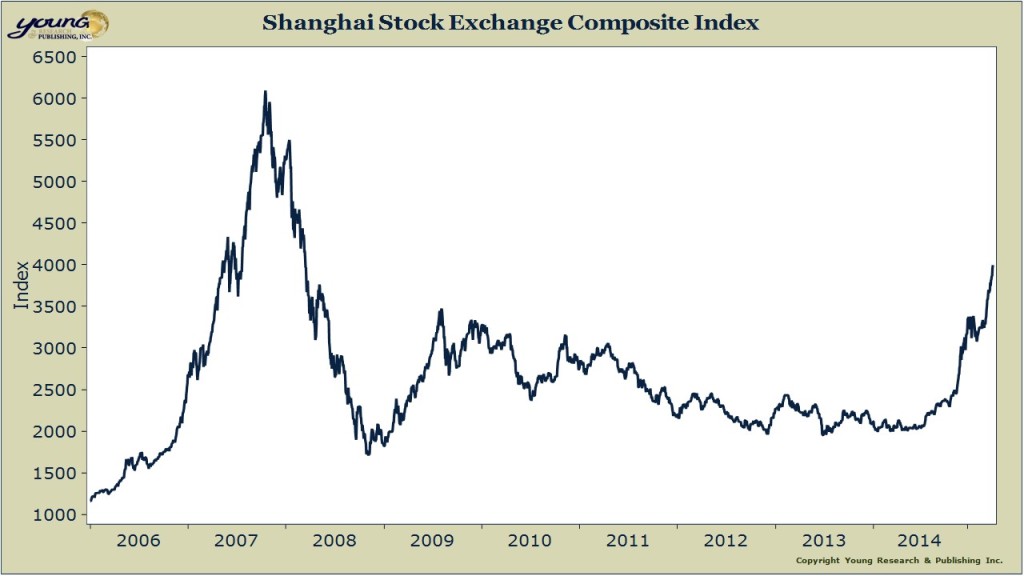

I don’t think China has this capitalism thing down yet. With the Chinese housing market rolling over and the Chinese economy slowing, the Shanghai Composite index is soaring.

I don’t mean soaring a little bit. I mean it’s up a ton. Chinese stocks have almost doubled over the last year.

There’s a stampede to join in the fun. The hottest sector is technology. Bloomberg reports that Chinese tech stocks are now trading at 220X earnings. In March of 2000 at the height of the greatest stock market bubble in U.S. history, the NASDAQ index was trading at 156X earnings.

Why are Chinese investors so hot on tech stocks? Apparently the Communist Party in China is promoting the technology industry to wean the country off of heavy manufacturing and property development.

That sounds like a brilliant idea. Because the promotion of manufacturing and property development didn’t create one of the largest fixed asset bubbles in history.

Why is the rest of the Chinese stock market rallying? It would appear that the slowing Chinese housing market and looser monetary policy have pushed the Chinese into the A-share market (stocks are being bought as an alternative to real estate in China).

Bidding up shares on the basis of liquidity without regard to economic fundamentals…poor misguided commies. They must not understand how capitalism works.

Wait!

That sounds a lot like what the U.S., Europe, and Japan are doing. Maybe the commies know more about modern “capitalism” than I first suspected. Or better yet, maybe today major central banks are acting more like monetary politburos. I lean toward the latter.

Somehow I doubt the current bubble in Chinese shares will end any better than every other bubble in financial market history. Bloomberg reports on some pretty disturbing facts about the nature of the Chinese stock market.

The use of margin debt to trade mainland shares has climbed to all-time highs, while investors are opening stock accounts at a record pace. More than two-thirds of new investors have never attended or graduated from high school, according to a survey by China’s Southwestern University of Finance and Economics.

Should you join the stampede into the A-share market? There’s no doubt there is a lot of excitement created during a stampede, but it is also true that those who join in risk getting trampled. Don’t get trampled.