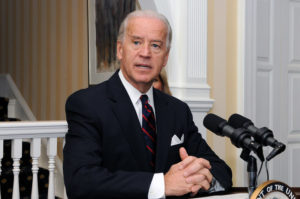

Vice President Joe Biden during a reception for the National Guard adjutants general of the states and territories of the United States at the Vice President’s Residence in Washington, D.C., on Feb. 22, 2010. (U.S. Army photo by Staff Sgt. Jim Greenhill) (Released)

Joe Biden wants to use the 401(k) system to redistribute wealth from wealthy taxpayers to lower-income savers. Daisy Maxey reports for Barron’s:

President-elect Joe Biden hopes to encourage lower- and middle-income workers to save more by changing the existing tax preferences for savings in retirement accounts. A divided Congress is likely to hinder his plans.

Currently, workers contribute pretax dollars to 401(k) or 403(b) retirement savings plans, then pay taxes when they withdraw money in retirement. This upfront tax break is more valuable for richer households because they fall into higher tax brackets.

Biden’s plan would institute tax credits for each dollar saved, leveling the playing field by offering the same incentive for retirement saving regardless of a worker’s income. He hasn’t said what percentage the credit would be, but the Urban-Brookings Tax Policy Center has estimated that a 26% credit would be roughly revenue-neutral over the first 20 years and beyond.

Currently someone who is single and making $120,000 falls into the 24% tax bracket. If he contributes $18,000, or 15% of his pay, to his 401(k), he would save $4,320 in taxes. But a single filer making $50,000 falls into the 12% tax bracket. If he contributes $7,500, or 15% of his pay, he would save $900 in taxes.

Assuming a 26% credit under Biden’s plan, the person earning $120,000 and contributing $18,000 to his plan would receive a tax credit of 26 cents on each dollar, or $4,680. However, the person earning $50,000 and saving $7,500 in his plan would receive a credit of $1,950, more than double what he would now save on taxes.

The initiative faces opposition from some asset managers and investment industry trade groups. Asset managers have in the past opposed plans that they feel might decrease usage of defined-contribution plans.

The Investment Company Institute, which represents mutual fund firms, said after news of the plan that it “supports tax deferral and the current, voluntary employer provided retirement system—and, as in the past, will oppose changes that undermine the success of this system for American savers.”

One result of Biden’s move might be to drive taxpayers into Roth IRAs and Roth 401(k)s, in which the taxes are paid up front. That would raise more revenue for a possible Biden administration. That’s most likely the real target of the plan.

Action Line: Talk with your tax professional about how Joe Biden’s change might affect your savings.

Originally posted on Your Survival Guy.