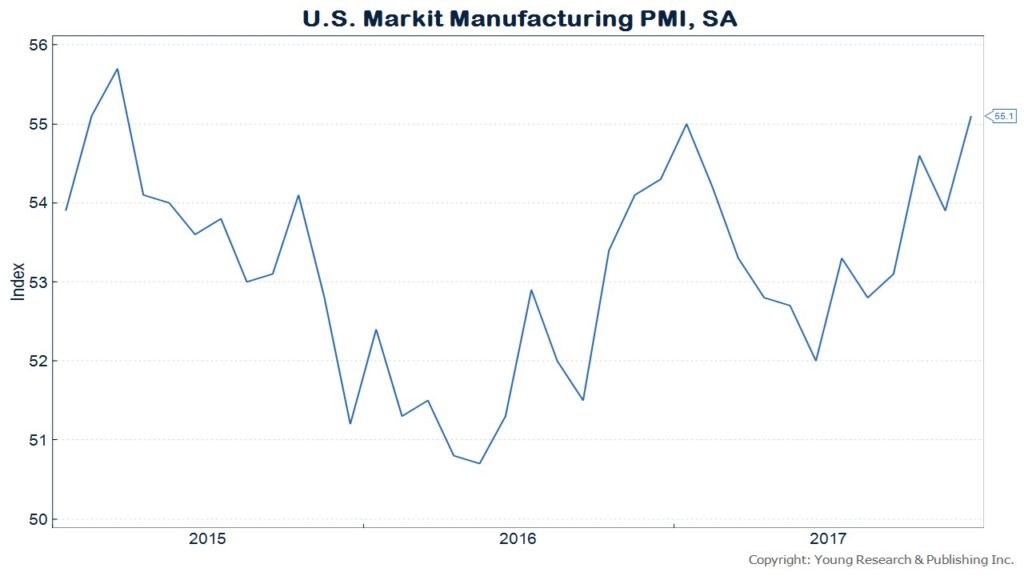

Purchasing managers indexes from around the world are indicating a global manufacturing boom. The U.S. Markit Manufacturing PMI rose today to 55.1, it’s highest reading since 2015.

Bloomberg’s Fergal O’Brien reports:

A slew of Purchasing Managers Indexes published on Tuesday from China, Germany, France, Italy and the U.K. all pointed to deeper supply constraints, with a U.S. gauge to be released at 9:45 a.m. Washington time.

Shrinking capacity may mean companies have to hire or invest more to avoid overheating, yet it could also force them to push up prices, propelling inflation enough to squeeze the expansion. Goldman Sachs Group Inc. and JPMorgan Chase & Co. are among the banks predicting worldwide growth will be around 4 percent this year, which would be the fastest since a post-recession rebound seven years ago.

“A key development to watch out for in 2018 is the potential advent of accelerating inflation,” said Larry Hatheway, chief economist at GAM. “It matters most because it is almost entirely unanticipated by markets, yet seems likely from the perspective of macroeconomic conditions.”

In the euro area, IHS Markit said “robust intakes of new business tested capacity” and there was a jump in backlogs of work as factories found it hard to keep up. In Germany, the region’s largest economy, this “poses a risk to the sector’s ability to kick on,” it said.

Read more here.