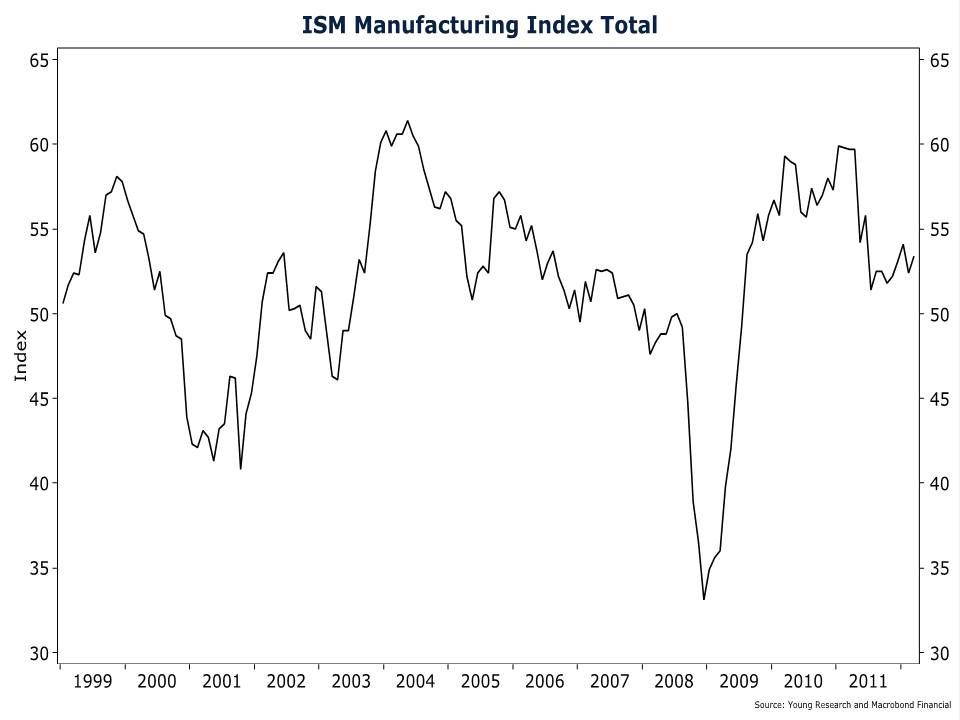

The ISM Manufacturing Report on Business was released this morning and produced a composite index result that was slightly better than a survey of economists surveyed by Bloomberg had predicted it would be. You can see on our chart that the index is trending up slowly. The components of the index were broadly optimistic, but some that tend to the lead the market left doubt about the future.

The Conference-Board uses ISM’s New Orders index as a component in its Leading Economic Index. In the recent report, the ISM New Orders index continued growing, but at a slower rate than in February. The ISM Supplier Deliveries Index was previously a component of the Leading Economic Index. Supplier Deliveries are slowing down—and at a faster rate. Faster Supplier Deliveries are a sign that manufacturers have fewer orders to fill, and therefore can fill them more quickly. Neither is an optimistic sign for the economy going forward.

Much like the data themselves, the comments from the report’s survey respondents were a mixed bag. Below is a sample including the respondents’ industries.

•”Business is robust, driven by a healthy demand for exports and relatively stable raw materials [pricing].” (Chemical Products)

•”Our customers are reporting a potential 10 percent to13 percent increase in purchases for 2012. Actual orders continue to be slow to appear, but expectations continue to be high.” (Machinery)

•”Business conditions [are] very strong and so is outlook.” (Fabricated Metal Products)

•”We have been experiencing 6 percent annual growth and expect that to continue in the near term.” (Food, Beverage & Tobacco Products)

•”Business continues to be brisk — if not robust — [this] month and looking forward.” (Miscellaneous Manufacturing)

•”Business remains essentially stable, with some concerns regarding continued slowdown in China.” (Computer & Electronic Products)

•”Business remains strong.” (Primary Metals)

•”Business improved year over year for the first quarter.” (Plastics & Rubber Products)

•”Generally increasing sales/demand [is] driving higher capacity utilization.” (Transportation Equipment)

•”Sales appear to be picking up over last year at this time, but still have a ways to go.” (Wood Products)