Good morning from Your Survival Guy. Are we having fun yet? Listen, markets are brutal. It’s why I’ve cautioned you from the beginning to focus on keeping what you make and not hoping for markets to do something for you. Now is a perfect time to be reminded of the words of wisdom of the late great Jack Bogle, founder of Vanguard: “Don’t just do something, stand there.”

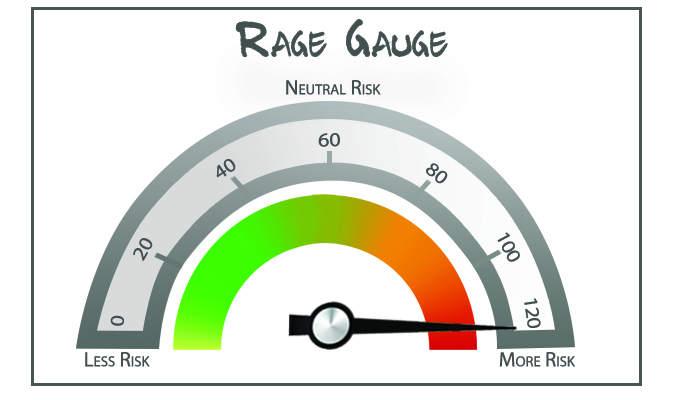

And yet, the pressure to do something continues to grind away at participants, forcing them to sell so they can sleep or to stop the question: “How much are we down now?”

When will it stop? When the selling stops. When will that be? Look I’m Your Survival Guy, not a psychologist. But I can tell you for a fact that investors realize their risk tolerance after the fact.

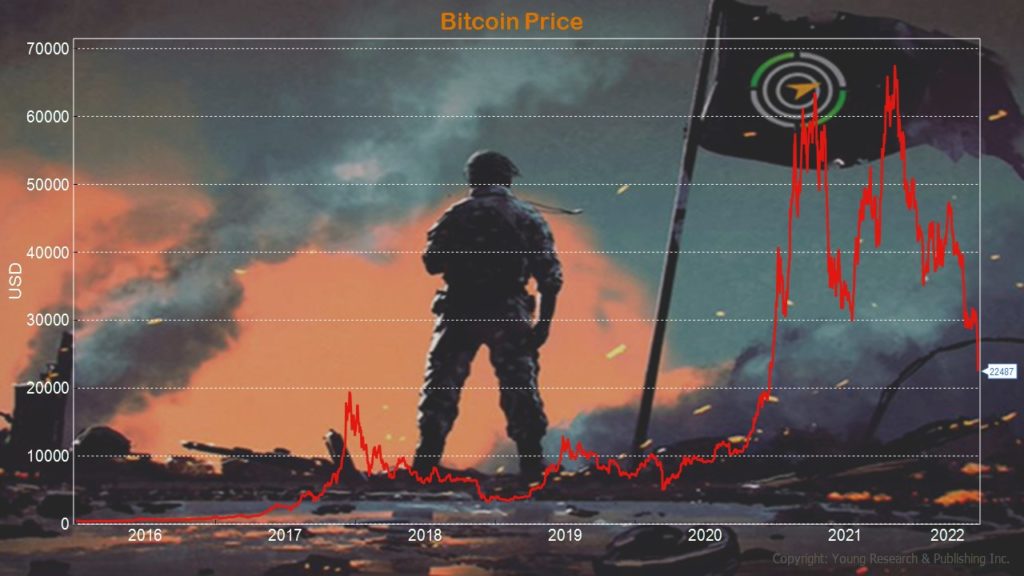

Today, Americans are feeling the pressure of a massive amount of risk, as some of them watch their speculative investments like bitcoin, plummet in value. Rates are moving, and markets are falling, and many people want to make rash decisions rather than sticking with their plan, if they had one.

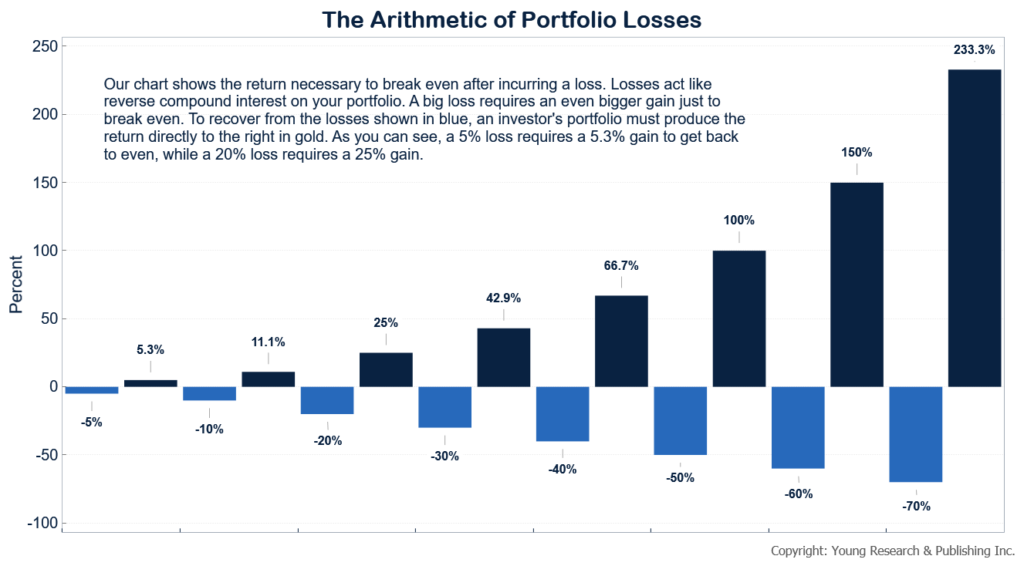

Bitcoin speculators are looking at 66% losses from the peak. It’ll take gains of over 150% just to get back to even.

This is when conservative, income-oriented, dividend-centric investors need to be patient and let the dust settle. It could take a while or could whip back up tomorrow. You’re dealing with your life savings. Let’s not make stupid bets on a hunch. Time to hunker down.

Action Line: It never ceases to amaze me how reckless investors are with their savings. Few are capable of making money slowly. Let’s not forget that slow and steady wins the race. If you want to build a portfolio focused on slow and steady success, let’s talk.

Originally posted on Your Survival Guy.