At Young Research we maintain three cyclical stock price indexes—an early cyclical index, a late cyclical index, and a stable growth index. When evaluated together, the relative performance of these indexes versus the S&P 500 serves as a useful real-time indicator of the economy. The benefits of using asset prices as one gauge of the strength of the economy are that they are not subject to reporting lags, data is not revised, and there is no chance of modeling error. Asset prices are determined daily by the collective wisdom of millions of well-informed investors. These investors have enough conviction in their beliefs to risk hard-earned capital. That doesn’t make asset prices infallible as an economic indicator, but it does make them useful.

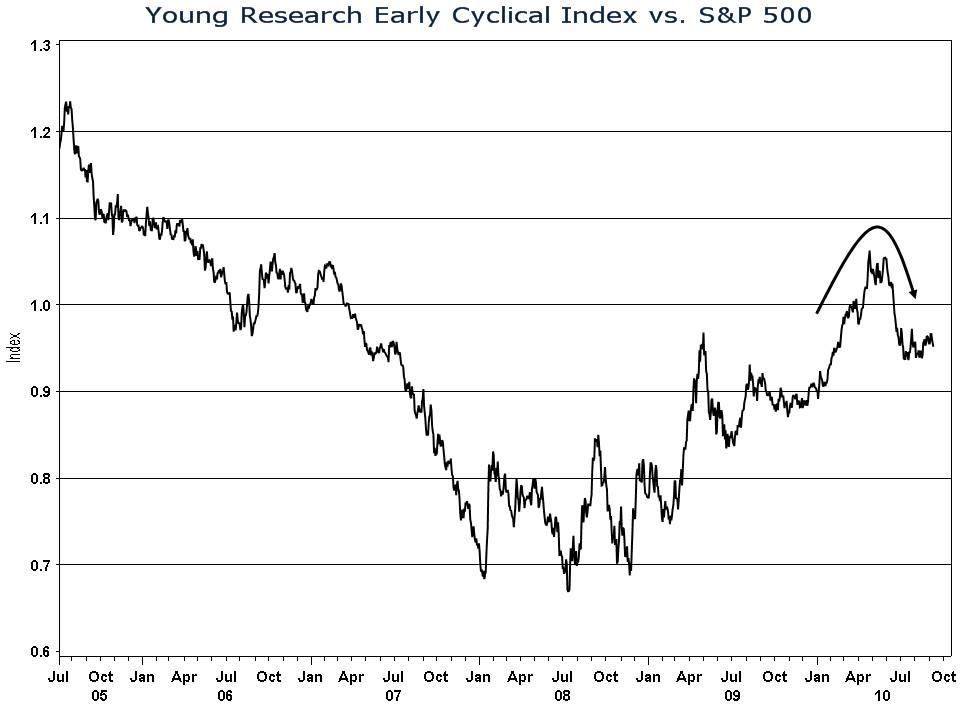

What are Young Research’s real-time cyclical indicators signaling about the economy today? Nothing encouraging. The early cyclical index, which includes companies that are impacted first by a recession, turned decidedly lower in May of this year, and has a real shaky look heading into the fall.

The late cyclical index, which is more of a coincident indicator, also has a worrying look. In relative terms, the index appears to be rolling over. These two indicators suggest that economic momentum peaked around April.

The relative performance of Young Research’s Stable Growth Index confirms the signal given by the early and late cyclical indexes. When the economy slows, investors often bid up less cyclically sensitive stocks relative to the rest of the market. In relative terms, the stable growth stocks have outperformed since April of this year. So then, the unanimous diagnosis from Young Research’s real-time cyclical indicators is that economic growth is slowing and the risk of recession is appreciable.