The January jobs numbers were released this morning. The monthly gain in payroll employment topped expectations by a modest amount, but there were 147,000 more job gains in November & December than originally reported. The three month moving average of private monthly payroll gains is now at a post recovery high and higher than at any point during the last economic expansion. The last time private payrolls were increasing as fast as they are today was November of 1997—over 17 years ago.

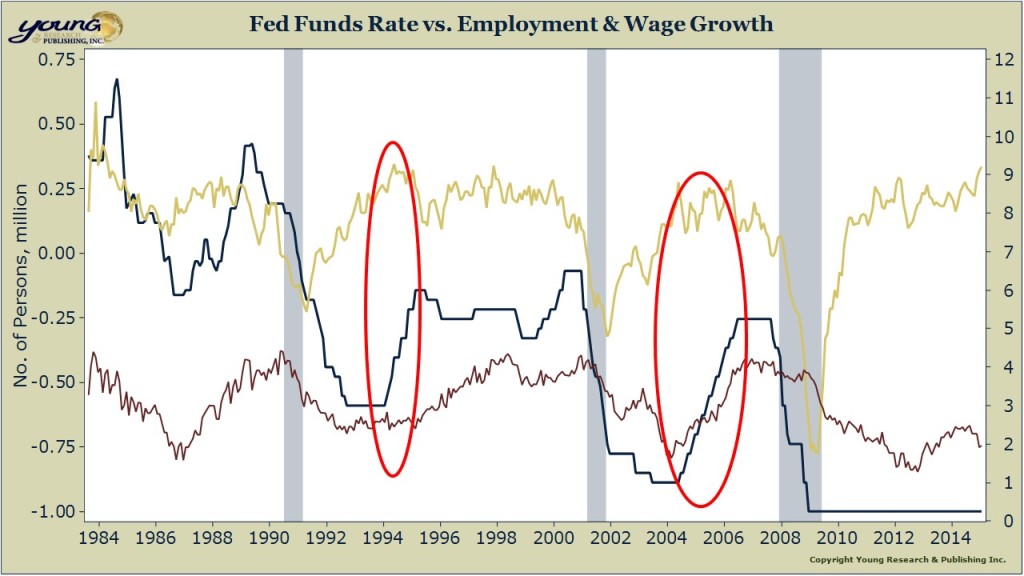

Wage growth also picked up last month after falling in December. Average hourly earnings are increasing at a rate of 2%. Yellen & Co., tell us they want to see higher wage growth before hiking interest rates for the first time in almost 9 years. But today’s level of wage growth hasn’t prevented the Fed from hiking rates in the past. As it shouldn’t. Wage growth is a lagging economic indicator. Monetary policy impacts the economy with long and variable lags. If the Fed waits to raise rates until wage growth accelerates, they will be even further behind the curve than they already are. In the 1994 tightening cycle, wage growth was 2.5% when the Fed first hiked rates and in 2004 it was 2%–the same as it is today.

Yellen & Co., seem to be trapped in a crisis mentality. The Fed is running emergency monetary policy when nothing of the sort is needed today. I would argue modestly higher rates might even help stimulate growth. Savers and retired investors have been deprived of income for years now. Many of the higher yielding bonds they owned before the crisis have matured and reinvestment opportunities provide much lower yields. There is the other side of the ledger that benefits from low rates, but the most impactful stimulus from zero rates wore off long ago. As interest income of retired investors rises, it may unlock some pent-up demand that has held back what are essentially wages for those who live off of their savings.