Dividend Kings like Procter & Gamble (PG) are companies that have increased their dividend for at least 50 consecutive years.

Kings is an unfortunate label for a group of stocks, though. There can only be one true king, and if we are talking U.S. stocks with long records of annual dividend growth, Procter & Gamble stock (PG) is the only true Dividend King.

P&G has increased its dividend for 64 consecutive years. That ties Procter & Gamble stock with American States Water (AWR) for a record number of consecutive annual dividend increases.

Procter & Gamble Has Paid Dividends Since 1891

So why does P&G get the Dividend King crown over American States Water? For starters, P&G is a much larger company than American States Water. The larger a firm becomes, the harder it is to grow. PG also beats American States Water on the number of years it has paid a dividend. P&G has paid a cash dividend every year since 1891. American States Water has paid a dividend every year since 1931. Both are impressive, but Procter & Gamble comes out ahead.

How did Procter & Gamble (PG) become Dividend King?

What is the key to P&G’s more than six-decade record of dividend success?

In addition to operating in an industry that isn’t susceptible to big cyclical swings, P&G’s marketing and innovation have helped the firm raise its dividend every year for 64 consecutive years.

After employee salaries and material costs, Procter & Gamble’s third-largest cost is advertising. Some financial analysts view advertising as an expense, but advertising done right can create enduring brand value as it has at Procter & Gamble.

Procter & Gamble Stock (PG) Overview

P&G has operations in some 70 countries worldwide and markets its products in more than 180. It is the world’s largest maker of consumer goods for home and health. P&G breaks its business down into five segments; Fabric & Home Care (33%) Baby, Feminine & Family Care (27%) Beauty (19%), Health (12%) and Grooming (9%).

Procter & Gamble’s portfolio of consumer brands is unmatched in the industry. P&G now has about 65 brands in 10 different categories within the five segments listed above. P&G’s brands include Pampers, Always, Bounty, Tide, Gain, Pantene, Gillette, Crest, and NyQuil, among other heavy hitters.

Building Brands isn’t as Easy as it Used to Be

For many years, establishing brand value by outspending the competition was a sure path to success, but industry dynamics are changing. The internet and social media platforms have lowered the barriers to mass marketing. Almost any firm can now get in front of consumers to explain why they offer the best shampoo or detergent.

Procter & Gamble and other consumer branded companies still have an edge as they have scale and ad budgets that can crush almost any startup. But it’s now more important than ever for the product lives up to the claims made in the advertisements or consumers will look elsewhere.

Procter & Gamble Wants to Be the Superior Choice

Most firms in the consumer-packaged goods industry have been impacted by these shifting industry dynamics, but not all have identified a strategy to stay on top.

Procter & Gamble believes it can maintain market leadership by truly creating value for consumers. PG wants to be the superior choice for consumers by offering superior products. That includes having the best product, the best packaging, the best advertising, the best retail strategy, and the best customer value.

P&G is an Innovator

P&G has long built brand value through savvy marketing, but it has also been one of the most innovative companies in the consumer sector.

As just one example, in the fast-growing e-commerce segment of Procter & Gamble’s business, the company created new packaging for Tide to deliver more value to consumers and connect with some consumers who are focused on sustainability.

You can learn more about how P&G is selling Tide over the internet using “ship-in-own container” packaging in the video below.

A Closer Look at Procter & Gamble’s (PG) Dividend King Record

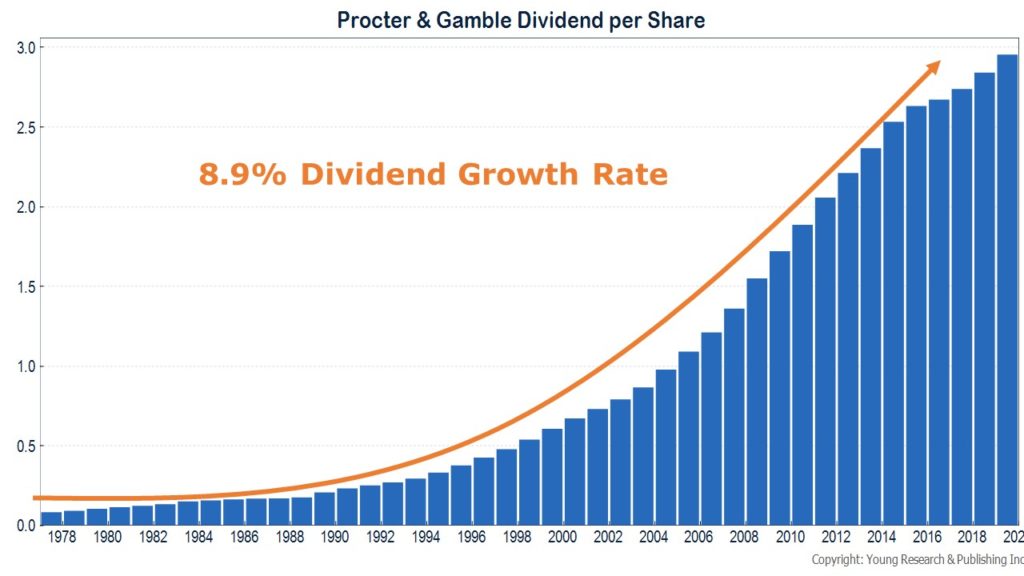

As we mentioned prior, Procter and Gamble’s 64 consecutive years of dividend increases make it the only true Dividend King. The chart below shows the annual dividend per share for Procter & Gamble as far back as our database has dividend information on the stock.

As we have indicated on the chart, since 1977, PG’s regular annual dividend has grown at a compounded annual rate of almost 9%. Over the last 20 years PG’s dividend has grown at a compounded annual rate of 8.25%. Over more recent periods the dividend growth rate has slowed some. Over the last ten years, PG’s dividend has compounded at 5.6%, and over the last 5 years it has compounded at 3%.

Periods of slower and faster dividend growth are not uncommon for P&G, though. Below we list the compounded annual dividend growth rate for Procter & Gamble by decade. The dividend growth rate was closer to 7% in the 1980s, 11% in the 1990s and 2000s, and 5.6% over the last decade.

Procter & Gamble (PG) Dividend Growth by Decade

| Decade | PG Dividend Growth Rate |

| 1980s | 7.2% |

| 1990s | 11.4% |

| 2000s | 11.0% |

| 2010s | 5.6% |

The slower dividend growth rate is a function of Procter & Gamble getting much larger and paying out more cash flow in the form of dividends.

P&G is the 11th largest company in the S&P 500, with a market value of $300 billion and annual revenues of almost $70 billion. Increasing sales from $10 billion to $20 billion is a much easier feat than increasing sales from $70 billion to $140 billion.

The higher payout is also a constraint on P&G. In fiscal year 2004, Procter & Gamble paid out 34% of free cash flow (cash flow after capital investment) in the form of dividends. In fiscal 2019, that payout ratio rose to 61%.

The 61% payout is still low enough to provide PG with room to continue increasing its dividend at a modest rate even if the business has a challenging year or two, but high enough that it means dividend growth and earnings growth must move in lockstep most years.

While Procter & Gamble is the only true Dividend King in the United States you can’t build a portfolio with only one stock. Young Research’s Retirement Compounders® program invests in dividend paying companies from around the world with a record of making regular annual dividend increases.

Originally posted on November 26, 2019.