It wasn’t too long ago that the favored acronym of many investors was BRICs. BRICs refers to Brazil, China, Russia, and India. The BRIC countries were supposed to offer profound promise to investors. They had resources, mostly young populations, and rapid growth. With such rapid growth ahead, the BRICs were a sure thing. Of course, things haven’t turned out as rosy as the bullish consensus believe at the peak of BRICs mania.

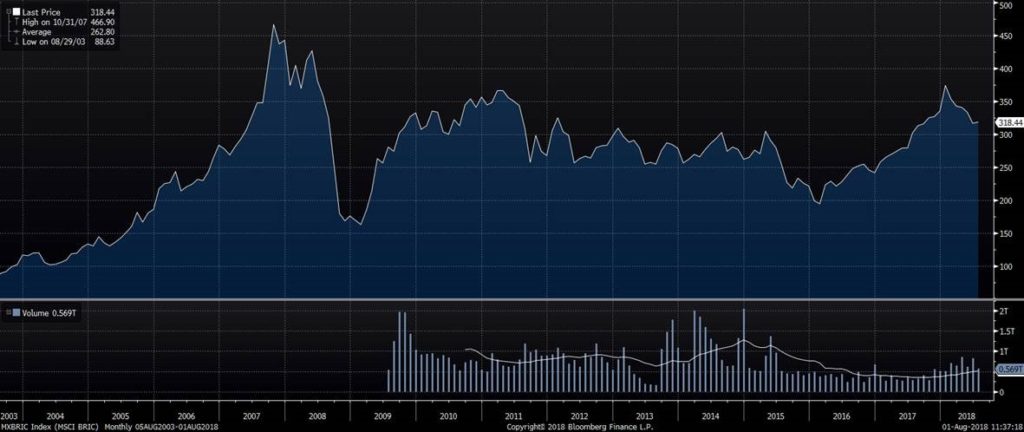

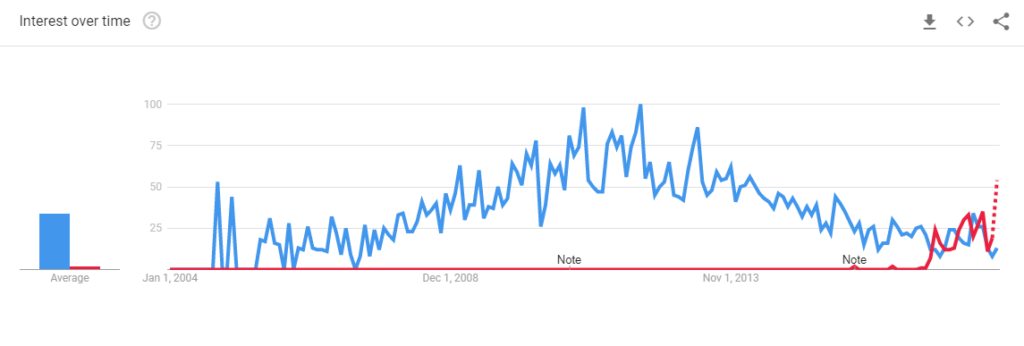

The chart below shows the performance of the MSCI BRIC index. The BRICs have had a lost decade. The MSCI index peaked in 2007, and remains more than 30% below its high to this day. The second chart below shows the Google trends chart for the search term, BRICS Countries and FAANG stocks. FAANG is the favored acronym of many investors today. The group has had an impressive run, but if the popularity of an investment was predictive of future performance, there would be a lot more millionaires in America than there are.

The late Sir John Templeton summed it up nicely. “If you want to have better performance than the crowd, you must do things differently from the crowd.”

MSCI BRIC Index