A poll conducted by The Associated Press-NORC Center for Public Affairs Research found that 23% of Americans don’t expect to stop working during their lives. Andrew Soergel writes in The Washington Times :

“The average retirement age that we see in the data has gone up a little bit, but it hasn’t gone up that much,” says Anqi Chen, assistant director of savings research at the Center for Retirement Research at Boston College. “So people have to live in retirement much longer, and they may not have enough assets to support themselves in retirement.”

When asked how financially comfortable they feel about retirement, 14% of Americans under the age of 50 and 29% over 50 say they feel extremely or very prepared, according to the poll. About another 4 in 10 older adults say they do feel somewhat prepared, while just about one-third feel unprepared. By comparison, 56% of younger adults say they don’t feel prepared for retirement.

Among those who are fully retired, 38% said they felt very or extremely prepared when they retired, while 25% said they felt not very or not at all prepared.

This group is the near opposite of the folks I profiled for you last week in my FIRE: Financial Independence, Retire Early series. I wrote:

Living Your Best Life

Are you familiar with the FIRE movement? You should be, and you will be shortly. And I’m not talking about a fire where, for example, a tree falls in your backyard onto power lines, ripping them down along with a transformer and nearly burning down your house on a quiet afternoon in Newport, RI. (You can read about that here).

The FIRE I’m talking about stands for—Financial Independence, Retire Early—and it’s a big-time movement especially with Millennials. Because more and more of them, are disillusioned with a life working for “the man” and not “working” enough, i.e.: saving, for themselves.

The FIRE men and women I’m talking about seek a reset from the pressure of two car payments, a mortgage, private pre-school, private primary and secondary school, never mind college. And other smaller expenses like occasional dinners out, etc. that put “pressure” on one’s peace of mind.

Because peace of mind and living your best life are at the heart of the FIRE movement.

Imagine this; Instead of going into debt in your 20s and hoping you can pay it all off during your working years, you forgo the debt all together—and save. You save until it hurts.

With the FIRE group, we’re talking about herculean savings rates in the mid-70% of their salary range, and perhaps even higher. Impossible you say?

It starts with living a lifestyle about 50% less expensive than the lifestyle you’re currently living.

Meet Mr. Money Mustache.

Mr. Money Mustache, through his blog, which has several million-page views per month, shows you exactly how he’s done it.

Hi there. If we haven’t met, my name is Mr. Money Mustache. I’m the freaky financial magician who retired along with a lovely wife at age 30 in order to start a family, as well as start living a great life. We did this on two normal salaries with no lottery winnings or Silicon Valley buyout windfalls, by living what we thought was a wonderful and fulfilling existence. It was only after quitting the rat race that we looked around and realized why we had become financially independent while most people, even with higher incomes, end up stuck needing to work until age 65 or later.

Or the Saving Sherpa who lives a cool life on a monthly grocery bill of $60 (no zero missing).

“I’m a Mississippi native working in Boston and want to help everyone find their path to becoming financially independent and, if you so choose, retire early. There are many other bloggers out there but few that are at the early stages of their journey so that you can follow along. Fewer still that are not making a six figure salary, had no inheritance, paid their way through college, and no risky investment strategies. Basically, I want you to follow along as I prove that retiring in your late 30’s early 40’s range is possible for anyone.”

Now I’m not saying this is the right life for you. But it might be for your children or their children. And there is most certainly a benefit for you if you’re retired. Because we have a live front row seat to a serious group of savers trying to make their nest egg last 60-plus years. Believe me we can learn something from this group.

“Dad, You’re Stressing Me Out”

Living a lifestyle where you spend 50% less than your “normal” spending doesn’t sound like much fun. But that’s exactly what many members of the FIRE movement are doing. FIRE standing for Financial Independence, Retire Early.

I’ve been studying this movement big-time, because there’s a lot for you and me to learn by understanding what others are doing. This is not some hypothetical model of how you’ll live your life off your investments. This is real. It’s a lifestyle.

When I brought up living a FIRE-centered life to my daughter she said, “Dad please stop with the FIRE, you’re stressing me out.”

“Don’t you want to hear about the Savings Sherpa?” I asked.

The Savings Sherpa, for example, on an Air Force officer’s salary of just over $100k (these are not deadbeats) or $90k after-tax, went on a 12-day vacation to Hawaii on a $725 budget. How is that possible? With creativity.

When he travels, he uses his lounge memberships and often arrives the night before his flight, eats dinner for free, sleeps comfortably in his sleeping bag on his feather soft foam pad, has breakfast for free, and makes his flight in the morning.

He travels with food containers and saves what he doesn’t eat to have later or bring home to his girlfriend who loves their lifestyle. It actually sounds fun and becomes like a game once you start reading these stories.

Now this may not be everyone’s cup of tea, but what I’ve said from the very beginning when studying this FIRE movement is that, we can all certainly learn from what they are doing.

It’s romantic. It’s the frontier of discovering what you need in your life. And there’s thousands of examples of FIRE lifestyles.

“I wish that I could give you something… but I have nothing left” FIRE!

FIRE is as much a mindset as it is a financial plan.

Think about what you spend the most money on and you’ll quickly realize some of it can be reduced but a lot of it cannot when you’re in retirement. Chances are you’re out of debt. You’ve saved until it hurt and now you should be living the retirement you deserve.

You’ve won the war.

But there’s one thing I need to talk to you about.

I talk to a lot of investors during any given week which provides me with a front row seat to specific pressure points for investors, especially retirees.

One pressure point that never goes away is the love you have for your children and grandchildren. We love them, and we want them to do well, and we help them especially in times of emergencies. Even responsible children get into financial trouble now and then.

But oftentimes, their emergency isn’t necessarily yours.

I’m not talking about houses at risk of being lost, or unavoidable hardships. They happen.

What I’m thinking about here is different.

What if your grandchild is going to a prestigious private school that just raised its tuition by triple the rate of inflation, or more, and now the hard decision needs to be made? Does the child go to a public school where she will have to make new friends, or do you step in to help? Then there’s college. You get the point.

There’s rarely enough money.

But what if the pressure point was less painful?

What if the financial burden was reduced by helping grandchildren embrace the FIRE way of life when they can still live a debt-free life well before they’re married with children of their own and rid themselves of the financial pressures accepted by an indebted society—without you forcefully telling them they need to live that way?

You see, saving enough money for your own retirement is hard enough. It’s when the surprise expenses come up that portfolios run the heightened risk of running out of money. Because, as I’ve said, most of you are not living frivolous lifestyles. You are already a member of the FIRE tribe. Maybe without the “E” for early.

We all understand the spending side of the equation. Spend less, keep more. But when surprise expenses come up, it puts your whole retirement further into the uncertain hands of the market. And with the future value of money as uncertain today as it has ever been—that’s scary.

The last thing you want is to need for the market to do something for you because you gave away too much of your money (Read my favorite piece on the subject here) when instead you could have taught a loved one how to find their happiness.

It’s not about the money.

That’s why it makes sense for you to have a discussion with a child who may feel like he needs your money to keep up his lifestyle—perhaps at the cost of yours—before it’s too late to matter.

Because you can give love f-o-r-e-v-e-r, and you can give money until you don’t have any left, but you can’t give happiness. That’s up to them to discover—the sooner the better.

In The Giving Tree, Shel Silverstein wrote:

“I wish that I could give you something… but I have nothing left. I am an old stump. I am sorry…”

“I don’t need very much now,” said the boy, “just a quiet place to sit and rest. I am very tired.”

“Well,” said the tree, straightening herself up as much as she could, well, an old stump is a good for sitting and resting. Come, Boy, sit down. Sit down and rest.”

And the boy did.

And the tree was happy.”

Will You Outlive Your Money?

One of the things I think you and I will learn from this movement is if it’s truly feasible to live off a portfolio for 60-plus years—a necessity when retiring in one’s early 30s. But this is not your typical set-it-and-forget-it retirement demographic.

Self-reliance is a way of life for the FIRE movement.

Yes, they are casting off the lines and heading out to the sea of financial independence with a portfolio that will need to keep them afloat for a long, long time. But they are also ready and willing to work out of choice and perhaps necessity at some point, all the while doing it on their terms. Think Uber driver, part-time construction work, and consulting as just a few examples of some side-hustles they will leverage.

This is a group who will do what it takes to survive. And what sets them apart from others is their massive savings rate, and a young enough age where they have harnessed the power of compound interest. Because the key to compounding money is t-i-m-e and they’ve carefully and methodically put time on their side.

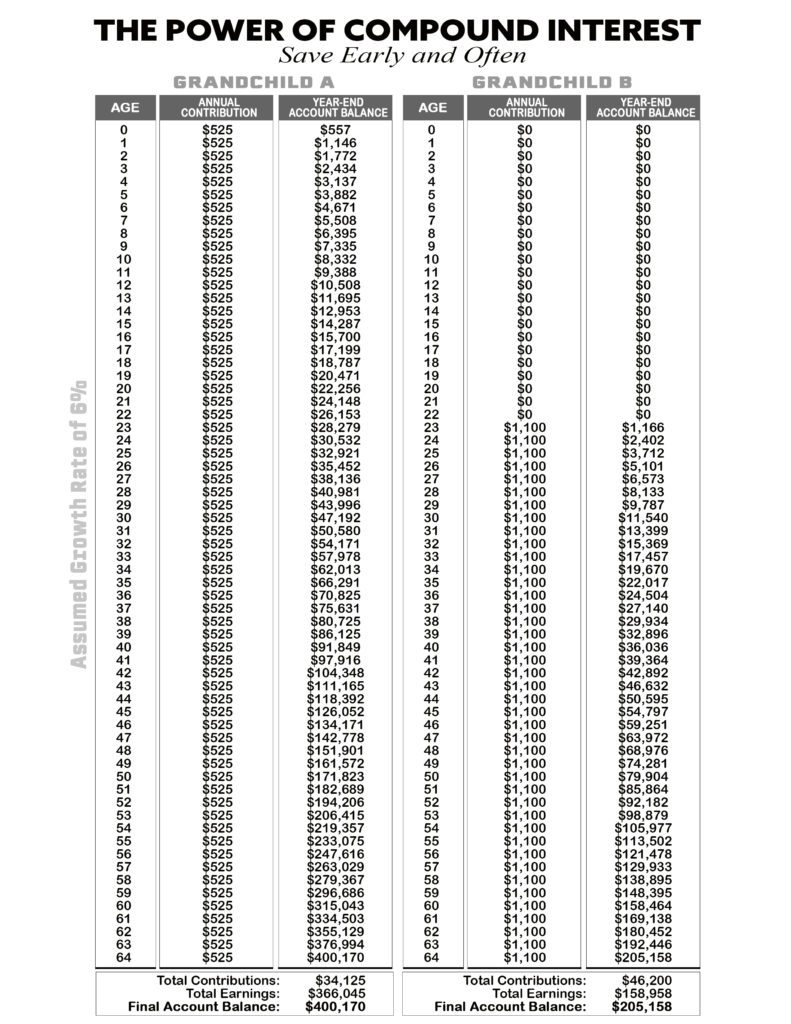

Take a trip with me. Let’s say you help a grandchild get into the savings game when they’re born by contributing $525 per year to an account you establish for them such as my favored UGMA. And then when the child is 22, she continues along the same path saving on her own, saving each year $525 until she’s 64. Compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. When he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side which did a lot of the heavy lifting. Not that your generosity didn’t help! Of course it did. And what’s not to be missed here is my conservative long-term expectation for stocks of 6% year. Which I also believe is being kind—much to the dismay of the needy crowd.

But when the intention is retiring forever, and to depend solely on your portfolio for 60-plus years, a lot of things need to go right. That’s why you and I need to pay attention. Will the FIRE movement be able to survive and thrive on their savings alone?

It’s a tough question, because no one knows the future. No matter how many scenarios are run, no one knows what tomorrow’s markets will bring.

At the core of living a lifetime on your money is having a safe withdrawal rate. This is really where the rubber meets the road for the next 60 years—having a safe withdrawal rate.

So where to go from here? A safe withdrawal rate is whatever keeps you in the game for the rest of your life. You do what you must, whether that’s go back to work, spend less, sell assets in a depressing fashion, or my advice—work as long as you can and say the heck with the markets (see Rich Man, Poor Man)

For me, I don’t see the margin of safety of living off a portfolio at such a young age. But I most definitely like how the FIRE group is approaching life. I want you to be able to retire and live comfortably off your portfolio for the rest of your life without the side hustle. How do you do that?

I’ll discuss that next.

A Scorched Earth Investment Landscape

“Never forget what I’m telling you here”

-Dick Young

When it comes to living off a portfolio for a lifetime, the word lifetime can mean different stretches of time for different investors. If the FIRE group is retiring in their 30s, and living off their retirement savings for the rest of their lives, then we should be able to pick up some intelligence.

Which brings me to that daunting subject of a Safe Withdrawal Rate, or as the FIRE movement simply refers to it: SWR. The most common SWR I’ve read from this group is a four percent withdrawal rate. And I think that’s a fair place to start, but personally I lean closer to three and if less is possible, then all the better.

What I have found encouraging is the FIRE lifers aren’t living in a vacuum. They’re adjusting with the times, and working side-hustles if and when necessary to help preserve their savings. But I want you to be able to retire when you’re ready, and it’s why I recommend the lowest draw rate you can handle.

The harsh reality today is that the investing environment looks like scorched earth. It’s barren. It’s like Mars. Not real livable.

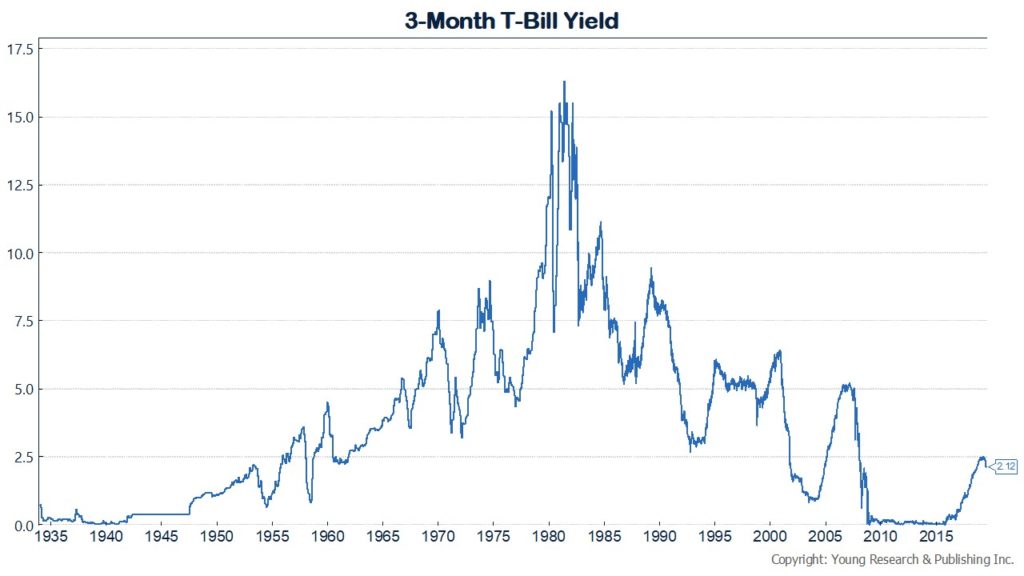

In the “Dick Young’s North Star” section of the February 2003 issue of Intelligence Report, he wrote: “I want to be real clear here. When the risk-free rate of return is a) negative in real terms and b) below 4% in nominal terms, red flags are flying. There is a regular and dangerous tendency to overreach and overstep with inappropriate and risky investments when investors cannot get a decent return on 90-day T-bills [see chart below]. Never forget what I’m telling you here on T-bill yields. The 90-day T-bill rate is the conservative investor’s North Star. It is certainly mine.”

You don’t need to know much about history to remember what happened in 2007 and to appreciate what Dick was telling investors. He wasn’t pontificating. He was describing the dangers at that specific moment in time.

Today, the risk-free rate is a) near zero after inflation and b) well below 4% in nominal terms. Red flags are flying. And like a broken-record, you are seeing investors pile into inappropriate and risky investments because they can’t get a decent return on 90-day T-bills. Index funds and ETFs that mimic perhaps the largest “managed” index in the world, the S&P 500 as I wrote to you here and here, are partying like it’s 1999. Investors have gotten so entangled in trading this formula or that stock option—they can no longer strike through the nub of things.

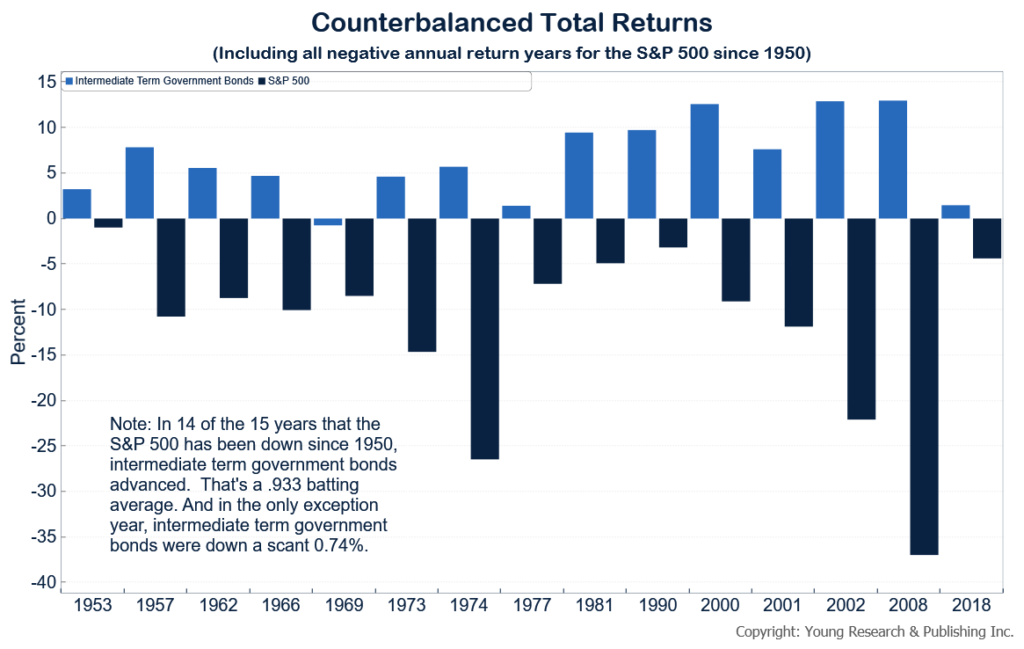

Run your finger left to right along the T-Bill rate and you can see how a low-interest rate policy has gutted the risk-free yield. In turn, it has pushed investors into stocks hoping for the market to do something for them. My take here is that when rates are this low it should push investors to work longer. Working longer is the one real variable investors have 100% control over. There’s no way I would leave a job in my 30s seeing that the bull market in bonds is o-v-e-r. That being said, I believe investors are naïve not to own bonds mainly to counterbalance their stocks.

What I want you to think about is this: The more you can put into bonds, the more comfortable I believe you’ll be. Can you put 70% in bonds and live off 3%? If yes, do it. If not, keep working (or spend less).

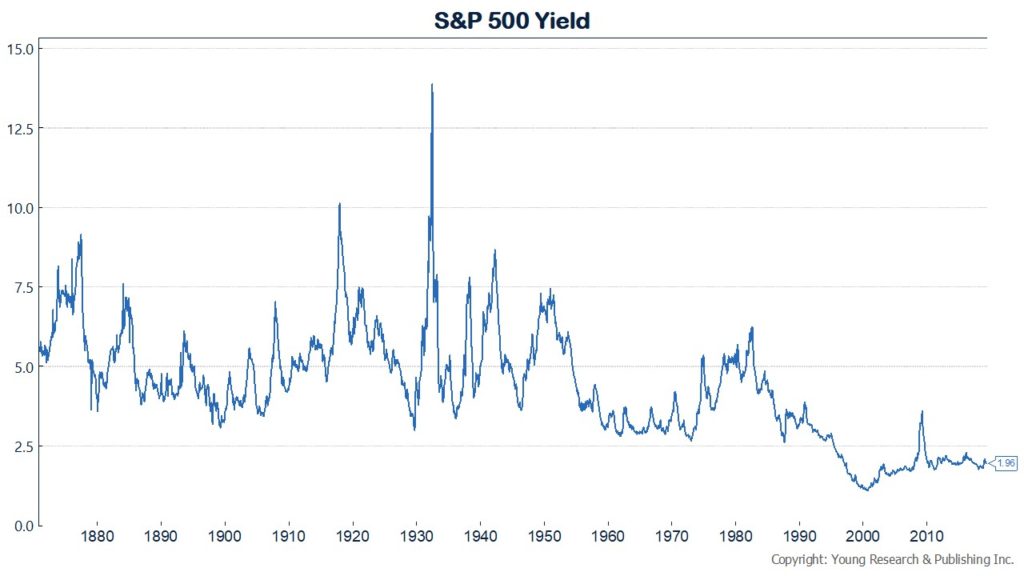

Next, I want you to look at the S&P 500 yield, or lack thereof. Historically stocks returned about 10% with about 4% coming from dividends. For most investors, dividends are an afterthought, or not thought of at all. But if you’re planning on living off your portfolio the hard truth is you need to focus on dividends, dividend increases and not killing your shares by selling them to live.

Take a look at the speculative S&P 500 index where dividend yields have historically been below the Dow for a scarier look. This is a pretty ugly chart. As the lemmings jump into the same passive index funds, the flow of money is like squeezing a water balloon—a self-fulfilling prophecy of expansion—until it bursts.

A retirement plan overloaded in stocks and not focused on yield for income is one that is set up for disaster if stocks crash. For some, going back to work is an option (FIRE self-starters) but those in their golden years will be less willing and able to work. If you can extend your working years, then do it.

That gives you an indication as to where we are today with income, and why reducing your annual draw rate as low as possible is necessary.

Investors who are loading up on stocks and forgetting the North Star are perhaps setting themselves up for portfolio hardship that will either push them out of the market, or set them back so many years in terms of lost value they will have no other choice but to either go back to work or live a much different lifestyle.

Remember, you want to be able to teach your grandchildren and children how to be careful with their money, and at the same time make sure you’re a sound steward of your own.

Originally posted on Your Survival Guy.