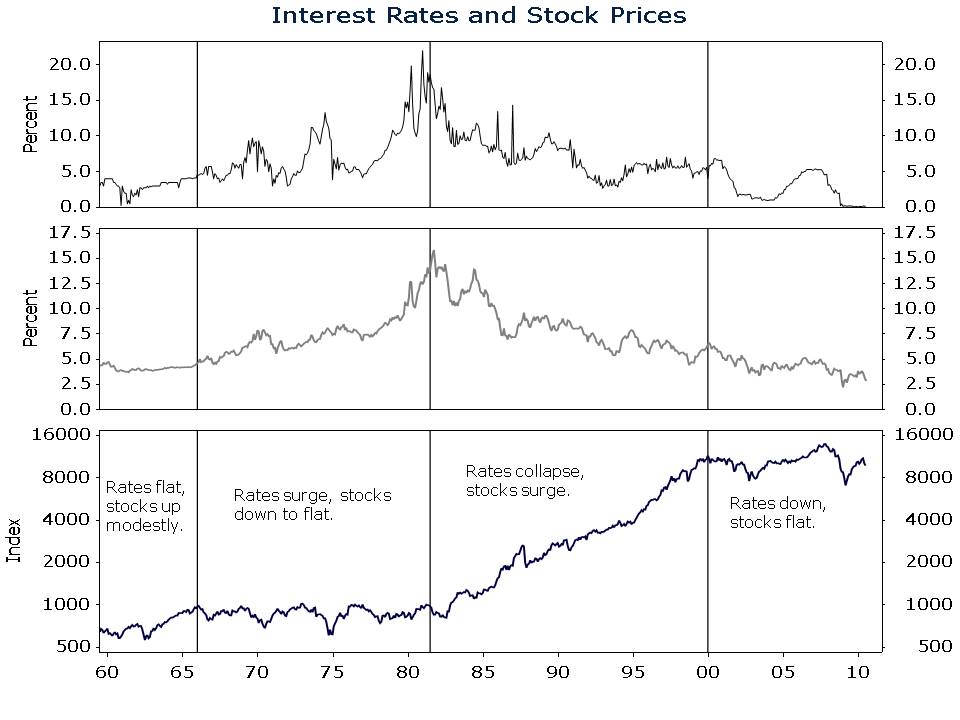

Since I graduated from Shaker Heights High School in 1959, the most important driver of long-term stock market returns has been the direction of interest rates. Bonds compete with stocks in investors’ portfolios. When interest rates rise, the prospective return on bonds goes up. In order for stocks to remain competitive with bonds, their prospective returns must also rise. Prospective stock returns rise when prices and valuations fall. Think of the dividend yield on a stock. If you own a $100 stock that pays a $4 annual dividend, you are looking at a 4% yield. If the price of that stock falls to $80, the dividend yield would increase to 5%. All else equal, when the same stock offers a higher yield, you obviously earn a higher return.

So then, we have established that rising interest rates detract from stock market returns, but what happens to stock prices when interest rates fall? Falling interest rates act like a high-octane fuel for stocks—they boost returns. The secular decline in interest rates in the 1980s and 1990s was a major contributor to the powerful bull market in stocks over that period.

Today, the stock market’s supply of high-octane fuel is exhausted. Bernanke and Co. have driven short-term interest rates as close to zero as they will get and the recent flight to U.S. Treasury securities has pushed long-term yields below 3%. Interest rates can’t fall much further from here and the risk of much higher rates in the medium term is frightening. There is over $1 trillion in excess reserves in the banking system and the federal government is issuing treasuries like they are going out of style. If the Fed doesn’t drain reserves and the government doesn’t reduce the deficit, interest rates will move much higher and stock prices much lower.

Without the tailwind of falling interest rates, capital gains will be harder to come by. And if interest rates make a decided move up, forget it—capital gains will become folklore. Portfolios short on dividend-paying stocks are most at risk in the current environment. Cold hard cash in the form of dividends offers protection against the threat of long dry spells in the stock market. If your stock portfolio is short on dividend payers, it is time to make a change.