“You Can Observe a Lot Just by Watching”—Yogi Berra

You may recall the summer of 1963 when The Beach Boys’ Surfin U.S.A hit #3 on the charts and the stock market was riding the tail end of a 1949 to 1964 wave, where it averaged a 10% return per year. Stocks were hot and that was it. End of story. Much like today.

In 1964, as Benjamin Graham points out in his the book The Intelligent Investor, “Few people were willing to consider seriously the possibility that the high rate of advance in the past means that stock prices are ‘now too high’, and hence that ‘the wonderful results since 1949 would imply not very good but bad results for the future.’”

From 1964 through 1981 stocks were basically flat. But it was also a tough period for long-term bond investors who also got hit as prices swung.

“In 1964 we discussed at length the possibility that the price of stocks might be too high and subject ultimately to a serious decline; but we did not consider specifically the possibility that the same might happen to the price of high-grade bonds (neither did anyone else that we know of).”

Writing in late 1970 Graham continued, “The major change since 1964 has been the rise in interest rates on first-grade bonds to record high levels, although there has since been a considerable recovery from the lowest prices in 1970.”

The 20-year bonds he referred to lost 38% in market value from 1964 to late 1970.

In 1971 Graham recommended that “In the shorter-term field the investor could realize about 6% on U.S. government issues due in five years.” He pointed out that investors need not be concerned about a decline in market value in these bonds because there will be full repayment at the end of a comparatively short holding period.

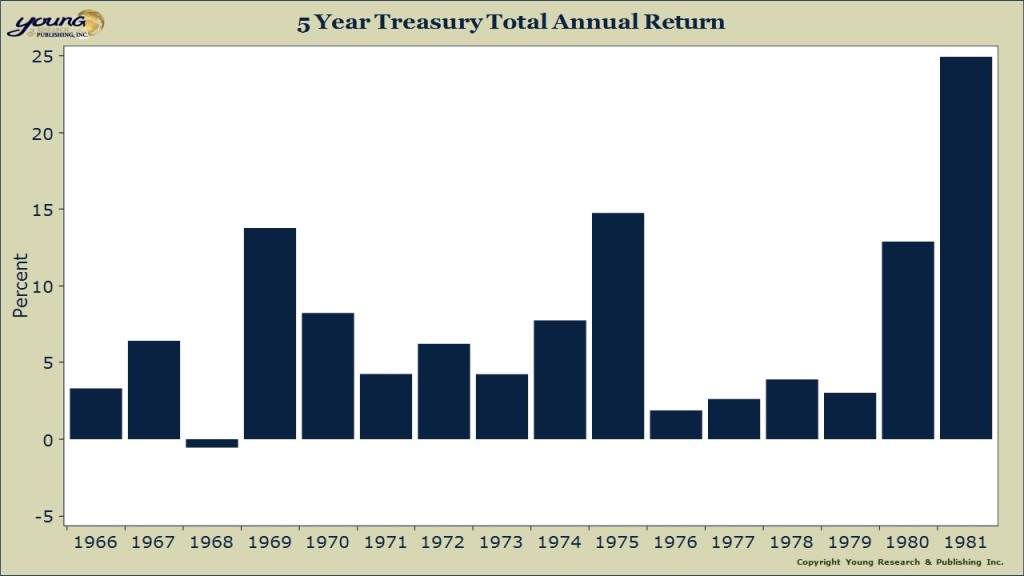

From 1966-1981 five-year Treasuries produced a 5.8% annualized return.

Graham would advise, “To enjoy a reasonable chance for continued better than average results, the investor must follow policies which are (1) inherently sound and promising, and (2) are not popular in Wall Street.”

Sounds like a great time to invest in short-term bonds.

Read The Intelligent Investor: Part I by clicking here.

Read The Intelligent Investor: Part III by clicking here.