Jeremy Siegel, the famous Wharton School finance professor coined the phrase “stocks for the long-run” with his identically titled 1994 best seller, Stocks for the Long Run: The Definitive Guide to Financial Market Returns and Long-term Investment Strategies. In the book, professor Siegel looks back at up to two centuries of financial market history to support his claim that stocks are the most profitable long-term investments. And indeed his conclusion has been true.

But the good professor failed to adequately warn investors that the long run can be a really long time. Check out my stock market charts on Spain, Italy, and Greece.

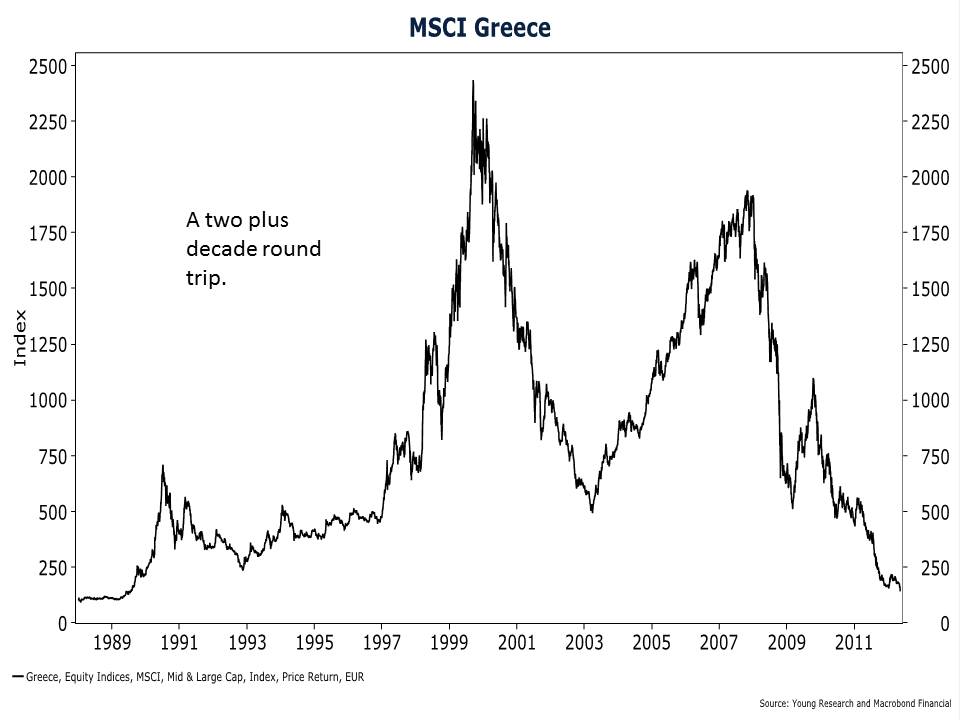

Spanish stock prices are no higher than they were 13 years ago. That is a long time to forego capital gains, but in comparison to the performance of Italian and Greek stocks, the Spanish stock market looks like a winner. Italian stock prices are no higher than they were in 1986—that’s 26 years without a capital gain. And Greek stocks don’t look much better. The MSCI Greece index has done a round-trip over the last two decades. How do you think an Italian investor who retired in the late 1980s would have fared with a portfolio invested entirely in stocks?

Siegel may be right about the long run profitability of stocks, but the famous British economist John Maynard Keynes warned us long ago that “In the long run, we are all dead.”

Diversification and balance (as in bonds) remain vital to your short and long run investment success.