In 2012 there were stunning trends in gold buying. Perhaps the most stunning was who was buying gold to lower risk from economic turmoil.

The World Gold Council says that in the third quarter central banks purchased a whopping 97.6 tonnes of gold. That’s in line with six of the last seven quarters in which central banks have purchased around 100 tonnes. Central bank buying was up by 9% as of mid-November.

That’s the reversal of a trend. Central banks through the end of the last century had been selling off their gold reserves in an orderly way. They didn’t really see the point of holding on to too much gold. After the 2008 financial crisis hit, many central banks reexamined the benefits of holding gold as part of their reserves. Since then net purchases of gold by central banks have been positive. The Federal Reserve’s furious printing of the world’s reserve currency probably helped them see the light. Among the countries buying gold are those with mineral resources like Iraq and Brazil who see the advantages of adding gold to their reserves.

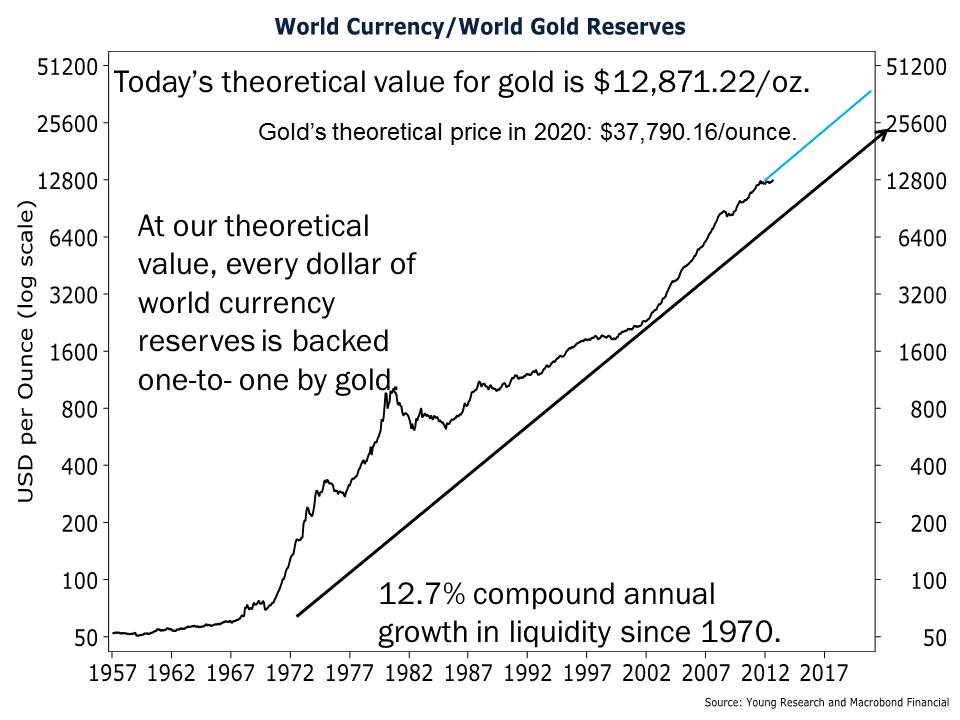

It’s not hard to determine why countries would like to add gold to their reserve portfolios. The Young Research World Currency/World Gold Reserves chart places a theoretical value on an ounce of gold at $12,871.22 if every dollar of currency reserves in the world were backed one-to-one by gold. That’s not a prediction of a future valuation for gold, but an indication of how flooded the world economy has become with paper currency. The trend on our chart is disturbing and makes central bank purchases of gold unsurprising.