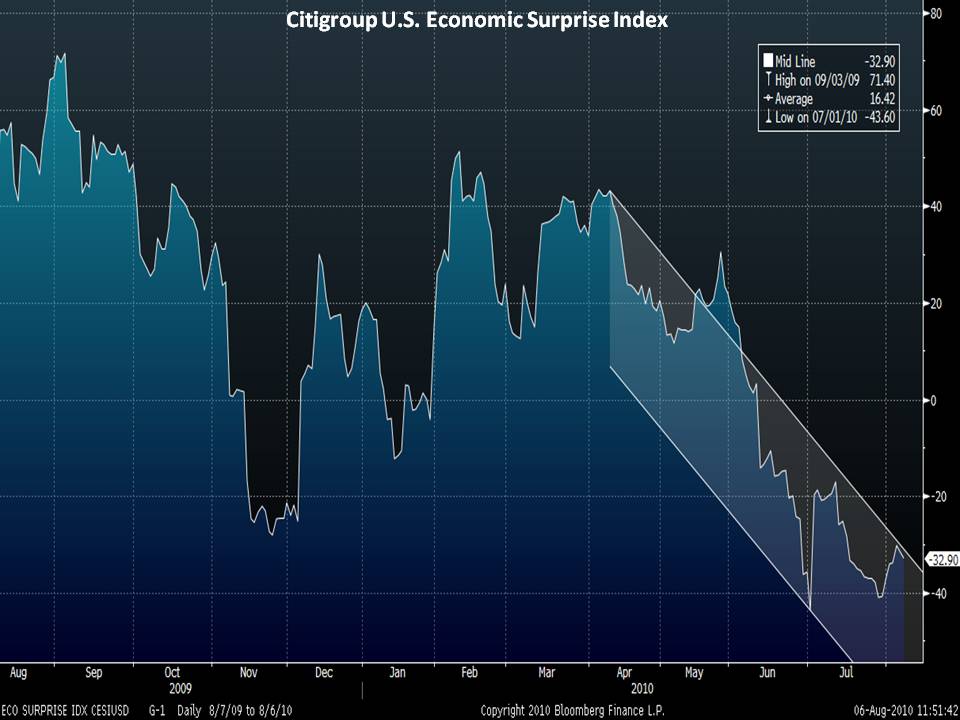

The stock market mounted a powerful rally in July. The S&P 500 jumped almost 7% for the month and has tacked on another 2% so far in August. The rally is most unusual given the raft of weakening economic data that has been reported in recent weeks. My chart shows a marked downtrend in the Citigroup U.S. Economic Surprise Index. The Citigroup index measures the difference between projected economic data and actual economic data. A falling index indicates that economic data is coming in worse than expected. Since expectations are what drive stock prices, a declining surprise index is often correlated with falling stock prices.

Another unusual aspect of the recent strength in equity prices is the drop in bond yields. If stock prices were rising because the economy was improving, one would expect bond yields to rise, but they aren’t. Bond yields are plummeting. Some intermediate-term maturity yields are approaching their crisis lows. Some pundits will tell you that bond yields are falling owing to the risks of deflation. But if deflation were a serious risk, stocks certainly wouldn’t be rising. Just pull up a price chart of the Dow during the Great Depression or Japan’s Nikkei 225 stock index over the last 20 years. In Japan, the Nikkei index is still 75% below its 1989 high. Deflation would destroy equity prices.

So then, why has the stock market been so strong recently? One reason may be the anticipation of another round of monetary stimulus. Wall Street would love nothing more than another big injection of liquidity from the Fed. They are virtually begging for it. The Street remembers what happened the last time the Fed injected liquidity into financial markets—asset prices soared—at least temporarily. If the Fed does decide to ramp up the printing presses yet again, stock prices could rise further, but don’t assume the gains are sustainable. Easy money is not a path to economic or financial prosperity.