By Peshkova @ Shutterstock.com

Panic selling during periods of market decline can be devastating to your long-term investment success. In 1987 many investors were frightened out of the market and missed out, not only on the rebound in shares in the following years, but on all the dividends they could have used to buy more shares at depressed prices. I reminded readers of that in February of 2009 when the Great Recession was at its bleakest. Here’s what I wrote:

The 1987 Debacle

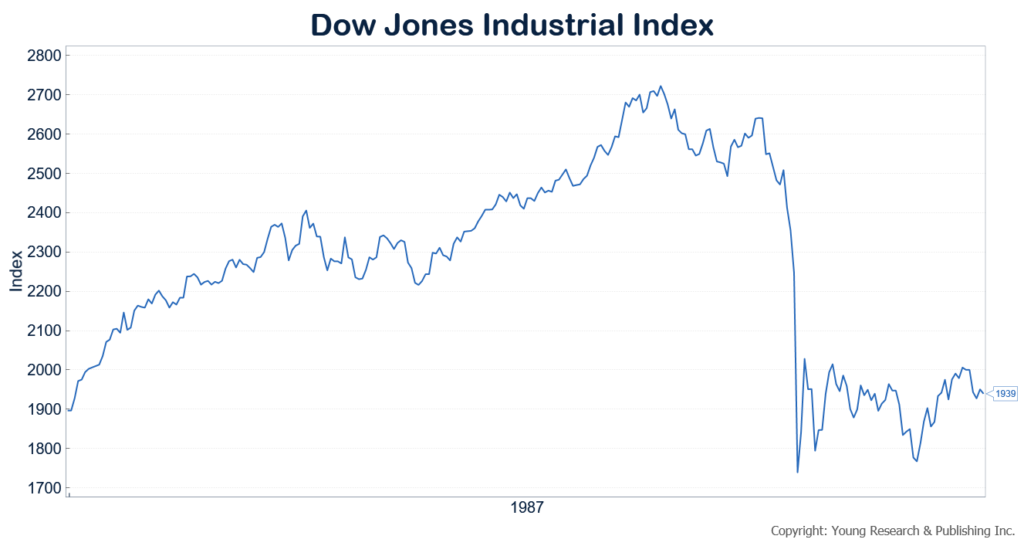

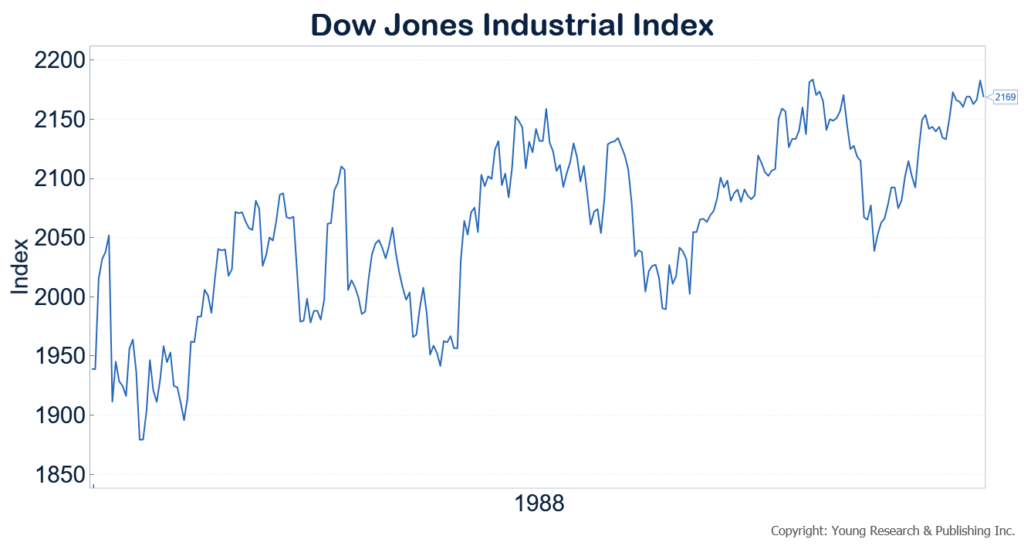

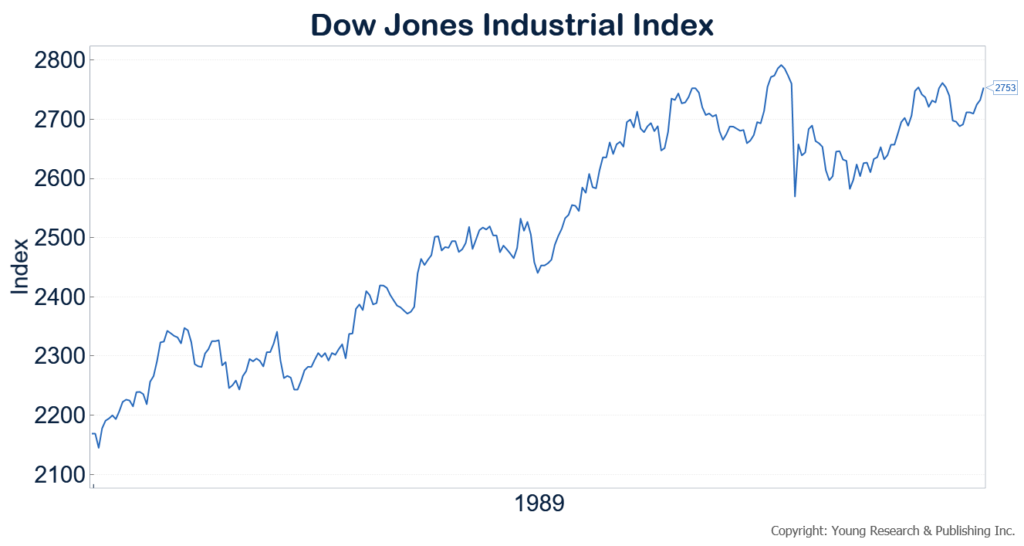

I remember the crash of September/October 1987 like it was yesterday. Virtually overnight, the Dow collapsed to about 1700 from 2700. Terrified investors fled the stock market, just as they did in 2008. Well, the next two years were gangbusters and, by fall 1989, the Dow was once again back above 2700. My three charts (below) give you a bird’s-eye view of each of the three historic years in American stock market history.

Dividends Paid Based on Shares

Recently, I’ve been driving home the point that what really counts is the shares you own and the dividends you are paid, not the point-in-time value of your shares. Companies pay your dividends based on the number of shares you own, not on the value of those shares on any given day. Picture it this way: You are sitting at your walnut desk with a stack of beautifully engraved stock certificates in front of you. The certificates are embossed with the number of shares each certificate represents. From your bright, sunny window you clearly can see your mailman as he drops off a pile of envelopes that you know from long experience includes your regular dividends (in many instances higher than in previous quarters). You are comforted by sorting through your stack of engraved certificates and excited to once again begin opening your companies’ envelopes, each providing you with a dividend check. It’s a pleasant scenario to be certain, as dividends are your financial lifeblood.

A Collector of Dividends

Look around you! No one has taken away any of your treasured certificates. And no one has altered the number of shares embossed on each of the finely engraved certificates. Furthermore, not one of your companies has failed to send along your dividend check as promised. Nor has your mailman failed to deliver your checks to your mailbox. You do not spend a moment wondering at what price you could sell your certificates to someone else, because, as a collector of dividends, you have no earthly reason to sell. This is certainly so if you have crafted from the start a quality list of 32 discerning blue-chip, dividend-paying companies.

Mystical-Like Compounding

Astute investors invest to accumulate wealth over the long term through dividends, dividend increases, and the mystical-like compounding of dividends. This is compared to flighty speculators who have the misguided goal of selling shares to someone else at a higher price.

Make a plan, focus it on dividends, and stick to it.

Originally posted on Young’s World Money Forecast.