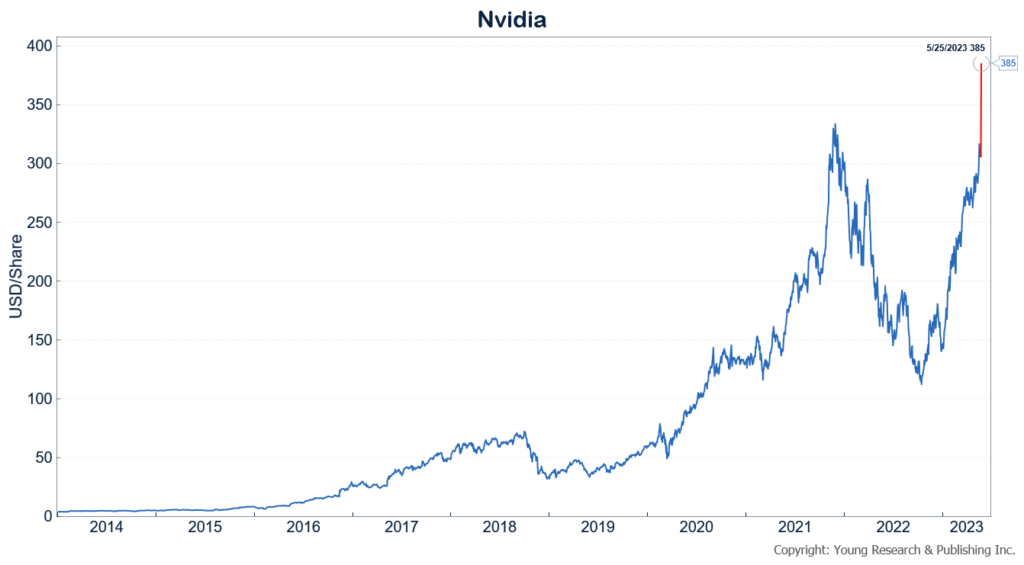

Nvidia’s sales of chips used for generative AI are booming. The company delivered an impressive boost to its outlook for the next quarter. The street loves it. Shares are up 28% in pre-market trading, adding over $250 billion to the company’s market value (more than the total market value of its chief competitor AMD). If the gains hold, it would be the largest single-day increase in market capitalization for a company in history. Whether the gains are deserved or not is another question.

Nvidia is the street’s preferred play in AI today, so there is a lot of hype and premium built into the stock. Tread carefully. Stocks trading at eye-watering multiples operating in cyclical industries that are susceptible to disruption risk have a tendency toward spectacular losses. That is, of course, not a guarantee the same will happen to Nvidia shares, but a reminder that the “sure thing” in stocks may not be a good investment.

Asa Fitch reports in The Wall Street Journal:

Chip giant Nvidia NVDA -0.49%decrease; red down pointing triangle is starting to capitalize on the craze for language-generating artificial intelligence, projecting a more than 64% jump in sales as the company rushes to get more processors in customer hands to satisfy booming interest in the technology.

A new generation of advanced Nvidia chips for AI calculations in data centers is in production, Nvidia CEO Jensen Huang said, and “we are significantly increasing our supply to meet surging demand for them.”

Nvidia’s shares, which have more than doubled in value this year, surged over 25% in premarket trading. The rise puts Nvidia, the U.S.’s largest chip-supplier by market value, on course for a record close and for a market cap comfortably above $900 billion.

The company forecast a record $11 billion in sales for the current quarter, far above the $7.2 billion Wall Street was expecting and what would be the highest quarterly total ever for the company.

“This demand has extended our data center visibility out a few quarters and we have procured substantially higher supply for the second-half of the year,” Chief Financial Officer Colette Kress said on an earnings call.