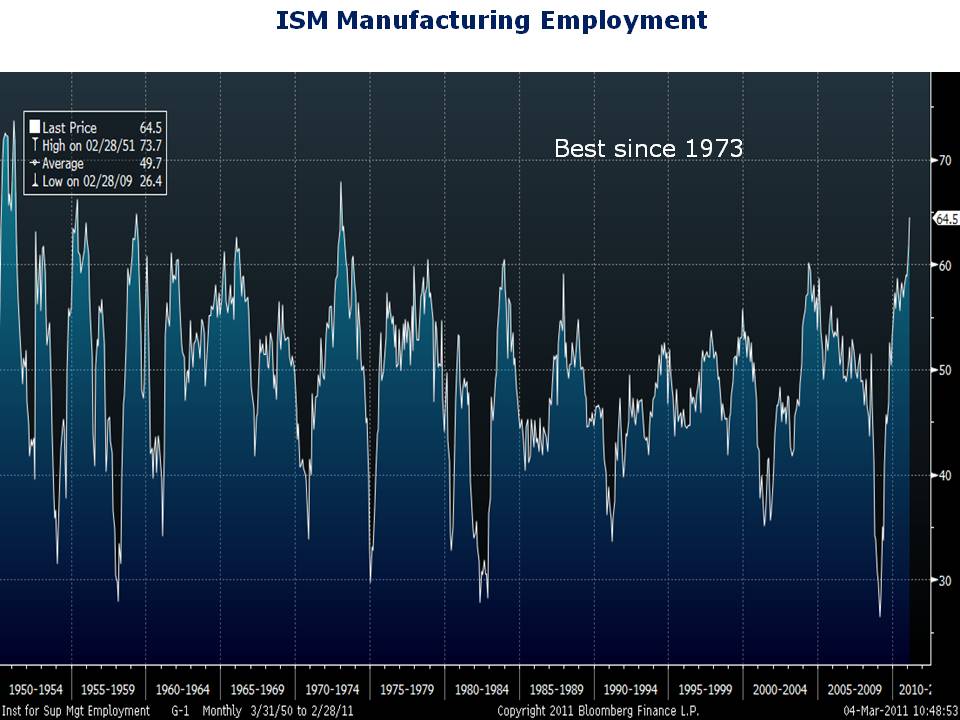

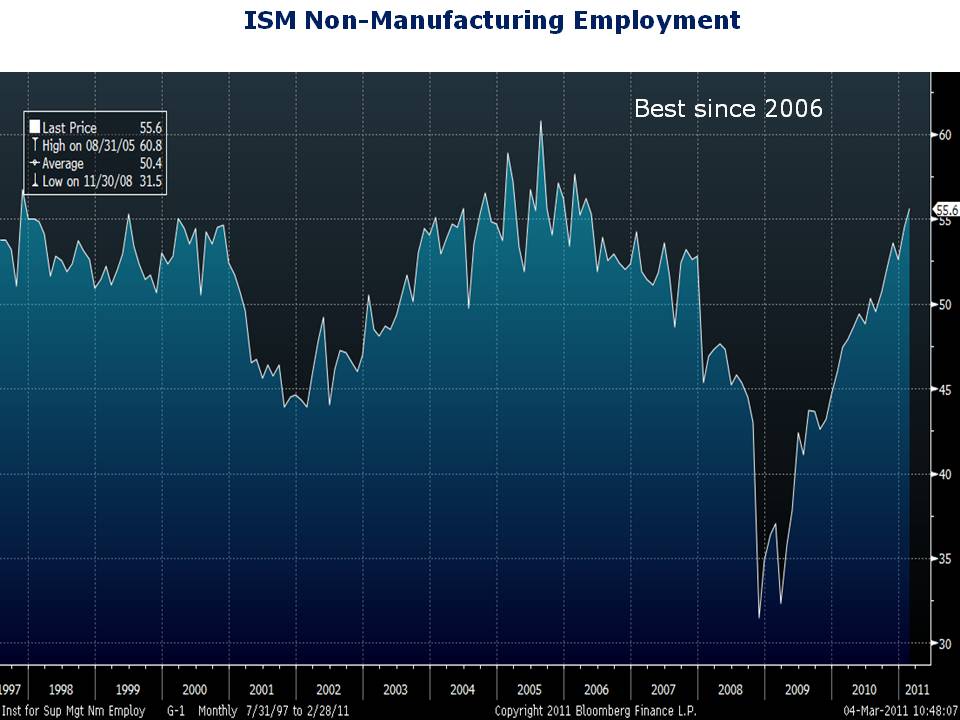

Lots of new data on labor market came out this week. I want to run through a few charts on the more important data points. First is the February ISM manufacturing index. The employment component of the manufacturing index surged to its highest level in almost four decades. The last time hiring intentions in the manufacturing sector were this strong was in 1973. The employment component of the non-manufacturing sector was also strong. My chart shows that non-manufacturing employment intentions reached their highest level since 2006.

Jobless claims also improved more than expected this week. Economists were looking for initial claims for unemployment to rise from last week’s level of 391,000 to 395,000, but instead claims fell to 368,000. That is the lowest number of unemployment claims since mid-2008. Jobless claims below 400,000 have historically been associated with sustained employment growth.

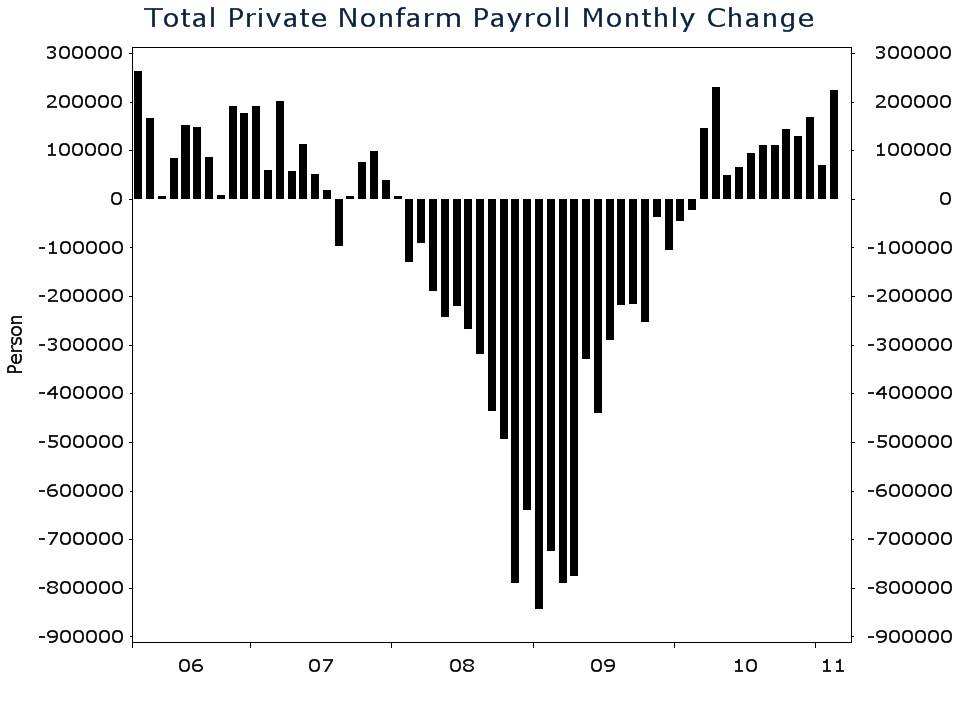

This week’s most important employment data was released on Friday in the February jobs report. The headline numbers that economists and investors tend to focus on are the change in nonfarm payrolls and the unemployment rate. The consensus estimate for the change in nonfarm payrolls was an increase of 196,000. The actual change in nonfarm payrolls was an increase of 192,000, which missed estimates, but private-sector employment increased by 222,000—exceeding estimates by 22,000. The monthly increase in private payrolls (see chart) was the best since April of last year.

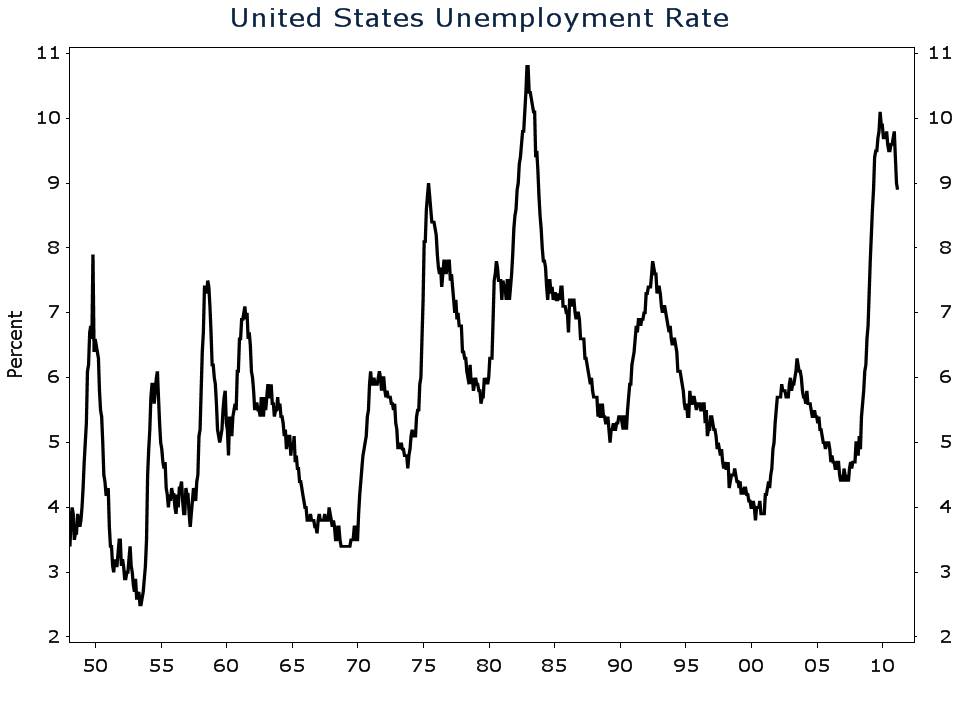

For unemployment, economists were anticipating a 9.1% rate, but instead the unemployment rate fell to 8.9%. February marks the third consecutive month that the unemployment rate has declined.

The February employment data indicate that the labor market is finally showing meaningful signs of improvement. That is encouraging for millions of unemployed Americans, but not Wall Street. Ironically, a strong labor market is bearish for stocks. The Fed’s unprecedented monetary stimulus has inflated stock prices to levels that are higher than they would be without the support. If the central bank starts withdrawing monetary accommodation, the ongoing speculative rally in stocks may falter. And given the forward-looking nature of markets, the rally could falter sooner than some may expect.