These are the kinds of records you don’t want to break. Illinois is the second state in history to be charged with securities fraud for failure to disclose its pension liability. It joins New Jersey.

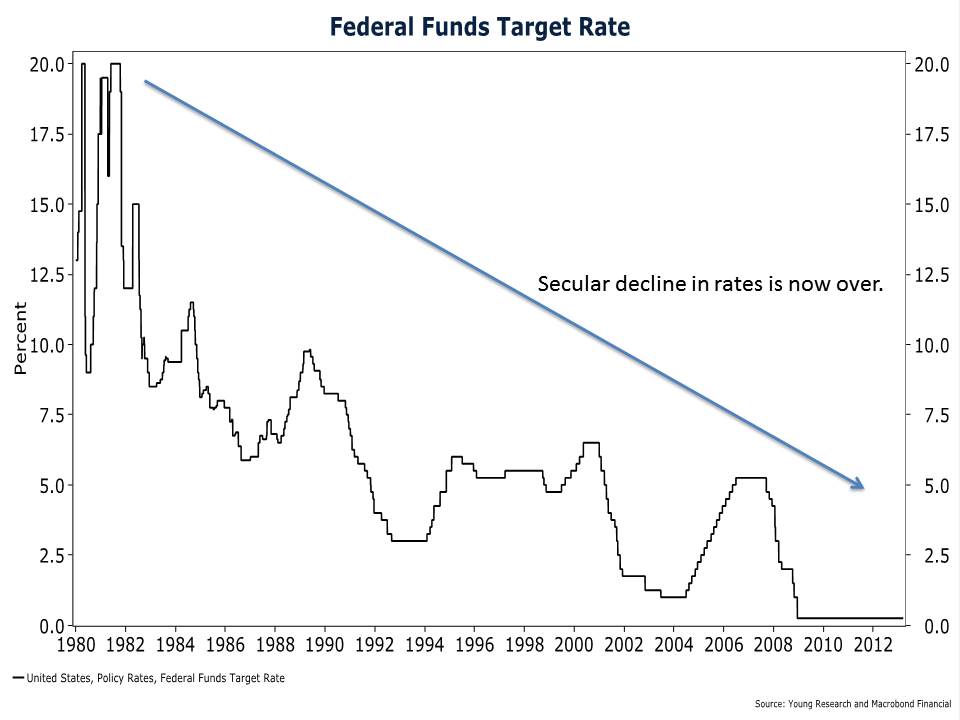

You don’t want anything to do with Illinois municipal bonds. The long-term secular decline in rates started in the early ’80s, and is now over, along with the easy money in bonds. When states like Illinois run out of money, who’s going to pay muni investors back? Why stick around in an investment when its key benefit, tax-free status, is controlled by politicians? It wouldn’t shock me if they tried to change the tax-free status of muni bonds to help lessen the load on the state fisc. Politicians on both sides of the aisle have hinted at eliminating the tax-free status of muni bonds to help close the deficit, even President Obama himself. The pressure on states continues to mount, and when push comes to shove, politicians need votes more than they need investors.