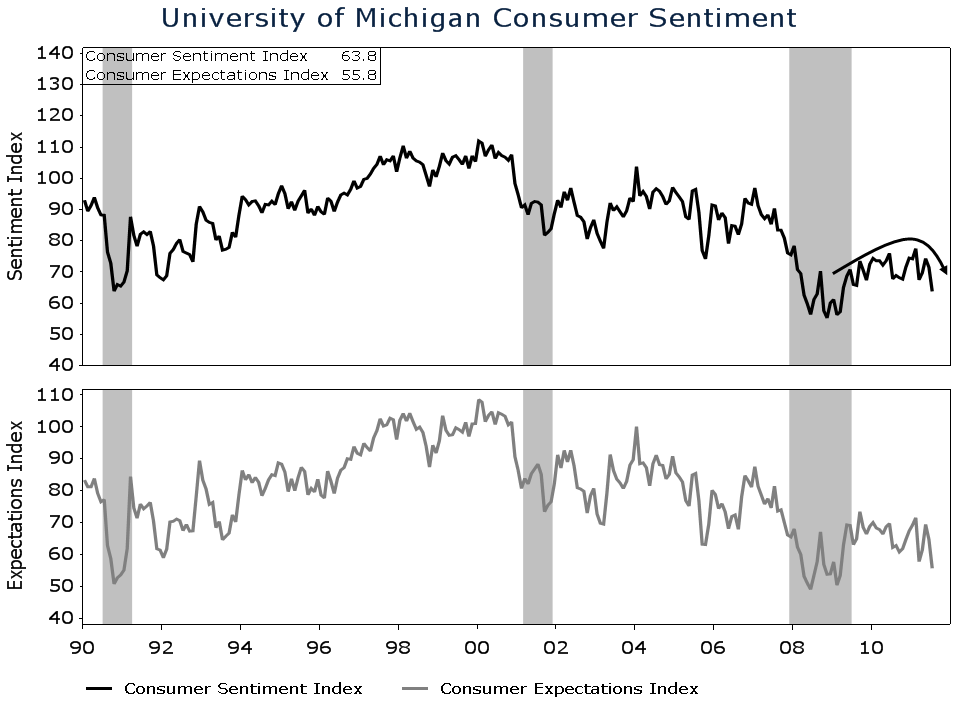

The Reuters/University of Michigan Survey of Consumer Sentiment plummeted to a post-recovery low of 63.8 in July. According to Bloomberg, economists were projecting a level of 72. The expectations component of the index, which asks consumers about their outlook over the coming 12 months, also fell to a post-recovery low.

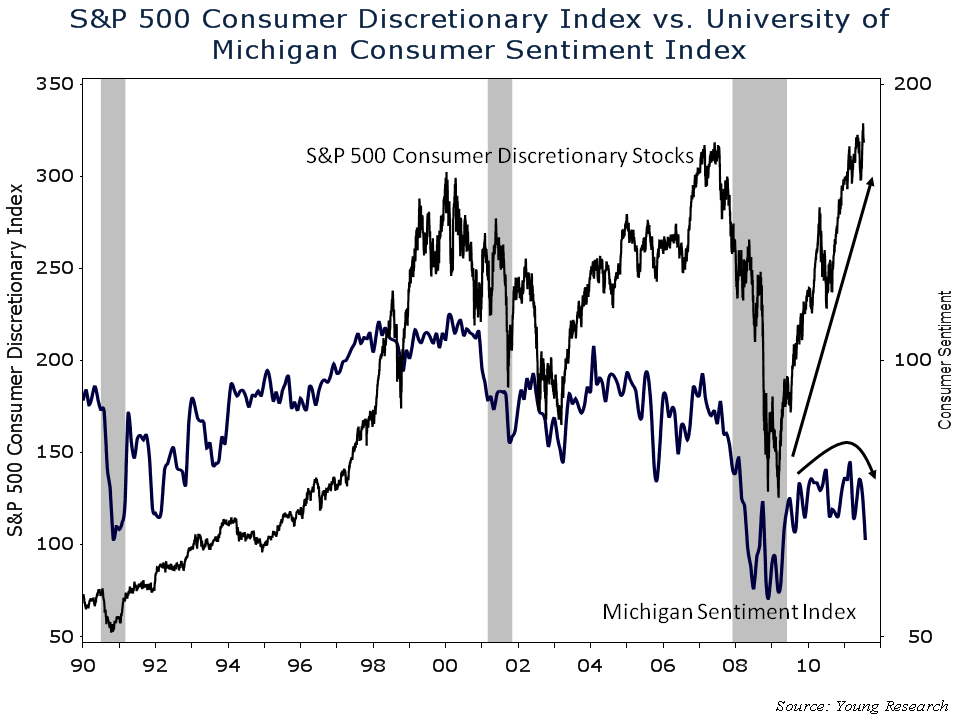

You can see in Young Research’s chart above that sentiment is now clearly rolling over. But the weakness in the Michigan survey is contrary to what the stock market is saying about sentiment. The S&P 500 Consumer Discretionary Index hit a new all-time high this month and the index is up more than 8% YTD. The divergence between discretionary stocks and consumer sentiment either signals that consumers are saying one thing and doing another or investors are buried so deep in a sea of liquidity that their vision is too blurred to see the underlying weakness of the consumer.