Scott Pelley: “You have what degree of confidence in your ability to control [inflation]?”

Ben Bernanke: “100%” – 60 Minutes 12/5/2010

The U.S. dollar took another beating this week. The greenback fell 1% vis-à-vis the euro, 1.1% against the Swiss franc, and 1.7% against the Australian dollar. The Federal Reserve’s continued ultraloose monetary policy in the face of both emerging global inflation threats and a more hawkish tone from almost all of the world’s other major central banks has contributed to the slide.

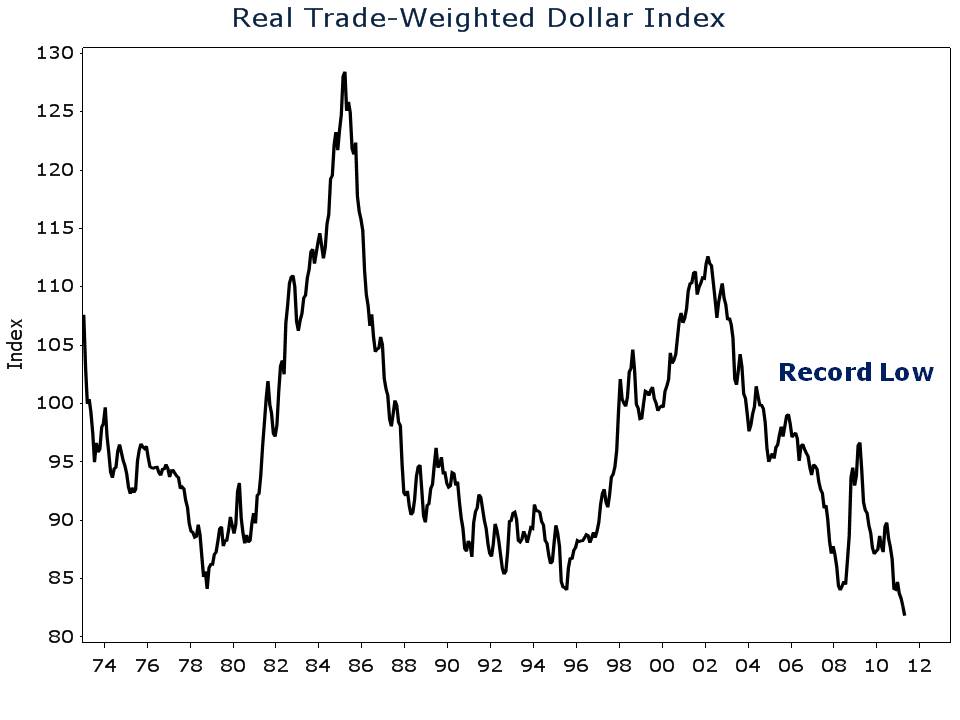

On an inflation-adjusted basis, the broad trade-weighted dollar index is now at an all-time low. The real dollar index adjusts for differing rates of inflation. For example, if inflation in the U.S. were 5% and inflation in Canada were 0%, one would expect the Canadian dollar to appreciate by 5% against the USD. If the CAD didn’t appreciate by 5% against the USD, Americans could buy goods in Canada and sell them for a 5% markup in the U.S. In theory, then, the nominal exchange rate should change to reflect varying rates of inflation, thereby leaving the real exchange rate constant. In reality, real exchange rates fluctuate—sometimes widely, as evidenced by my dollar index chart.

What is the recent slide in the real trade-weighted dollar index telling investors? Confidence in U.S. monetary and fiscal policy is flagging. Despite the apparent undervaluation of the dollar signaled by the record low real trade-weighted dollar index, market participants continue to shift funds away from dollar assets. And who could blame them? Short-term U.S. interest rates are near zero, the government is running up debt by the trillions each year, and the Fed’s irresponsible monetary stance risks accelerating relative rates of inflation. Higher relative future inflation would of course result in a depreciating nominal dollar. Are currency markets telling us they are 100% certain that Ben B. won’t control inflation? It sure seems that way.