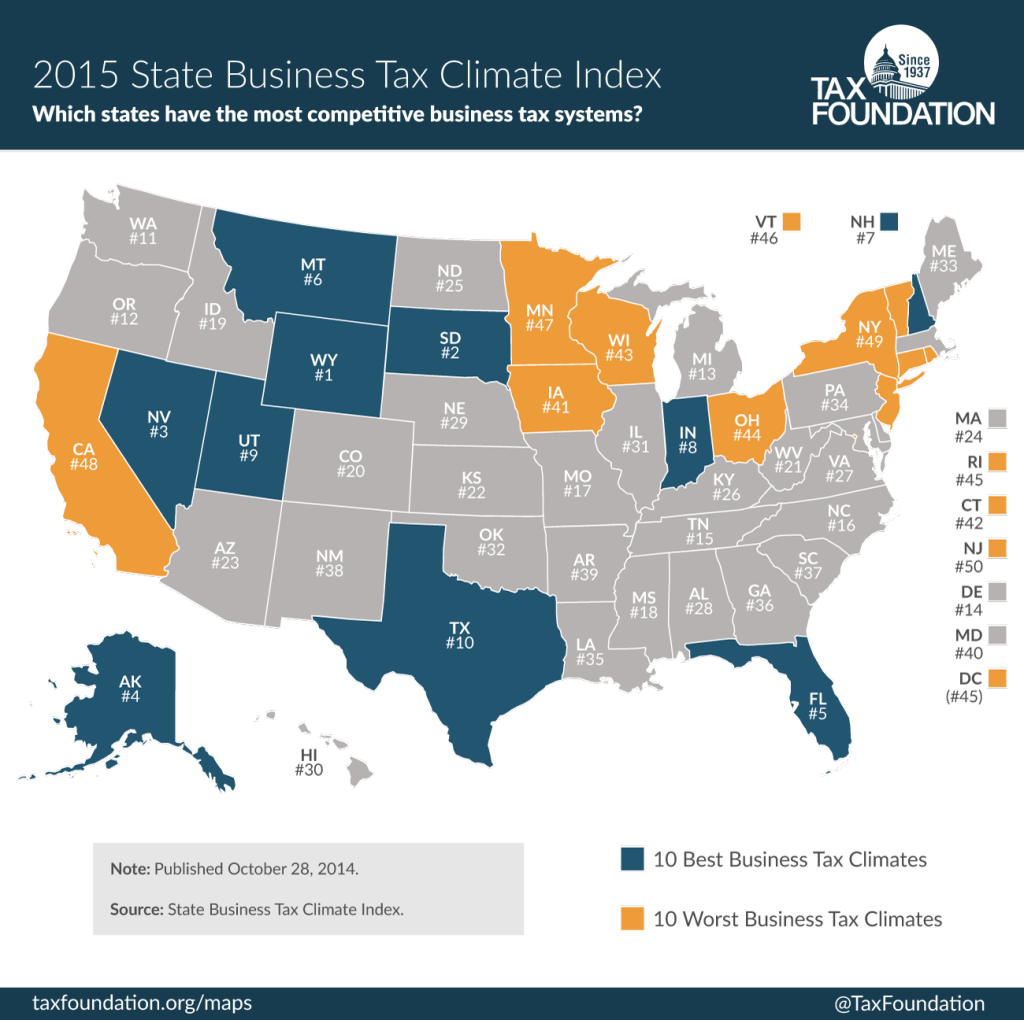

The Tax Foundation’s State Business Tax Climate Index was released this week. No surprises here:

The 10 best states in this year’s Index are:

- Wyoming

2. South Dakota

3. Nevada

4. Alaska

5. Florida

6. Montana

7. New Hampshire

8. Indiana

9. Utah

10. TexasThe absence of a major tax is a common factor among many of the top ten states. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate tax, the individual income tax, or the sales tax. Wyoming, Nevada, and South Dakota have no corporate or individual income tax; Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.

But this does not mean that a state cannot rank in the top ten while still levying all the major taxes. Indiana and Utah, for example, have all the major tax types, but levy them with low rates on broad bases.

The 10 lowest ranked, or worst, states in this year’s Index are:

- Iowa

42. Connecticut

43. Wisconsin

44. Ohio

45. Rhode Island

46. Vermont

47. Minnesota

48. California

49. New York

50. New JerseyThe states in the bottom ten suffer from the same afflictions: complex, non-neutral taxes with comparatively high rates. New Jersey, for example, suffers from some of the highest property tax burdens in the country, is one of just two states to levy both an inheritance and an estate tax, and maintains some of the worst structured individual income taxes in the country.