Here is a shocker for you. Are you sitting down? Some of you might not like what I am about to say, but it has implications for your portfolio. You know those 4.5 million private sector jobs that President Obama boasts about creating? Yes, I know the President created nothing of the sort. Our discerning readers will point out that there has been no net job growth under Obama and that if it weren’t for all the folk who quit looking for work since the President took office, the unemployment rate would be over 11%.

But it turns out that even those 4.5 million jobs the President is crowing about shine an unduly bright light on the labor market. Not because the 4.5 million jobs created since the bottom of the labor market barely keeps up with growth in the labor force. But because almost 60% of the jobs created are in low wage occupations. These are burger flipping jobs the President is boasting about. You can barely make rent, let alone raise a family with one of these jobs.

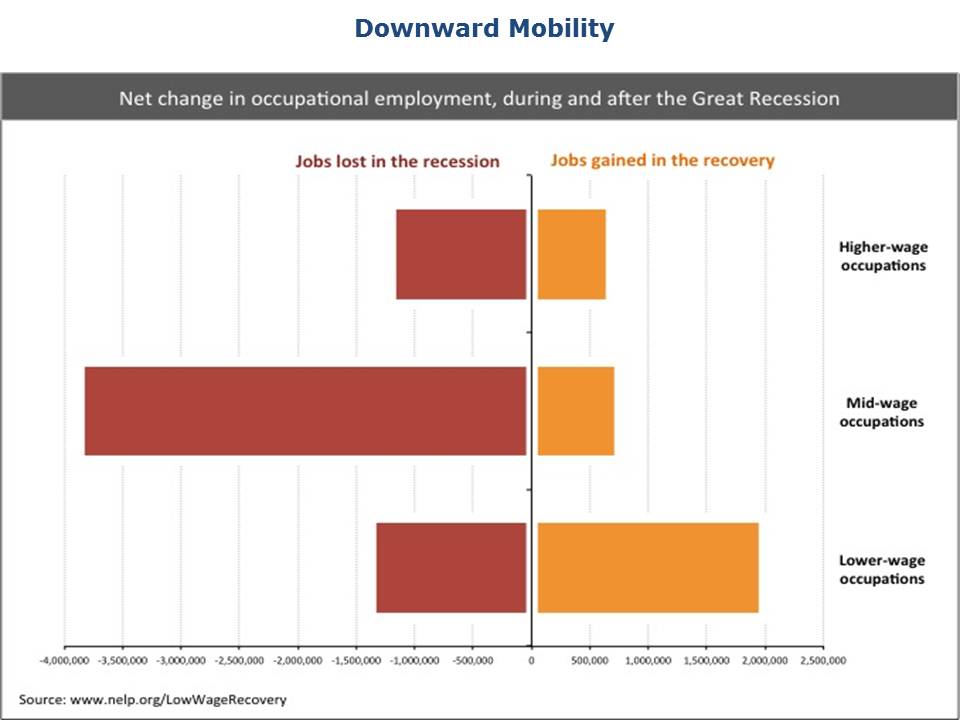

The National Employment Law Report, reports that lower wage occupations, those jobs that pay between $7.69 per hour and $13.83 per hour accounted for only 21% of the jobs lost during the recession, but 58% of jobs gained in the recovery. Mid-wage occupations accounted for 60% of the jobs lost in the recession, but only 22% of the jobs gained in the recovery. Kind of makes those speeches about growing the economy from the middle class out ring hollow, does it not?

You knew intuitively all along that this recovery was a mirage. That growth has been artificially and unsustainably propped up by deficit spending and monetary bribery. But now, there is more evidence, hard evidence to confirm your suspicions. The labor market is still in the tank. And without a vibrant labor market this economy is going nowhere. Invest accordingly.