The Wall Street Journal’s Corrie Driebusch reports a move toward consumer companies in stock markets. Driebusch calls the move “a sign that investors are hedging their bets by picking up shares of firms they believe will provide returns in a struggling economy.”

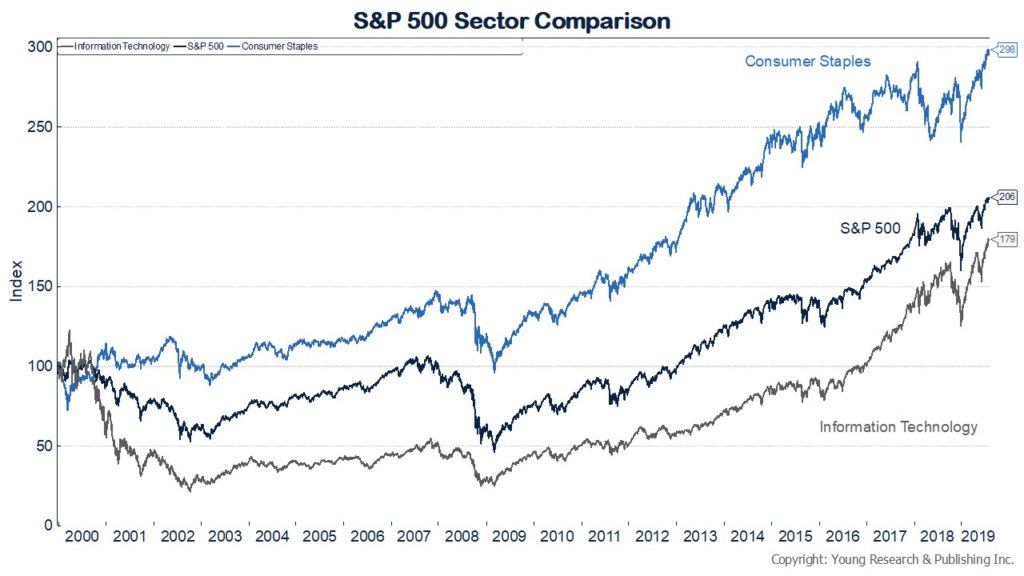

You’ll notice on my chart below during this century, consumer staples have beaten tech stocks and the S&P 500 index.

Now it seems, investors are buying consumer staples in a bid for defense against a potential economic recession. Driebusch writes:

One of the hottest stock-trading strategies lately is buying shares of stable consumer companies, a sign that investors are hedging their bets by picking up shares of firms they believe will provide returns in a struggling economy.

Over the past three months, consumer-staples companies—firms that sell everyday household goods and popular foods and beverages—are the second-best performers in the S&P 500, up nearly 5%, lagging only technology firms. Coca-Cola Co. KO -0.42% , Procter & Gamble Co. PG 0.94% and Walmart Inc., WMT -0.75% all of which fall into this category, are trading at or near all-time highs.

In addition to the consumer-staples sector, other companies that fall into this defensive-quality bucket include McDonald’s Corp. MCD -0.27% and Starbucks SBUX -1.10% Corp., some analysts say.

On Friday, McDonald’s soared to a record after the burger giant’s sales grew across the world in the latest quarter. Starbucks’ stock also jumped to an all-time high Friday after the world’s largest coffee chain reported late Thursday that its sales rose in key U.S. and China markets, beating expectations.

Read more here.