The Vanguard Wellesley (VWINX) and Wellington (VWELX) funds are both balanced mutual funds managed by the Wellington Management company. Wellington and Wellesley both invest in dividend-paying stocks as well as bonds, but there are some crucial differences.

We will explain the similarities and differences between Vanguard Wellesley and Wellington to help you decide which fund, if either, works best for you.

Richard C. Young an Authority on Vanguard Wellesley & Wellington

Young Research has followed both Wellesley and Wellington for over four decades. We aren’t aware of any other investment research firm in the business that has followed Vanguard, Wellington Management, and the Vanguard Wellesley & Wellington funds longer.

Young Research’s founder, Richard C. Young (Dick), goes way back with both Vanguard and Wellington Management. Dick has been covering Vanguard since Jack Bogle, Vanguard’s late founder, was still at Wellington Management in Boston.

Wellesley & Wellington are Two of the Oldest Balanced Funds

Vanguard Wellington was the nation’s first balanced mutual fund. The Wellington fund has an inception date of July 1, 1929. Vanguard Wellesley has also been around for decades. With an inception date of July 1, 1970, Wellesley is over 50-years old. There aren’t many balanced funds or mutual funds in general that have survived for 50 years.

Dan Newhall, a principal in Vanguard Portfolio Review Department, said “said Wellington is sometimes referred to as the “blue blazer” of Vanguard mutual funds — that’s a compliment, by the way. Not sexy, but reliable.” Erin Arvedlund reports in the Philadelphia Inquirer “Wellington Fund, which aims for long-term capital appreciation and some current income, invests approximately 60 to 70 percent of assets in blue-chip stocks, and 30 to 40 percent in government and corporate bonds. Since it has a mandate to generate dividends for investors, it is popular among retirees, just like its sister fund, the Wellesley Income Fund, Newhall said.”

Asset Allocation Comparison of Wellesley (VWINX) & Wellington (VWELX)

Wellesley’s and Wellington’s balanced investment approaches give both funds appeal for retired investors and those nearing retirement. Both Wellesley and Wellington buy a mix of dividend-paying common stocks and investment-grade bonds. In asset allocation terms, the funds are pretty close to being mirror images of one another. Vanguard Wellesley targets 60%-65% in bonds and 35%-40% in stocks. Vanguard Wellington targets 30%-40% in bonds and 60%-70% in stocks.

The Benefit of a Balanced Portfolio

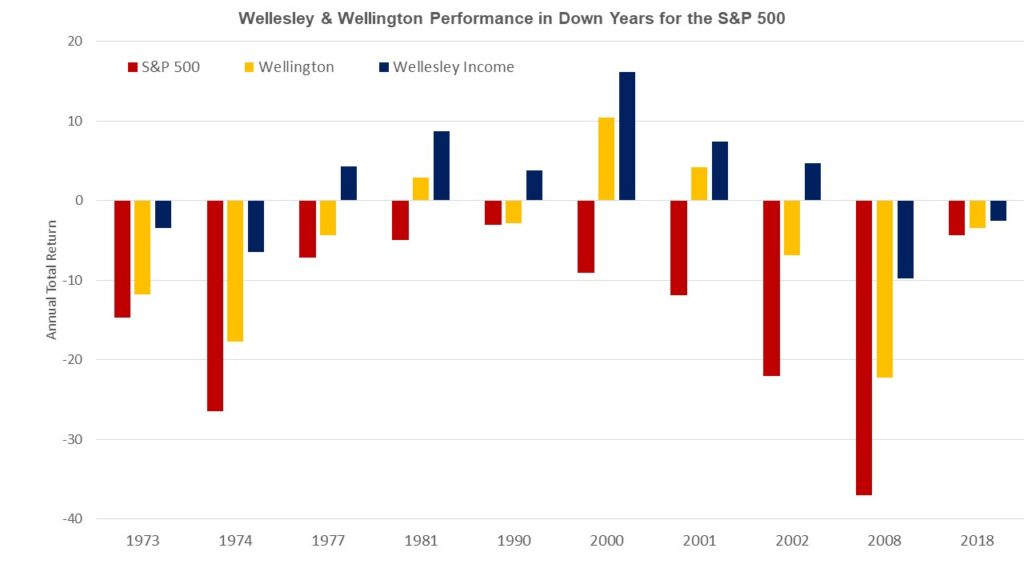

You can see the benefits of a balanced approach in the chart below. We show the return of the Vanguard Wellington Fund and the Vanguard Wellesley fund in every down year for the stock market since year-end 1970 (Wellesley’s inception year).

The S&P 500 has experienced ten down years since 1970. Vanguard Wellesley has only fallen in four of those years, and with the exception of 2018, the declines were only about a quarter of the decline in the S&P 500.

Wellington’s more aggressive asset allocation leads to more frequent and greater losses in down years from stocks, but it still falls much less than an all-stock portfolio. Wellington has fallen in seven out of the ten years the S&P has declined since 1970. When Wellington and Wellesley both fall, Wellington’s declines are often more than twice as bad as Wellesley’s declines.

Wellesley is also a more consistent performer than Wellington. Since its first full year in operation, Wellesley has only generated annual declines on seven occasions. That’s a .857 batting average. And with the exception of 1973, every year following an annual decline Wellesley has been up double digits.

Wellesley (VWINX) Stock Strategy vs. Wellington (VWELX) Stock Strategy

Both Wellesley and Wellington invest in companies that pay dividends, but Wellesley has a greater focus on companies that pay above-average yields. Wellington invests in both dividend-paying common stocks and to a lesser extent, non-dividend paying stocks.

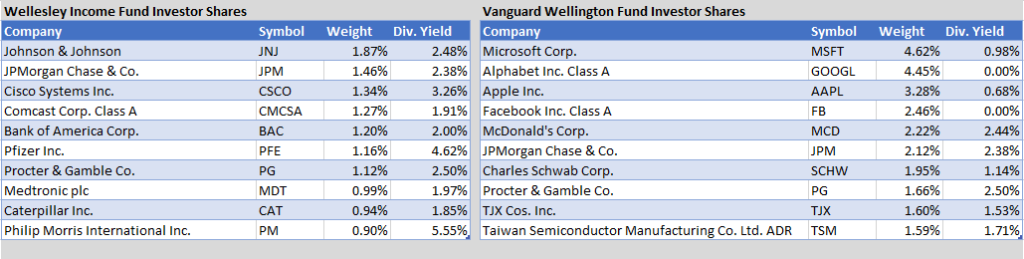

You can see some of the differences in the composition of each portfolio in the table below. The table shows the top 10 stocks holdings of the Wellesley and Wellington funds including the weighting of each position and itscurrent yield.

Vanguard Wellesley Stocks have a Higher Dividend Yield

The top 10 holdings of the Vanguard Wellesley Fund have an average yield of 3% (not asset-weighted). The average yield of the Wellington fund’s top ten stock holdings is 2.2%. The differential is similar for the entire portfolio. Wellesley’s stock holdings have about a 3% dividend yield and Wellington’s stocks have about a 2.5% dividend yield.

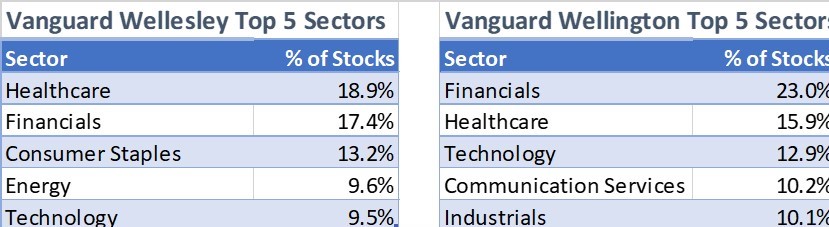

Sector Breakdown of Wellesley & Wellington

You can also pick up some subtle differences in the portfolio management approach by comparing the allocations to the top five sectors in each fund. Wellesley has a greater focus on more defensive sectors, including healthcare and consumer staples. Wellington holds more in cyclical sectors including financials, technology, and industrials.

Wellesley (VWINX) Bond Portfolio vs. Wellington (VWELX) Bond Portfolio

The bond portfolios of the Wellesley and Wellington funds are more similar than the stock portfolios. Both funds invest in intermediate-term investment-grade bonds.

Wellesley and Wellington Bond Portfolio Characteristics

Each fund owns over 1,000 bonds, and the portfolios have an average yield to maturity of 2.6% and with an average coupon of about 3.6%. Both funds also have a duration of 7.4 years.

Duration is a significant factor when evaluating bonds. Duration measures the sensitivity of a bond portfolio to changes in interest rates. A portfolio with a duration of 7.4 will gain about 7.4% if interest rates decline one percentage point, and it will lose 7.4% if interest rates rise by one percentage point.

Credit quality is another big factor when investing in fixed income. The credit quality of the Wellington and Wellesley funds are similar. Vanguard Wellesley has 37% of its portfolio invested in bonds that are rated Aa3 or better while Vanguard Wellington has 40% of its portfolio in similarly rated bonds.

Wellesley vs. Wellington: Assets Under Management

Vanguard Wellington is the larger fund as measured by assets. Wellington currently has $111 billion under management compared to $59 billion for Vanguard Wellesley. Vanguard Wellington’s $111 billion under management makes it the third-largest balanced mutual fund in the U.S. and the 6th largest fund including all actively managed stock and balanced funds. Vanguard Wellesley’s $59 billion under management puts it at number 6 for all balanced mutual funds in the U.S. and 16th for all actively managed stock and balanced funds.

Unfortunately for Wellesley and Wellington, being monstrous isn’t an advantage in asset management. Managing the biggest pile of assets puts a fund at a distinct disadvantage. The number of investment opportunities available to massive mutual funds is a fraction of the total opportunities available to more modestly sized managers.

If Wellington wants to maintain a passive stake in the stocks it purchases of no more than 3% of a company’s outstanding shares, it must purchase stocks with a market value of at least $73 billion. There are only about 80 U.S. companies with a market value of $73 billion or more today. Compare that to the more than 5,000 U.S. companies with a market value of more than $100 million.

Wellesley & Wellington Best for Specific Situations

For many years, we advised Vanguard Wellesley and Vanguard Wellington, but today we view a portfolio of individual stocks and bonds as a better option for most investors. Wellington’s and Wellesley’s bloated size, along with a bond portfolio that has a relatively long and inflexible duration in today’s historically low-interest rate environment, and a stock portfolio focused mostly on U.S. firms makes them less appealing. However, if you have to purchase funds because your 401K account only allows funds or your 529 plan only allows funds, Wellesley and Wellington are worthy options. Either fund is also an option for investors who have limited assets to invest (say under $100,000).

Keep it Simple Guide to Choosing Between Wellesley (VWINX) and Wellington (VWELX)

Choosing between Wellesley and Wellington comes down to which asset allocation best meets your ability and willingness to take risk. Every investor is different, but as a general guideline, if you are in retirement, you may want to lean more toward Wellesley than Wellington. Wellesley’s higher-yielding stocks and bigger bond component will cushion losses more in a downturn. If you have another decade or two until retirement and consider yourself to be a more conservative investor, you may want to lean toward Wellington.