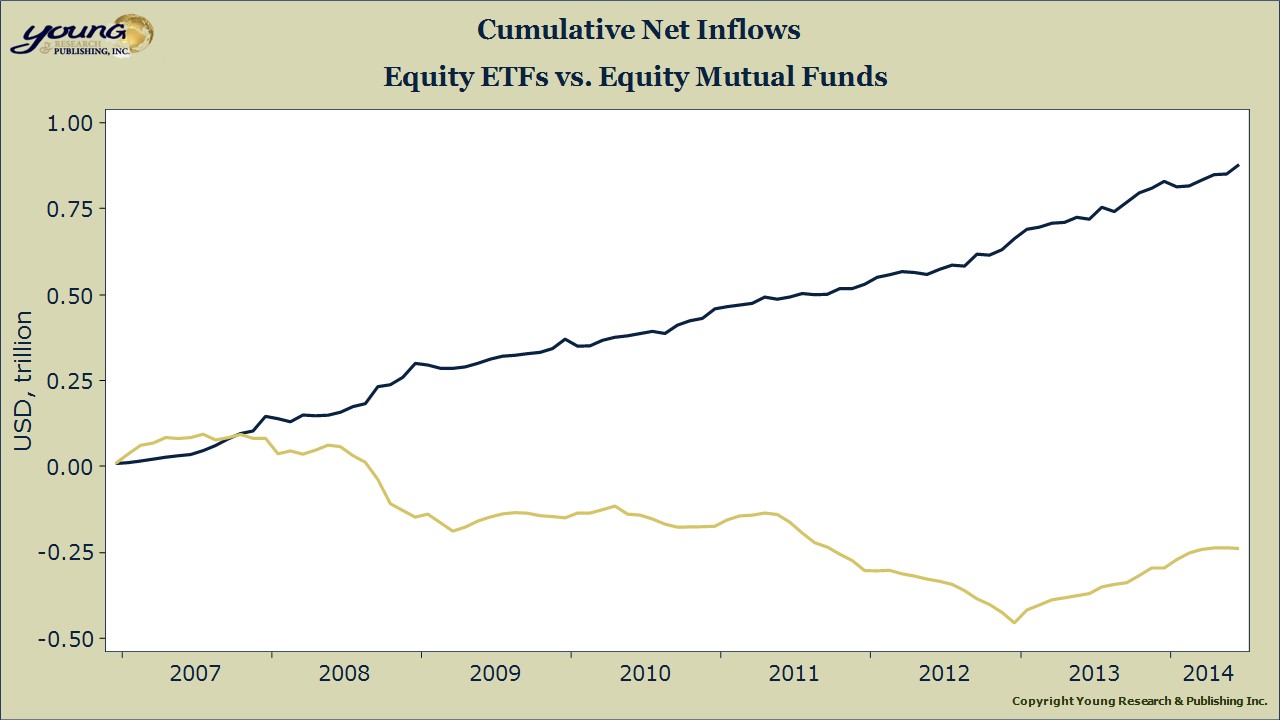

Over the last eight years, net inflows to equity ETFs have amounted to almost $900 billion, while open-end mutual funds have experienced net outflows of $240 billion. Investors have apparently recognized many actively managed mutual funds for what they truly are—expensive closet-index funds.

According to at least one recent study published in the Financial Analysts Journal, as much as half of all mutual fund assets are either indexed or closet indexed. And that study only looked at data through 2009. The shift toward index-based ETFs has progressed meaningfully since.

Is it any wonder investors are abandoning actively managed funds? Closet indexing is a fraud. Fund companies charge for active management, but deliver nothing of the sort. Why should investors pay the higher fees when they can buy the real deal for a fraction of the cost and get better results?

At Richard C. Young & Co., Ltd. and in our premium strategy reports we have almost completely abandoned actively managed equity funds. The problem isn’t the active management. The study I cited above also indicated that those managers who truly engaged in active management outperformed their benchmarks by more than 1% per year. The problem with actively managed funds is the fees, and the incentive for managers to closet index.

The Cyclical Component

There is also a cyclical component to today’s strong interest in index ETFs. Index investing tends to move in and out of favor with the stock market cycle. In the later stages of bull markets when a larger share of active funds tend to lag, (this is a function of both a narrowing market and lower return dispersion), indexing is held up as the only prudent approach to managing money.

I would argue we are in this stage of the cycle today. Just pull up your favorite financial news site and you are bound to see at least one article mocking those who still bother with actively managed funds. The mocking of actively managed funds by the same folk who formerly touted these funds is a useful anecdotal indicator of investor sentiment. Remember, indexing looks best late in a bull market.

The bottom line: Exchange Traded Funds are here to stay. They are the funds of the future. But today’s infatuation with index based ETFs says more about investor sentiment than it does about a shift in investor fund preferences.