Yesterday, the Bureau of Economic Analysis released its final estimate of third quarter GDP growth. Growth for the third quarter came in at a blistering 5%. That is the best quarter of economic growth in over a decade.

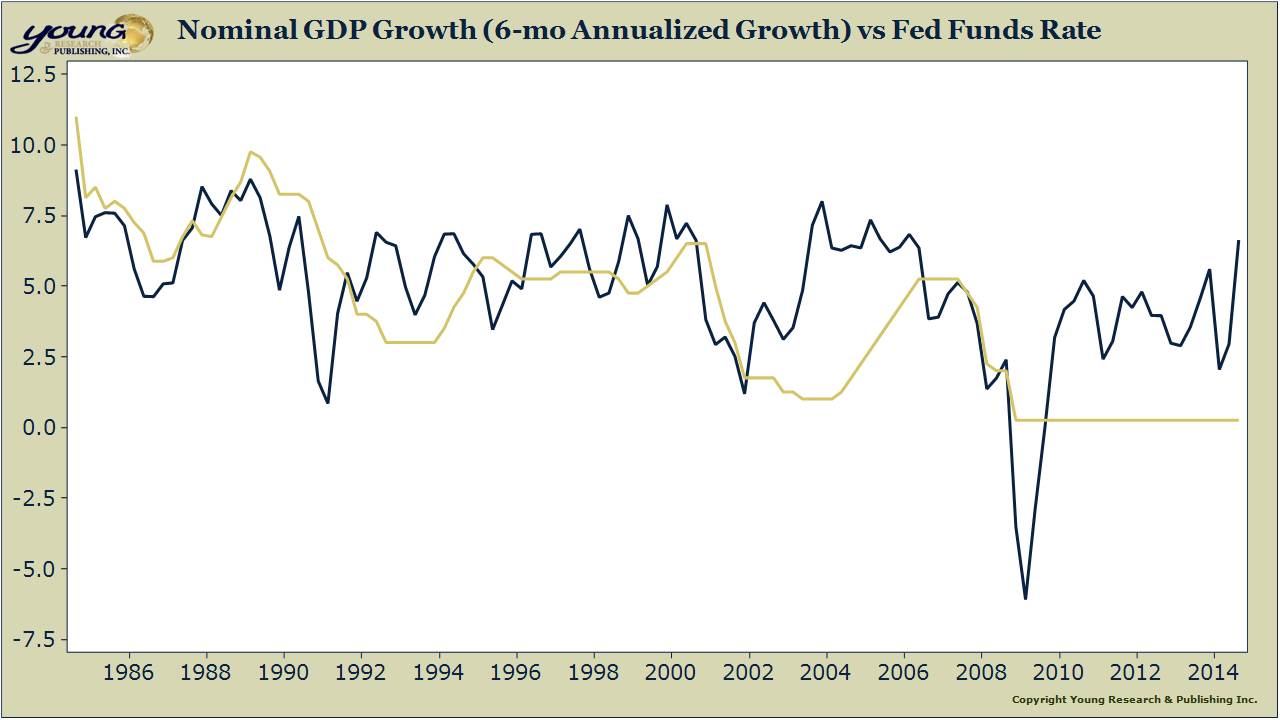

It should now be evident to even Yellen & Co., that the Fed’s monetary policy is absurdly inappropriate. Interest rates should not still be at zero, nor should they have been held there for so long into the recovery. The last time we had nominal GDP growth this good, short-term interest rates were over 5%. By holding interest rates at zero for the entire recovery and engaging in multiple rounds of money printing, the Fed has encouraged an untold amount of mispricing and misallocation across the economy. We only hope the side-effects of the Fed’s cure won’t be worse than the disease.