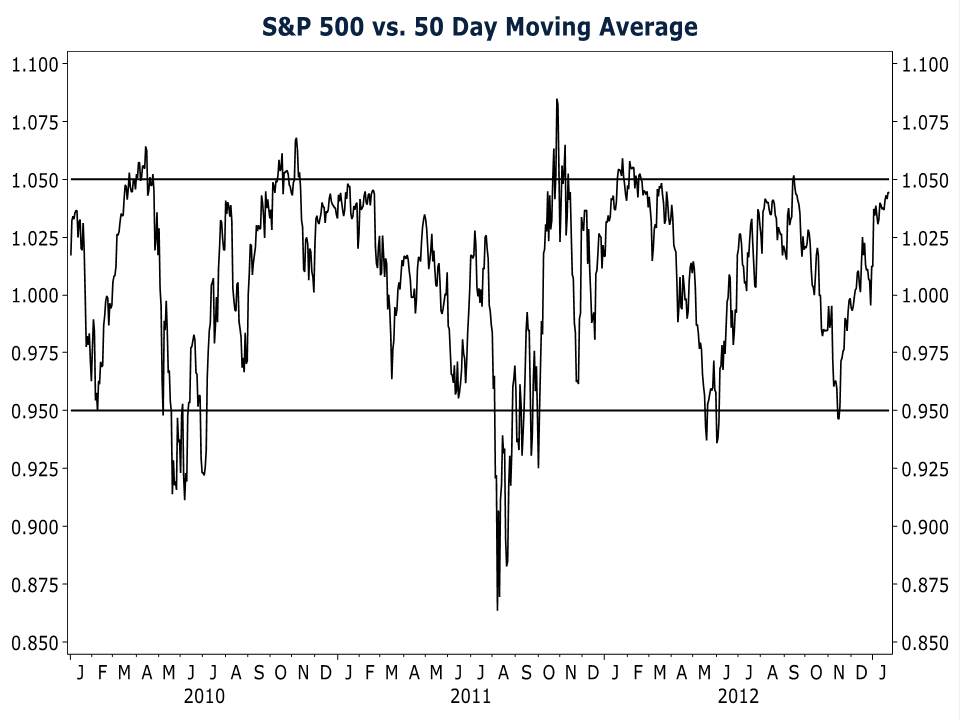

After rocketing upward by 4.8% already in the new year, the S&P 500 is entering extreme overbought territory. On the chart below you can see the ratio of the S&P 500 price index to its 50 day moving average. The ratio is nearing 1.05, traditionally a turning point.

What’s driving equity prices higher? It’s not earnings. Trailing P/E ratios of the S&P are increasing quickly. Is the market expecting faster growth in the future? Forward P/E ratios are increasing too, so that’s not the root cause.

More likely, the cause is that the massive amounts of high powered money injected into the market by the Federal Reserve are inflating stock prices. Nobel Prize winning economist Milton Friedman postulated that monetary policy decisions affect the economy with “long and variable lags.” It may be that after more than four years of being bludgeoned by Mr. Bernanke’s zero percent interest rate policy and perpetual money printing campaign investors have finally given up trying to make rational investment decisions. Speculation is the only game in town in this market. When a stock like Netflix soars over 35% on a better than expected earnings report, you can be certain speculative excess is rampant. Under the leadership of Mr. Bernanke, the Fed is well on its way to creating a third monetary induced asset bubble in less than 15 years. That’s an impressive feat.