Yeah, you read that right. In today’s stock market where tall tales can ignite a speculative frenzy in individual names reminiscent of the dotcom bubble, companies that return cash to shareholders have been eschewed. Generating revenue and profits and paying dividends is apparently out of fashion in 2020.

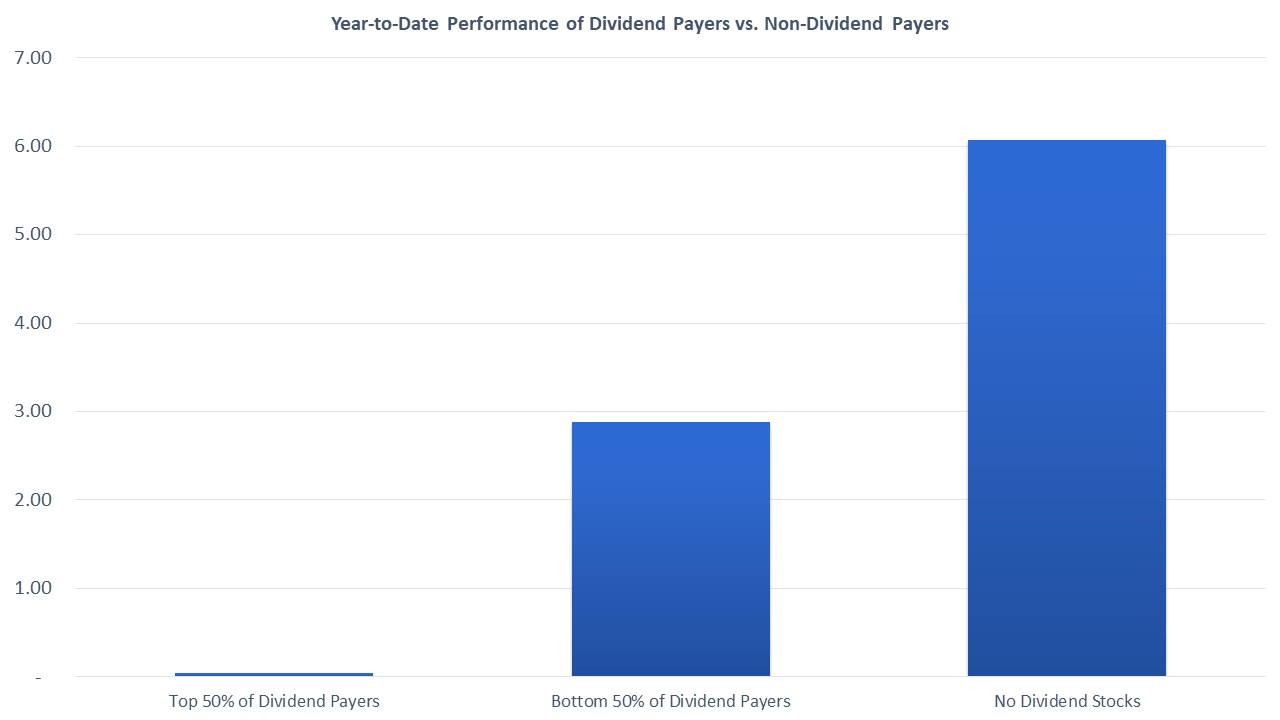

The chart below shows the YTD performance of three different groups in the Russell 1000 index (largest 1000 stocks). The first group is the highest 50% of dividend payers not counting companies that don’t pay dividends. The second group is the bottom 50% of dividend payers not counting non-dividend paying stocks. The third group is all non-dividend payers.

As you can see in the chart, speculators are making hay YTD. Non-dividend payers are up 6%, YTD while the highest dividend payers are essentially flat on the year.

How long the speculative mood continues is anybody’s guess, but trying to participate in such a frenzy has much more in common with casino gambling than investing.

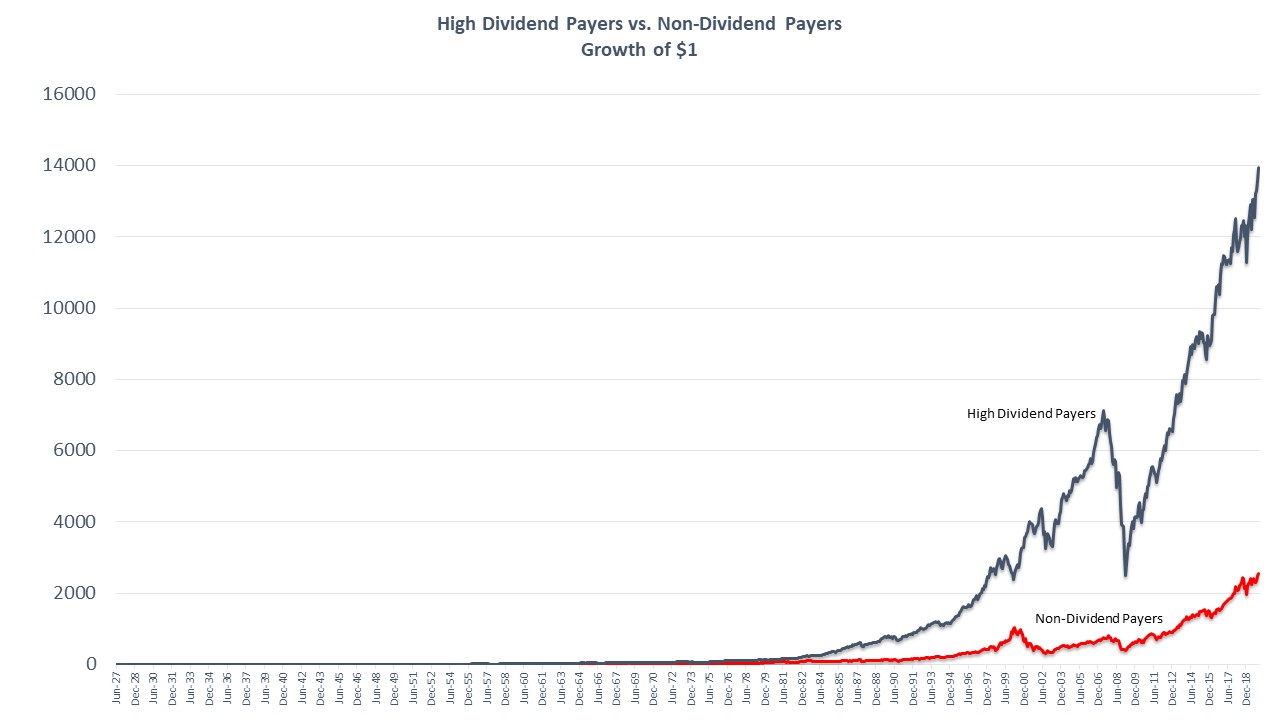

Seasoned investors know that a bird in the hand is worth more than two in the bush. See chart below if you need a reminder.