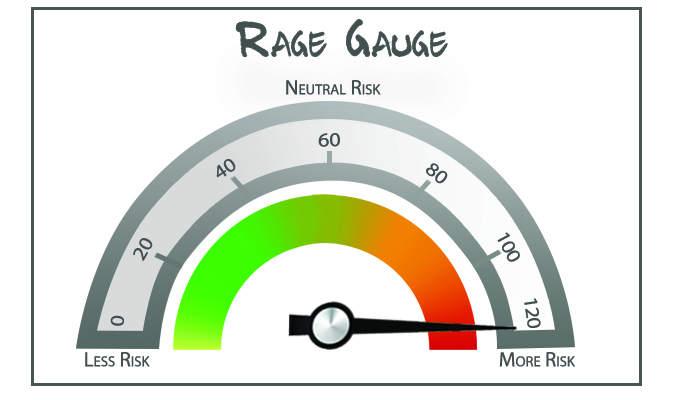

OK, my December RAGE Gauge is in, and risk continues to run high. Before we get into the reading, let’s go over a few items that are on my mind.

- The days of drawing down 4% of your portfolio per year have sailed on, especially while interest rates are nailed to the floor. Instead, a more reasonable draw today is in the 3% range, and even that is up for debate. Try to keep your draw rate as low as possible now, so you’re not forced to reduce it later because of a market correction.

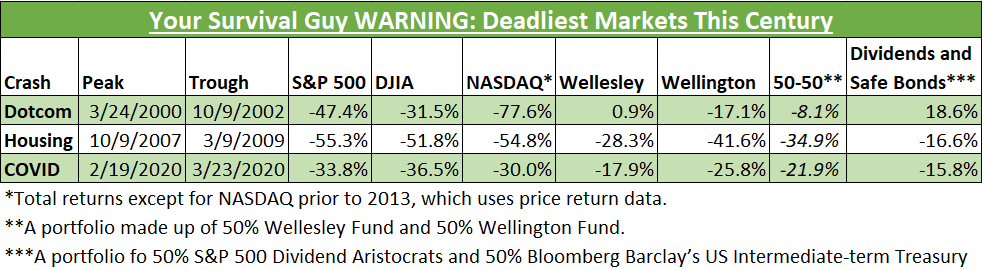

- Consider where we are in the current environment with stocks. It’s a risky time for retirees and near-retirees because if we’re setting up for a correction, how will you protect your assets? Remember, there’s been a few nasty markets already this century.

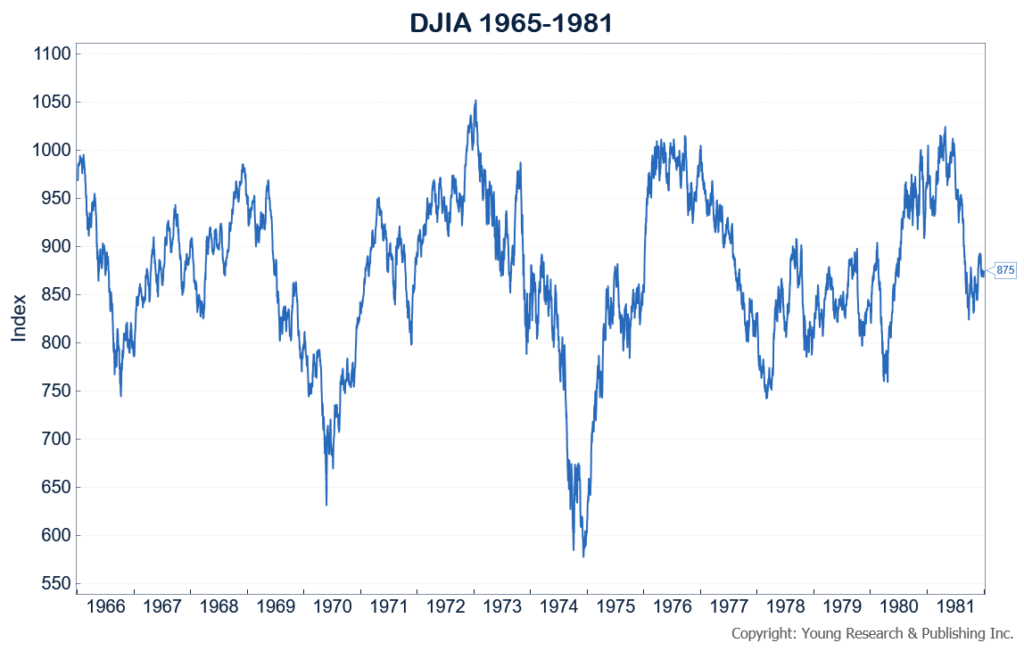

- Imagine retiring on the eve of any of the above cracks in the market. Sure, it’s easy to say, “stocks always come back,” but they don’t always come back on your schedule. Consider, for some perspective, the chart below where stocks were flat from the mid-60s to early 80s.

- You’re asking me more and more about bitcoin. I like blockchain. I don’t like bitcoin, or cryptos. There’s no harm, as far as I’m concerned, in letting this play out a bit. I have no problem being late to this party.

- Look at all the money being thrown at ESG, and you realize it’s a “you invest, they win” gamble that will absolutely line the pockets of the financial industry. But the verdict is still out on how that helps the individual investor. The momentum in the overall market is crazy. Everyone’s a winner right now. Stay tuned.

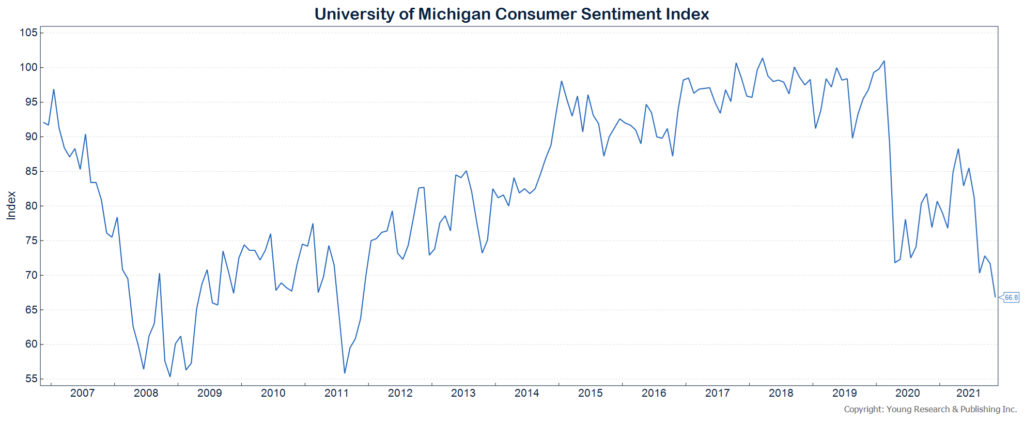

- Everyone’s a winner except for Biden. The Michigan Consumer Sentiment just came out at the lowest reading in a decade.

- Lower your expectations for your portfolio in times like these.

- Understand how valuable you are if you’re working part-time in retirement. If you’re making $10,000 a year, how much would you have to save if you wanted to match that with a 3% draw? $333,333 or a factor of 33. Suddenly $15/hr looks more like $500.

- No surprises here: Private jet travel is up in Florida, Texas, and California. Guess which one has the most outbound one-way tickets? Investors will always seek shelter in states where their money is treated with respect.

- How about New York City real estate? Prices are up, coming in just above pre-COVID levels as city dwellers eschew the countryside. Hey, if you’re a city person, you’re a city person. It’s just the way it is. My takeaway? Look at the No Go Zones in Paris, and you’ll see the same play out the years ahead in NYC.

- In my conversations with you, you’re telling me how you’re looking for a Liberty Retirement. Yes, I’m concerned with your retirement life, and want to help you achieve your goals. If you need help, I would love to talk with you.

Action Line: Keep an eye on what your situation looks like. Risk remains high. Batten down the hatches and prepare for some tough times in the market. Is that a prediction? No. But I’m Your Survival Guy, and my RAGE Gauge warning signs are flashing RED.

Originally posted on Your Survival Guy.