Emboldened by JP Morgan’s $2 $3billion trading loss, proponents of the Volcker rule (provision in Dodd-Frank to restrict banks from making speculative investments) are calling for even tougher financial regulation. Treasury Secretary Geithner said of Morgan’s loss: “this failure of risk management is a powerful case for reform.” And in a letter to regulators, Senators Carl Levin and Jeff Merkley wrote:

The massive failed bet by JPMorgan Chase provides a stark reminder why we desperately need your agencies to implement the Volcker Rule—a modern Glass-Steagall firewall that separates our core banking system from high-risk, hedge fund-style proprietary trading. We again urge you to remove ill-advised loopholes and implement a strong Volcker Rule without further delay.

Proprietary trading positions led to billions of dollars in losses during the financial crisis and threatened the collapse of many key institutions. Taxpayers had to bail out these big banks to prevent the economy from further collapsing into depression. Even without the bailouts several banks had damaged themselves so badly that they remained crippled, leaving far too many American businesses and families without the credit they need to prosper.

With this type of revisionist history, Senators Levin and Merkley want voters to believe that a Volcker Rule could have prevented the financial crisis, but nothing could be further from the truth.

The big institutions that failed during the financial crisis were not depository institutions. They were investment banks (Lehman and Bear Stearns)—the very institutions that Glass-Steagall helped create—and AIG, an insurance company. After Lehman failed and Bank of America bought Merrill Lynch, it was the repeal of Glass-Steagall that allowed Morgan Stanley and Goldman Sachs to convert to commercial banks to ensure their survival. The commercial banks that did fail during the crisis failed because they made bad loans, not because of “hedge fund-style proprietary trading.”

Which brings me to the JPMorgan loss. JPMorgan is the nation’s largest bank, with over $2.3 trillion in assets. A $2–3 billion trading loss is equal to .08% of the company’s assets. JPMorgan loses $2 billion on bad loans almost every quarter. In 2010, the company lost more than $23 billion on bad loans. I don’t recall hearing from Senators Levin and Merkley then.

I am not trying to excuse JPMorgan for its bad trades. And I think that if the federal government is going to provide deposit insurance to the banking system, there should be capital requirements and limits on trading.

But financial regulation is no panacea. Glass-Steagall wouldn’t have prevented the most recent financial crisis, and it failed to prevent others. The better approach to strengthening the U.S. financial system is not more but less financial regulation. Why not drastically scale back or even eliminate federal deposit insurance?

Deposit insurance eliminates market discipline from the banking system. Because depositors know their money is guaranteed by the full-faith-and-credit pledge of the U.S. Government, the deposit market doesn’t distinguish between risky banks and conservative banks. All FDIC insured institutions can borrow from depositors at about the same interest rate.

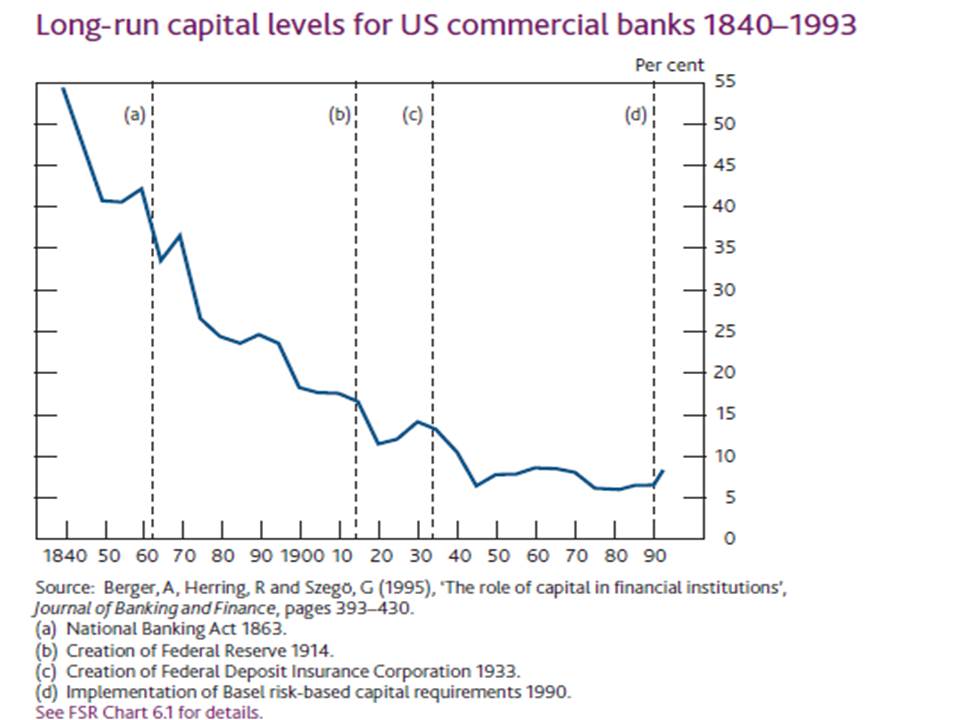

If depositors’ money was at risk, they would favor banks with the strongest balance sheets and eschew banks like JPMorgan that engage in speculative trading. It is instructive to note that, prior to the creation of the Federal Deposit Insurance Corporation in 1933, banks held much more capital (see chart) and invested customer deposits much more conservatively. Without the safety net of the federal government, the market takes on the role of bank regulator.

Wouldn’t you rather entrust the safety and soundness of the financial system to the collective wisdom of millions of depositors (the market) than to a small team of bank regulators—many with aspirations of joining the very industry they are tasked with regulating?