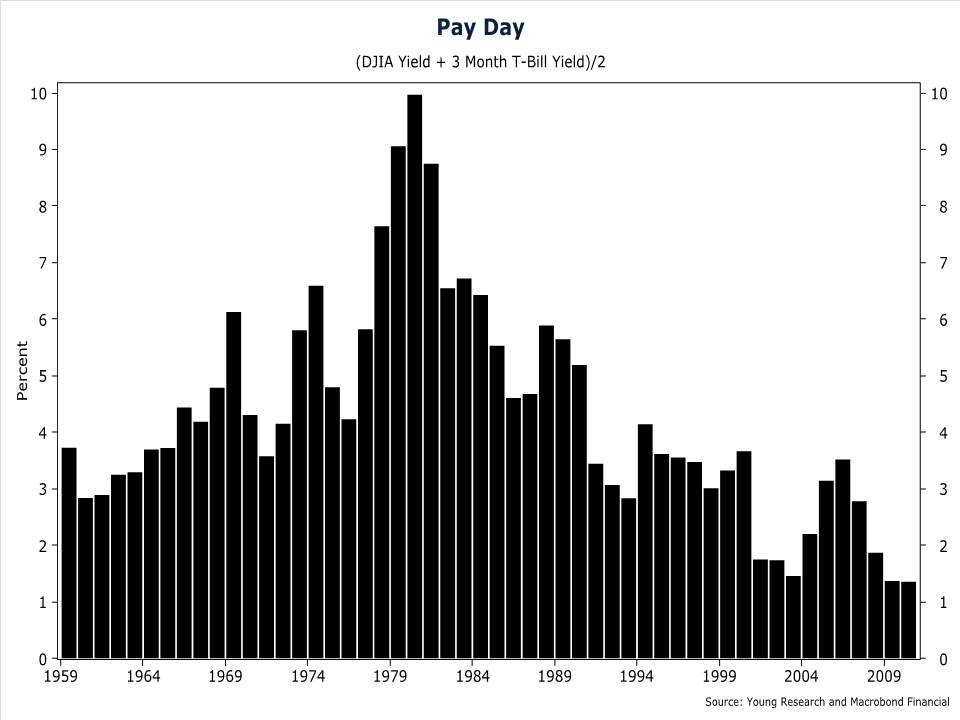

Doing less, with less, is one way to describe retirement on a fixed income today. This sad truth is illustrated by Young Research’s proprietary Payday Indicator, the average of the Dow Jones Industrial Average yield plus the three-month Treasury bill yield. In the history of the series, it has never looked so pathetic.

Stocks and bonds compete for investor money. The accommodative Federal Reserve policy hasn’t helped matters. Treasury bill yields are so low that stocks don’t need to offer much yield to attract money. The Dow is certainly not a good value at a 2.59% dividend yield. At the end of the day, stocks are a stream of cash just like bonds. Retirees searching for income are being pressured to take on more stock-market risk. And that’s not what they should be doing.