Inflation risks are greatly overstated, says Ben Bernanke. We should be worried about debilitating deflation, not inflation. Ben B., of course, focuses on core inflation as his guide to price stability. Core inflation excludes food and energy. So as long as you don’t mind starving in the freezing cold with the lights off, core inflation is what you should focus on.

However, if you are like the other 308 million of us who prefer to eat with the lights on in a warm house, core inflation is not at all useful. The headline Consumer Price Index (CPI), which includes food and energy, is a better measure of inflation, but it too has flaws. Don’t forget that the CPI is a government statistic—and one that is published by the same government that oversees the central bank that is responsible for controlling inflation. Clearly, there is motive to downwardly bias the “official” inflation rate.

I’m not suggesting that there is something deceitful going on here. The original intention of the CPI was to measure the change in price for a fixed basket of goods; but, that is no longer true. There have been several important methodological changes to the CPI over the last 30 years. House prices have been replaced by a rental equivalence measure, hedonic adjustments have been added to the index, and calculations to adjust for substitution have been made. The CPI no longer measures the price changes in a fixed basket of goods to maintain a constant standard of living. It measures the price change required to maintain a constant level of satisfaction.

Satisfaction according to whom?

John Williams, an economist who runs the website shawdowstats.com, calculates that if all of the methodological changes that have been made to the CPI over the last 30 years were reversed, inflation would be north of 7% today compared to the official rate of 1.1%.

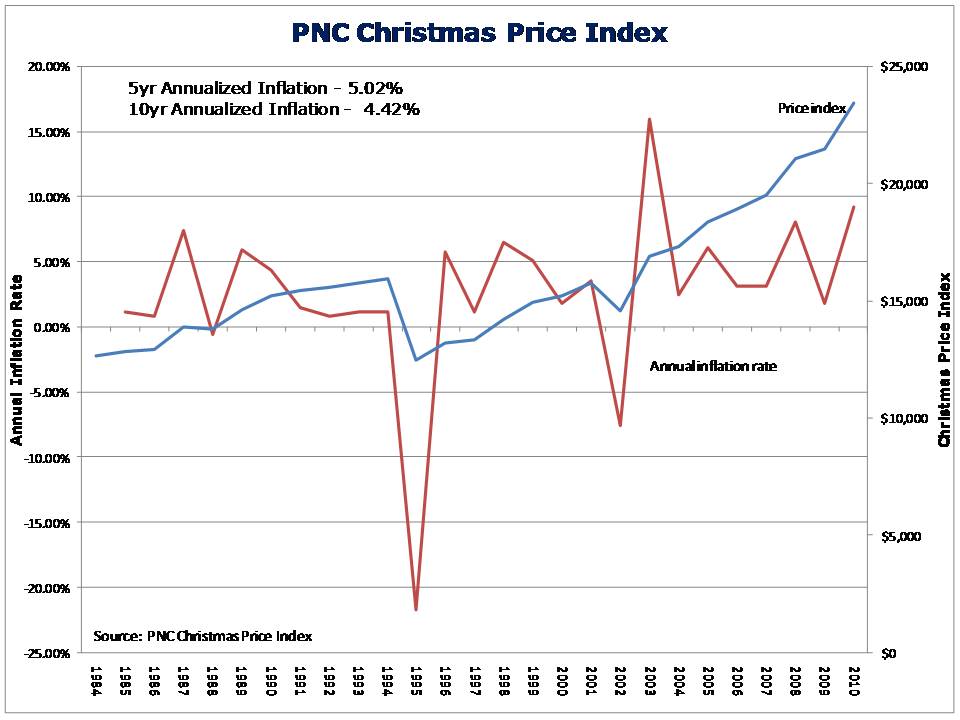

Even simple price indices show that the CPI is greatly understating the true rate of inflation. Take PNC’s annual Christmas Price Index by example. Since 1984, PNC Bank has calculated the cost of buying all of the goods and services listed in the song The Twelve Days of Christmas. PNC adds up the cost of buying everything from a partridge in a pear tree to five gold rings to twelve drummers drumming, and calls it the Christmas Price Index. The Christmas Price Index obviously isn’t a serious attempt to quantify inflation, but it measures what a price index should measure—the price change of a fixed basket of goods.

Below I’ve included a chart of the PNC Christmas Price Index with the annual inflation rate overlaid. In 2010, Christmas price inflation was 9.2%. Over the last five years, Christmas price inflation averaged 5%. The “official” inflation rate over the last five years was 2.04%.

I’ll let you be the judge of which price index is a better measure of inflation.

Merry Christmas and warm regards,

Dick