Every month for the last few years Americans—especially politicians—have been keeping a close eye on the employment report to see how many jobs were created, and what the unemployment rate would be each month. Once the report is released, it’s off to the races, politicking and nitpicking the headline numbers to throw mud at any opponent. But the most startling trend emerging is revealed deeper in the report.

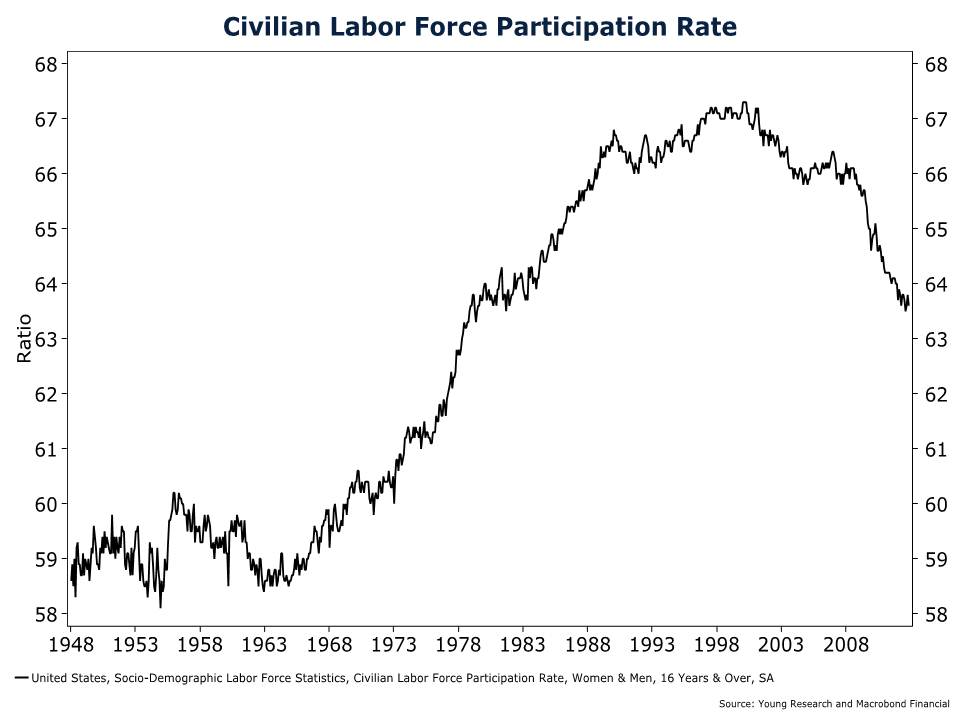

The labor force participation rate has cratered since the recession took hold in 2008. The rate has been on the way down since 2000, when it peaked at 67.3%. That height was reached through the combination of a secular shift in female workforce participation that started after World War II, and record demand for labor in the post-Reagan reform era that led to the dot-com bubble. Both tailwinds have dissipated. Today the labor force participation rate (chart 1) has fallen to 63.6%, near lows not seen since the 1980s.

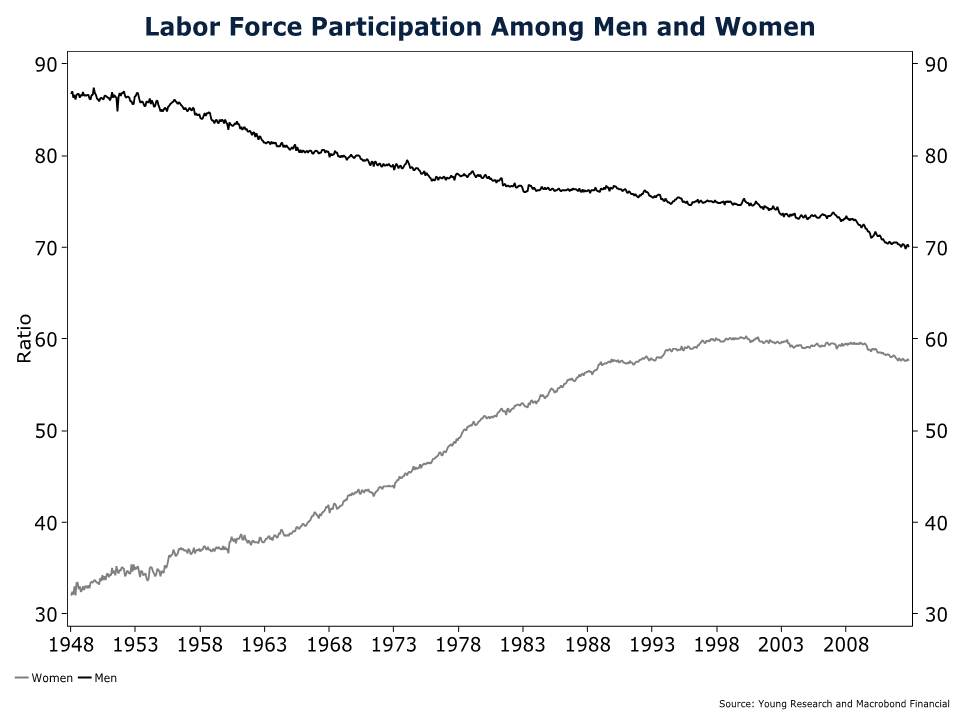

The plummeting rate comes as the long term secular decrease in male labor force participation has quickened, and the rate of female participation in the labor force has taken a u-turn (chart 2). The rate of growth in female workforce participation has been flat or negative for 45 months in a row. That’s the longest stretch of negatives ever and beats the 17 month stretch in 2003-2004 by over two years. Men are also facing their longest and deepest uninterrupted reduction in labor force participation, speeding up a disturbing trend that was already underway.

The result of the reduction in labor force participation is more single-income households, and no-income households. Many of these families will be forced to rely on public assistance, further exacerbating federal, state and local government budgets that are already in tatters. Until labor force participation rates begin to rise again, there is unlikely to be any sustainable economic recovery.