Predictions. They’re right up there in the mountain range of Mount Hope and Chance Peak near the end of “Failure to Plan” trail. Because when it comes to life, especially in investing, accidents that happen are most often accidents that should have been avoided—and could have been avoided. And yet, after every crash, slip, and fall, there’s carnage below with injured souls blaming the conditions, the weather, and never much self-introspection—no questioning of the route taken up the mountain.

When I see the glossy reports spit out by a robot or algorithm and delivered by a salesman calling himself a “Financial Planner,” I wonder who that’s helping—the salesman or you? Do they know you? How is this going to help you? Living your dream retirement isn’t an accident. It’s been in the works your entire life. These financial salesmen are willing to sell you boots and gear, but are they willing to climb the mountain with you for the long haul like a guide? Hardly.

In my conversations with you, you tell me you’re saving ‘til it hurts, working as long as you can, considering part-time work in retirement, and spending within your means. Simple, yet hard to do. You and I are on the same page. I can work with you. You’re the exception. Because I don’t work with just anyone walking through the door. There’s a screening process, and I’m not the only one being screened.

“Bonds are in a bubble,” smacks some arrogant know-it-all with another worthless prediction. Where was this guy during the deadliest markets this century?

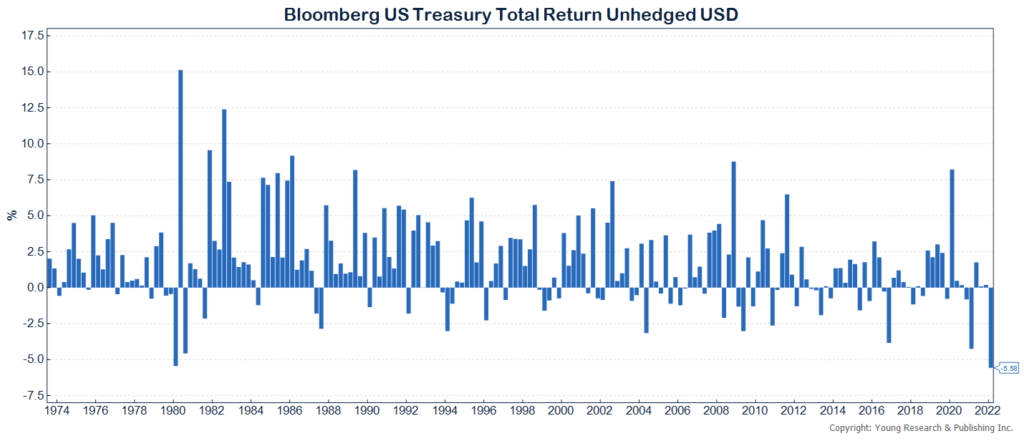

The key for you to understand about bond prices is they’re exactly that, a price. Prices, like predictions, are a qualitative signal, not quantitative. Look at this illustration below. This has been one of the worst quarters for bonds in 50-years, and it’s based on expectations. Will the Fed have the conviction to raise rates another half-dozen times or so? We’ll see…

What you’re looking at above is the performance of the Bloomberg Treasury Total Return Index. Last quarter was the worst return on record for the index, which started in 1973.

Action Line: Don’t let markets ruin your plan. Markets are a culmination of opinions—a qualitative price signal, not quantitative. I want you to focus on the interest payments and the return of principal at maturity, not hope and chance. Stick with me here. You can contact me here.

Originally posted on Your Survival Guy.