The Vanguard Wellington Fund (VWELX) is the original balanced mutual fund. It was the first mutual fund to include bonds in its portfolio and the 7th open-end mutual fund ever launched in the United States. It also happens to be one of the most successful mutual funds of all-time.

From its inception in 1929, the Vanguard Wellington Fund has turned a $10,000 investment into over $11,000,000 (through year-end 2018).

Wellington’s approach of investing in stocks, as well as bonds, is the driving force behind the fund’s 90+ year record of investment success. Were it not for the decision of Walter Morgan, the fund’s founder, to include bonds in the portfolio, the Wellington Fund may have failed as so many stock-only mutual funds did during the Great Depression.

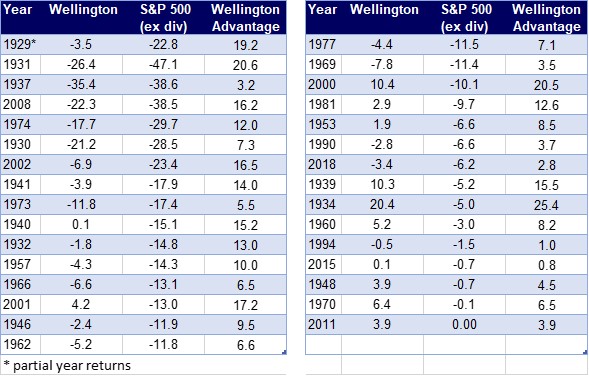

Of course, the Wellington Fund did not escape the Great Depression unscathed, but its losses of 3.5%*, 21.2%, 26.4%, and 1.8% in 1929, 1930, 1931, and 1932 paled in comparison to the gut-wrenching crashes of 23%*, 28%, 47%, and 15% in the S&P 500 during the same years (dividends excluded).

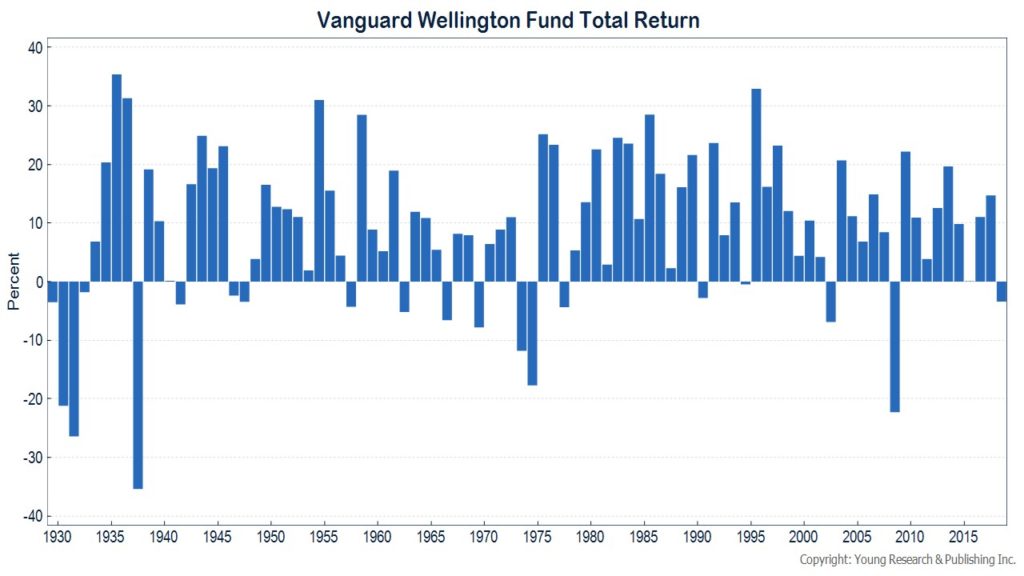

Vanguard Wellington Fund Annual Returns Chart

The chart below shows the annual return of the Vanguard Wellington Fund from its inception in 1929 through year-end 2018. Below that, you will find a table Wellington’s returns in down years for the stock market.

When the stock market has declined, the Vanguard Wellington fund has most often declined much less, and on some occasions, it has even gained in value.

Vanguard Wellington Returns in Down Years for Stock Market

Wellington’s Investment Objective

Today, Wellington continues to invest with a similarly balanced approach. The fund purses a conservative investment strategy, targeting an asset allocation mix of about 35% in bonds and 65% in stocks.

The bond side of the portfolio focuses on the investment-grade sector of the bond market with positions in mortgages, corporates, and treasuries.

The equity side of the portfolio favors dividend stocks that are out of favor and trade at low valuation multiples.

Wellington No Longer a Favored Fund with New Money

While the Vanguard Wellington fund continues to pursue a strategy similar to the one that it did when Morgan founded the fund over 90 years ago, it has lost some appeal.

The Wellington Fund is now a massive $110 billion portfolio. It is not as nimble as it should be, and the universe of companies large enough to accommodate a 2% position ($2.2 billion) from the fund has dwindled.

If Wellington wants to maintain a passive stake in the stocks it purchases of no more than 3% of a company’s shares, it must purchase firms with a market value of at least $73 billion. There are only about 80 U.S. companies with a market value of $73 billion or more today.

There is a Better Way than the Vanguard Wellington Fund

At both Young Research and our investment counsel firm, we long ago started to move away from mutual funds suffering from asset bloat.

Today, we favor an individual securities approach for most investors. A balanced portfolio of individual bonds and dividend-paying stocks is where our focus lies, and we would submit most other investors’ attention should lie as well.

That’s not to say Wellington is the worst an investor can do, only that most can do better.

Vanguard Wellington is AOK in 401Ks and 529 Plans

If your employer offers a 401K plan or you have a 529 plan set up for your children or grandchildren, and the menu of fund choices is limited, Vanguard Wellington is AOK. Wellington is a much better choice than many of the balanced funds we see offered in employer-sponsored retirement plans. You will want to make sure the fund is appropriate to meet your investment objectives and risk tolerance before investing.

The Vanguard Wellington Fund’s Rich History

The Wellington Fund was founded by Walter Morgan, who began operations of the Industrial & Power Securities Company.

Morgan, a native of Wilkes-Barre, Pennsylvania, was a young accountant during the roaring ‘20s and could see that the market was getting riskier. Morgan was the youngest certified public accountant in Pennsylvania but was earning little, so he left to prepare taxes for wealthy clients. In that new job, he realized the wealthy people he was working for needed investment advice. Morgan began his fund and put together investments that would be less risky than those owned by his competitors.

In a 1997 Vanguard newsletter interview, Morgan said of the market in 1929 that “there was so much speculation, and stocks were just too high.”

In light of what he considered high valuations for stocks, Morgan decided, “we should have ‘an anchor to windward’ in the form of a large position in fixed-income securities.” The fund became the first mutual fund ever to include both equities and fixed income securities.

In 1935, Morgan renamed the fund after the Duke of Wellington, and the Wellington Fund (VWELX) was born.

Wellington’s Rapid Growth, Jack Bogle and Vanguard

By 1944 Wellington was the tenth largest fund in the industry, with assets under management of almost $25 million.

In 1951, Morgan hired John Bogle, who would eventually inherit the Wellington Fund and go on to start the Vanguard Group in 1974, bringing Wellington along with him.

In a 2004 letter celebrating 75 years of the Wellington Fund, Bogle would explain Vanguard Wellington’s three-pronged objective: “From the very outset, Wellington’s three-fold objective has remained constant: (1) Conservation of Capital, (2) Reasonable Current Income, and (3) Profits Without Undue Risk.”

Walter Morgan passed away in 1998, but his pioneering work in crafting a durable investment portfolio has had a lasting impact in the investment industry and a lasting impact on Young Research and Richard C. Young & Co., Ltd. Wellington’s three core principles are at the heart of the Young Companies approach to investment research and counsel.

*partial year